- Hong Kong

- /

- Real Estate

- /

- SEHK:1995

Undiscovered Gems None Features 3 Promising Small Caps

Reviewed by Simply Wall St

In the current global market landscape, small-cap stocks have faced headwinds amid geopolitical tensions and consumer spending concerns, with indices such as the S&P MidCap 400 and Russell 2000 experiencing declines. Despite these challenges, opportunities remain for discerning investors to identify promising small-cap companies that demonstrate resilience and potential for growth through strong fundamentals or innovative strategies.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Gallantt Ispat | 15.54% | 34.24% | 41.38% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Dwi Guna Laksana | 138.37% | 17.37% | -4.02% | ★★★★★★ |

| Bengal & Assam | 4.72% | -3.69% | 46.32% | ★★★★★☆ |

| Rir Power Electronics | 21.19% | 21.54% | 38.94% | ★★★★★☆ |

| Kalyani Investment | NA | 25.45% | 12.48% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

| Monarch Networth Capital | 8.98% | 32.34% | 49.29% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Ever Sunshine Services Group (SEHK:1995)

Simply Wall St Value Rating: ★★★★★★

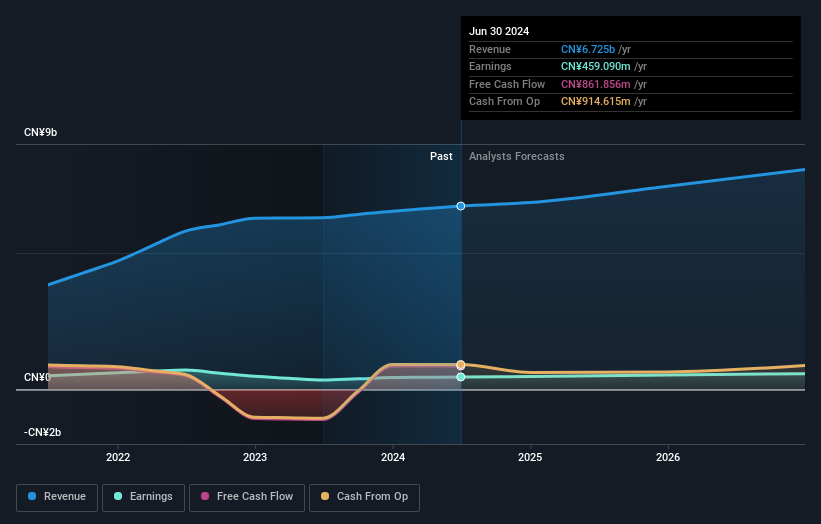

Overview: Ever Sunshine Services Group Limited is an investment holding company offering property management services across the People's Republic of China, with a market capitalization of approximately HK$3.25 billion.

Operations: The company generates revenue primarily from its property management services, amounting to CN¥6.72 billion.

Ever Sunshine Services Group, a promising player in the market, trades at a significant discount of 85% below its estimated fair value. The company has shown impressive earnings growth of 33.8% over the past year, outpacing the real estate industry's decline of 15.9%. With a debt-to-equity ratio reduced from 0.9 to 0.7 over five years and more cash than total debt, financial stability seems assured. High-quality earnings and positive free cash flow further bolster its profile, while future earnings are projected to grow by 9.6% annually, indicating potential for continued expansion in the sector.

Zhejiang Rongsheng Environmental Protection Paper (SHSE:603165)

Simply Wall St Value Rating: ★★★★☆☆

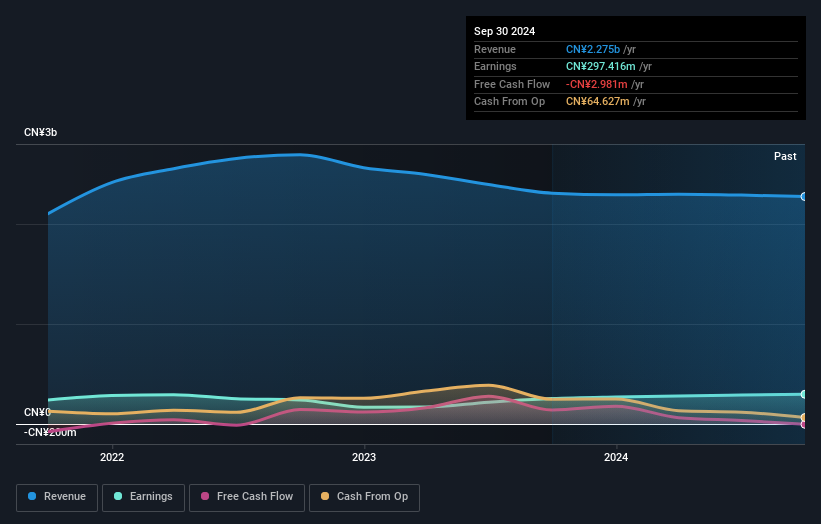

Overview: Zhejiang Rongsheng Environmental Protection Paper Co., Ltd. operates in the paper industry with a focus on environmentally friendly products and has a market capitalization of CN¥3.43 billion.

Operations: The company generates revenue primarily from its paper products, with a focus on environmentally friendly offerings. It has a market capitalization of CN¥3.43 billion.

Zhejiang Rongsheng Environmental Protection Paper, a smaller player in the market, showcases a mixed financial landscape. The company's earnings have grown modestly at 1.7% annually over the past five years, with recent annual growth of 16.6%, slightly trailing the Forestry industry's 19%. Its price-to-earnings ratio stands attractively at 12.7x compared to the broader CN market's 38x, suggesting potential undervaluation. However, debt management is an area of concern as its debt-to-equity ratio has increased from 16.3% to 78.1% over five years, indicating rising leverage that could impact future flexibility and growth opportunities.

Amano (TSE:6436)

Simply Wall St Value Rating: ★★★★★☆

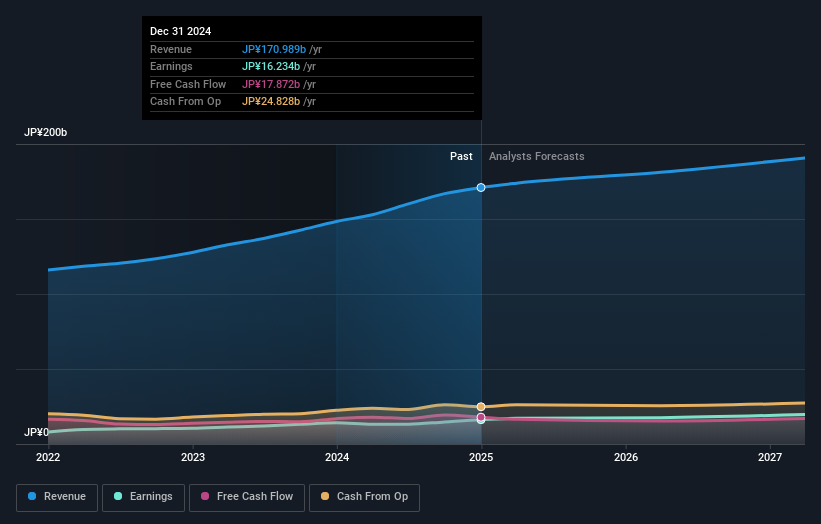

Overview: Amano Corporation operates in the fields of time information, parking, environmental, and cleaning systems both in Japan and internationally, with a market cap of ¥273.76 billion.

Operations: Revenue streams for Amano are derived from its operations in time information, parking, environmental, and cleaning systems. The company has a market capitalization of ¥273.76 billion.

Amano, a small player in the electronics industry, has demonstrated robust earnings growth of 15.1% over the past year, outpacing the sector's 7.2% rise. This growth is underpinned by high-quality earnings and a solid cash runway that supports its operations without concern for liquidity issues. While their debt-to-equity ratio has slightly increased from 0.6 to 0.7 over five years, Amano maintains more cash than total debt, reflecting a sound financial position and free cash flow positivity that bodes well for future endeavors as they gear up to release Q3 results soon.

Taking Advantage

- Navigate through the entire inventory of 4759 Undiscovered Gems With Strong Fundamentals here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ever Sunshine Services Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1995

Ever Sunshine Services Group

An investment holding company, provides property management services in the People's Republic of China.

Very undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives