- Hong Kong

- /

- Real Estate

- /

- SEHK:216

Chinney Investments' (HKG:216) Shareholders Will Receive A Smaller Dividend Than Last Year

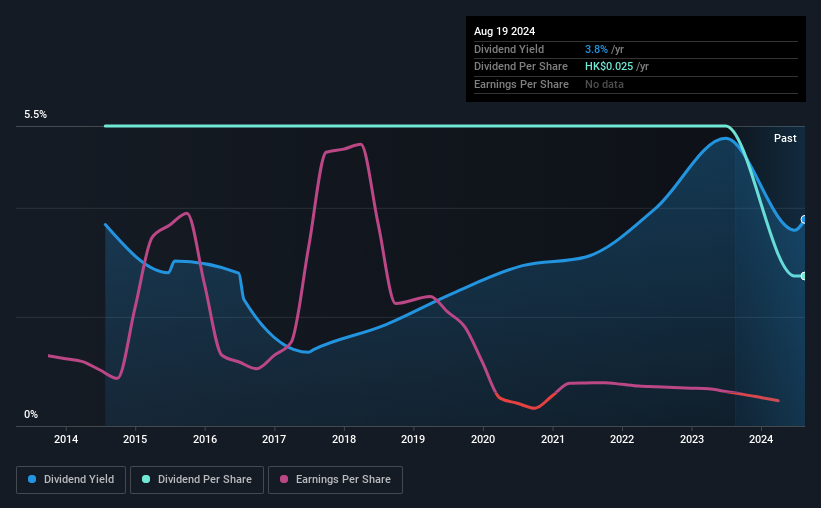

Chinney Investments, Limited (HKG:216) has announced that on 4th of October, it will be paying a dividend ofHK$0.025, which a reduction from last year's comparable dividend. This means that the dividend yield is 3.8%, which is a bit low when comparing to other companies in the industry.

Check out our latest analysis for Chinney Investments

Chinney Investments Might Find It Hard To Continue The Dividend

If it is predictable over a long period, even low dividend yields can be attractive. While Chinney Investments is not profitable, it is paying out less than 75% of its free cash flow, which means that there is plenty left over for reinvestment into the business. This gives us some comfort about the level of the dividend payments.

Over the next year, EPS might fall by 65.4% based on recent performance. While this means that the company will be unprofitable, we generally believe cash flows are more important, and the current cash payout ratio is quite healthy, which gives us comfort.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The dividend has gone from an annual total of HK$0.05 in 2014 to the most recent total annual payment of HK$0.025. Doing the maths, this is a decline of about 6.7% per year. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

Dividend Growth Potential Is Shaky

Dividends have been going in the wrong direction, so we definitely want to see a different trend in the earnings per share. Chinney Investments' earnings per share has shrunk at 65% a year over the past five years. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future.

Chinney Investments' Dividend Doesn't Look Sustainable

Overall, it's not great to see that the dividend has been cut, but this might be explained by the payments being a bit high previously. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. This company is not in the top tier of income providing stocks.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Just as an example, we've come across 4 warning signs for Chinney Investments you should be aware of, and 2 of them are a bit concerning. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

If you're looking to trade Chinney Investments, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:216

Chinney Investments

An investment holding company, primarily engages in the property development and investment activities in Hong Kong, Japan, and Mainland China.

Slight unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives