- Hong Kong

- /

- Real Estate

- /

- SEHK:1922

Yincheng Life Service CO., Ltd. (HKG:1922) Stock's 26% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Yincheng Life Service CO., Ltd. (HKG:1922) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 21% in that time.

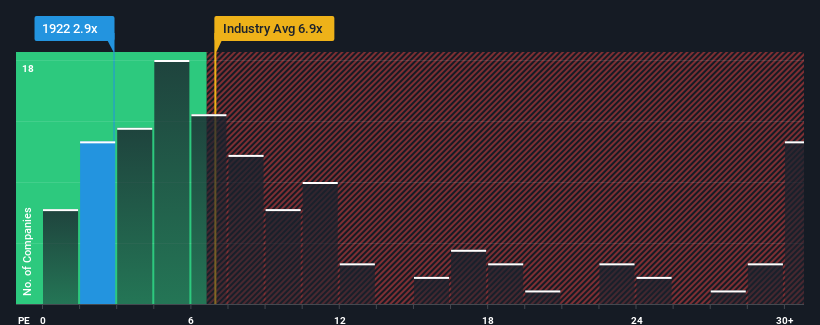

Although its price has dipped substantially, Yincheng Life Service's price-to-earnings (or "P/E") ratio of 2.9x might still make it look like a strong buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 10x and even P/E's above 19x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Yincheng Life Service has been doing a good job lately as it's been growing earnings at a solid pace. It might be that many expect the respectable earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

See our latest analysis for Yincheng Life Service

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Yincheng Life Service would need to produce anemic growth that's substantially trailing the market.

Retrospectively, the last year delivered a decent 9.4% gain to the company's bottom line. This was backed up an excellent period prior to see EPS up by 74% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 21% shows it's about the same on an annualised basis.

With this information, we find it odd that Yincheng Life Service is trading at a P/E lower than the market. It may be that most investors are not convinced the company can maintain recent growth rates.

The Bottom Line On Yincheng Life Service's P/E

Yincheng Life Service's P/E looks about as weak as its stock price lately. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Yincheng Life Service revealed its three-year earnings trends aren't contributing to its P/E as much as we would have predicted, given they look similar to current market expectations. There could be some unobserved threats to earnings preventing the P/E ratio from matching the company's performance. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Yincheng Life Service that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1922

Ruisen Life Service Co

An investment holding company, provides property management services in the Mainland China.

Flawless balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.