- Hong Kong

- /

- Real Estate

- /

- SEHK:2007

Could Index Inclusion Boost Country Garden Holdings' (SEHK:2007) Standing Among Global Investors?

Reviewed by Sasha Jovanovic

- Country Garden Holdings Company Limited (SEHK:2007) was recently added to the S&P Global BMI Index, marking an important milestone for the Chinese real estate group.

- This inclusion may draw added interest from global investors and index-linked funds, potentially increasing the company's exposure in international markets.

- We'll explore how heightened visibility from index inclusion could influence Country Garden's evolving investment narrative moving forward.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Country Garden Holdings' Investment Narrative?

To be a shareholder in Country Garden Holdings right now, you have to believe in a possible turnaround for one of China’s largest, and currently most troubled, property developers, despite deep-seated financial and operational risks. The addition to the S&P Global BMI Index on September 22 may boost near-term visibility, opening the door for passive institutional flows and renewed international attention. But given the company’s current fundamentals, a sharp drop in sales, widening net losses, high debt levels, and ongoing restructuring, the long-term investment story remains fraught with uncertainty. Before the inclusion, the most pressing catalysts were survival-centric: staving off default, restructuring debt, and stabilizing core business operations. While index inclusion could improve liquidity, the fundamental concerns, like risk of default and further revenue decline, still overshadow any near-term trading bumps, recent price gains, while strong, need to be set against years of heavy losses and ongoing uncertainty. Still, this index milestone might slightly shift the balance among short-term risks and catalysts by encouraging more market participation and potentially calming volatility for now.

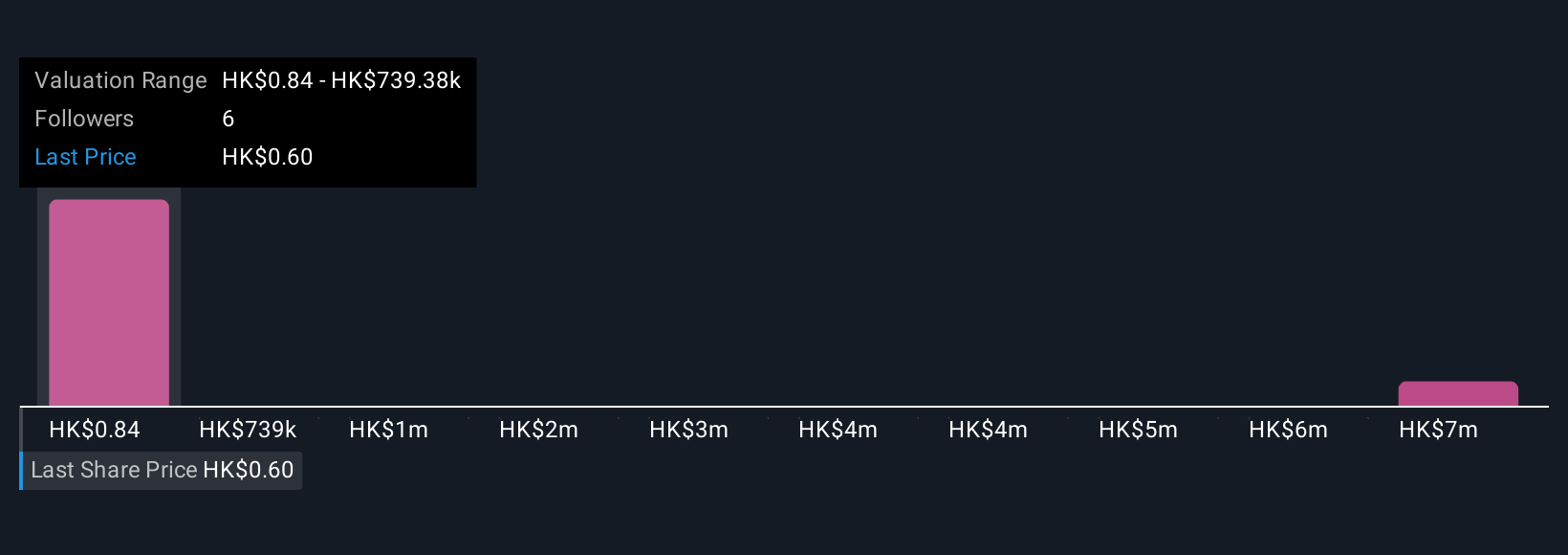

But some of the largest risks, like default or a cash crunch, are far from resolved. Insights from our recent valuation report point to the potential undervaluation of Country Garden Holdings shares in the market.Exploring Other Perspectives

Explore 6 other fair value estimates on Country Garden Holdings - why the stock might be a potential multi-bagger!

Build Your Own Country Garden Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Country Garden Holdings research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free Country Garden Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Country Garden Holdings' overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2007

Country Garden Holdings

An investment holding company, invests, develops, and constructs real estate properties in Mainland China.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives