- Hong Kong

- /

- Real Estate

- /

- SEHK:216

Chinney Investments' (HKG:216) Shareholders Will Receive A Smaller Dividend Than Last Year

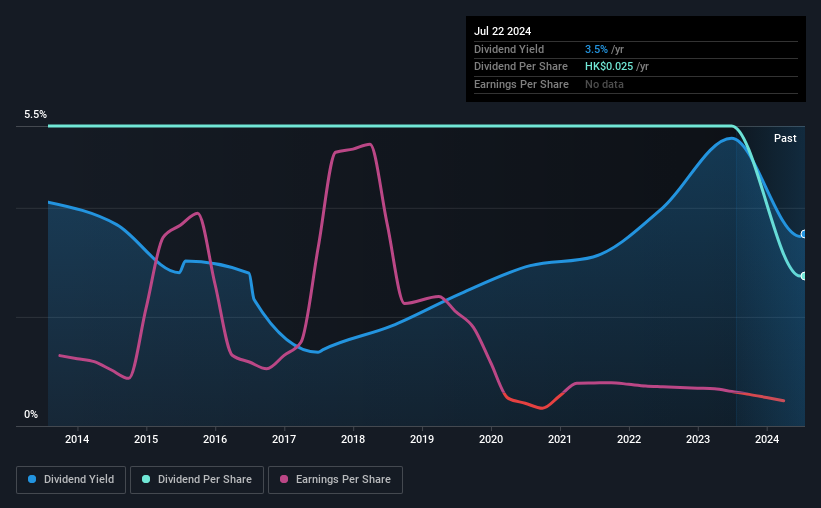

Chinney Investments, Limited (HKG:216) has announced that on 14th of October, it will be paying a dividend ofHK$0.025, which a reduction from last year's comparable dividend. This payment takes the dividend yield to 3.5%, which only provides a modest boost to overall returns.

View our latest analysis for Chinney Investments

Chinney Investments' Distributions May Be Difficult To Sustain

The dividend yield is a little bit low, but sustainability of the payments is also an important part of evaluating an income stock. While Chinney Investments is not profitable, it is paying out less than 75% of its free cash flow, which means that there is plenty left over for reinvestment into the business. In general, cash flows are more important than the more traditional measures of profit so we feel pretty comfortable with the dividend at this level.

Looking forward, earnings per share could 65.4% over the next year if the trend of the last few years can't be broken. This means the company won't be turning a profit, which could place managers in the tough spot of having to choose between suspending the dividend or putting more pressure on the balance sheet.

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. Since 2014, the dividend has gone from HK$0.05 total annually to HK$0.025. The dividend has shrunk at around 6.7% a year during that period. A company that decreases its dividend over time generally isn't what we are looking for.

The Dividend Has Limited Growth Potential

With a relatively unstable dividend, and a poor history of shrinking dividends, it's even more important to see if EPS is growing. Chinney Investments' EPS has fallen by approximately 65% per year during the past five years. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough.

Chinney Investments' Dividend Doesn't Look Sustainable

Overall, the dividend looks like it may have been a bit high, which explains why it has now been cut. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We would be a touch cautious of relying on this stock primarily for the dividend income.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Just as an example, we've come across 4 warning signs for Chinney Investments you should be aware of, and 2 of them are a bit unpleasant. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:216

Chinney Investments

An investment holding company, primarily engages in the property development and investment activities in Hong Kong, Japan, and Mainland China.

Slight unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives