- Hong Kong

- /

- Real Estate

- /

- SEHK:2207

With A 30% Price Drop For Ronshine Service Holding Co., Ltd (HKG:2207) You'll Still Get What You Pay For

To the annoyance of some shareholders, Ronshine Service Holding Co., Ltd (HKG:2207) shares are down a considerable 30% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 38% share price drop.

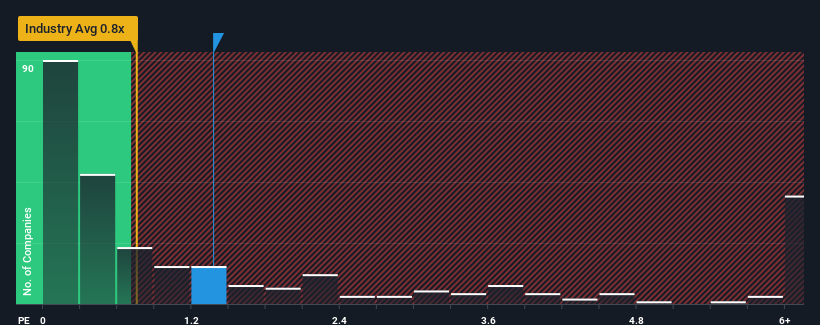

Even after such a large drop in price, when almost half of the companies in Hong Kong's Real Estate industry have price-to-sales ratios (or "P/S") below 0.8x, you may still consider Ronshine Service Holding as a stock probably not worth researching with its 1.4x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Ronshine Service Holding

What Does Ronshine Service Holding's Recent Performance Look Like?

For instance, Ronshine Service Holding's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. If not, then existing shareholders may be quite nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Ronshine Service Holding's earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Ronshine Service Holding's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 12% decrease to the company's top line. Even so, admirably revenue has lifted 69% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 17%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's understandable that Ronshine Service Holding's P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Key Takeaway

There's still some elevation in Ronshine Service Holding's P/S, even if the same can't be said for its share price recently. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Ronshine Service Holding maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Ronshine Service Holding that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2207

Ronshine Service Holding

Provides property management services for property developers, owners, and residents in the People's Republic of China.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives