- Hong Kong

- /

- Real Estate

- /

- SEHK:1972

Why We Think Swire Properties Limited's (HKG:1972) CEO Compensation Is Not Excessive At All

Key Insights

- Swire Properties will host its Annual General Meeting on 13th of May

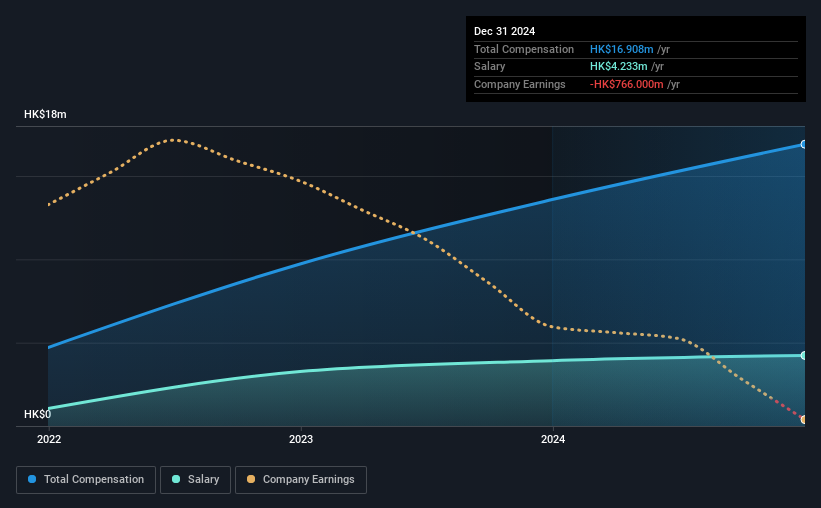

- CEO Tim Blackburn's total compensation includes salary of HK$4.23m

- The overall pay is comparable to the industry average

- Swire Properties' EPS declined by 62% over the past three years while total shareholder return over the past three years was 7.7%

Despite positive share price growth of 7.7% for Swire Properties Limited (HKG:1972) over the last few years, earnings growth has been disappointing, which suggests something is amiss. Some of these issues will occupy shareholders' minds as the AGM rolls around on 13th of May. One way that shareholders can influence managerial decisions is through voting on CEO and executive remuneration packages, which studies show could impact company performance. From what we gathered, we think shareholders should be wary of raising CEO compensation until the company shows some marked improvement.

View our latest analysis for Swire Properties

Comparing Swire Properties Limited's CEO Compensation With The Industry

Our data indicates that Swire Properties Limited has a market capitalization of HK$96b, and total annual CEO compensation was reported as HK$17m for the year to December 2024. Notably, that's an increase of 24% over the year before. We think total compensation is more important but our data shows that the CEO salary is lower, at HK$4.2m.

On comparing similar companies in the Hong Kong Real Estate industry with market capitalizations above HK$62b, we found that the median total CEO compensation was HK$17m. So it looks like Swire Properties compensates Tim Blackburn in line with the median for the industry.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | HK$4.2m | HK$3.9m | 25% |

| Other | HK$13m | HK$9.7m | 75% |

| Total Compensation | HK$17m | HK$14m | 100% |

Speaking on an industry level, nearly 82% of total compensation represents salary, while the remainder of 18% is other remuneration. Swire Properties sets aside a smaller share of compensation for salary, in comparison to the overall industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Swire Properties Limited's Growth Numbers

Over the last three years, Swire Properties Limited has shrunk its earnings per share by 62% per year. It achieved revenue growth of 1.3% over the last year.

The decline in EPS is a bit concerning. The fairly low revenue growth fails to impress given that the EPS is down. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Swire Properties Limited Been A Good Investment?

With a total shareholder return of 7.7% over three years, Swire Properties Limited has done okay by shareholders, but there's always room for improvement. Accordingly, a proposal to increase CEO remuneration without seeing an improvement in shareholder returns might not be met favorably by most shareholders.

To Conclude...

While it's true that shareholders have owned decent returns, it's hard to overlook the lack of earnings growth and this makes us question whether these returns will continue. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 1 warning sign for Swire Properties that you should be aware of before investing.

Switching gears from Swire Properties, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1972

Swire Properties

Develops, owns, and operates mixed-use, primarily commercial properties in Hong Kong, Mainland China, and the United States.

Moderate growth potential with mediocre balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026