Liu Chong Hing Investment Limited (HKG:194) will pay a dividend of HK$0.17 on the 6th of June. Based on this payment, the dividend yield will be 6.7%, which is fairly typical for the industry.

We've discovered 2 warning signs about Liu Chong Hing Investment. View them for free.Liu Chong Hing Investment's Distributions May Be Difficult To Sustain

We aren't too impressed by dividend yields unless they can be sustained over time. While Liu Chong Hing Investment is not profitable, it is paying out less than 75% of its free cash flow, which means that there is plenty left over for reinvestment into the business. We generally think that cash flow is more important than accounting measures of profit, so we are fairly comfortable with the dividend at this level.

Looking forward, earnings per share could fall by 66.6% over the next year if the trend of the last few years can't be broken. This means that the company will be unprofitable, but cash flows are more important when considering the dividend and as the current cash payout ratio is pretty healthy, we don't think there is too much reason to worry.

See our latest analysis for Liu Chong Hing Investment

Dividend Volatility

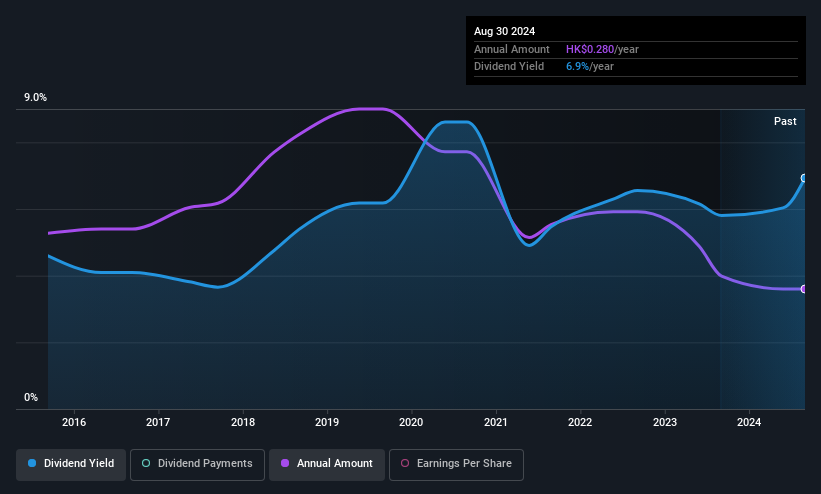

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The annual payment during the last 10 years was HK$0.40 in 2015, and the most recent fiscal year payment was HK$0.28. This works out to be a decline of approximately 3.5% per year over that time. A company that decreases its dividend over time generally isn't what we are looking for.

The Dividend Has Limited Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Earnings per share has been sinking by 67% over the last five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in.

Liu Chong Hing Investment's Dividend Doesn't Look Sustainable

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We would be a touch cautious of relying on this stock primarily for the dividend income.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. To that end, Liu Chong Hing Investment has 2 warning signs (and 1 which can't be ignored) we think you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:194

Liu Chong Hing Investment

An investment holding company, engages in the investment, development, sale, management, and letting of properties in Hong Kong, the People’s Republic of China, the United Kingdom, and Thailand.

Fair value with mediocre balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)