- Hong Kong

- /

- Real Estate

- /

- SEHK:1813

KWG Group Holdings Limited's (HKG:1813) 26% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/SRatio

KWG Group Holdings Limited (HKG:1813) shares have retraced a considerable 26% in the last month, reversing a fair amount of their solid recent performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 22% share price drop.

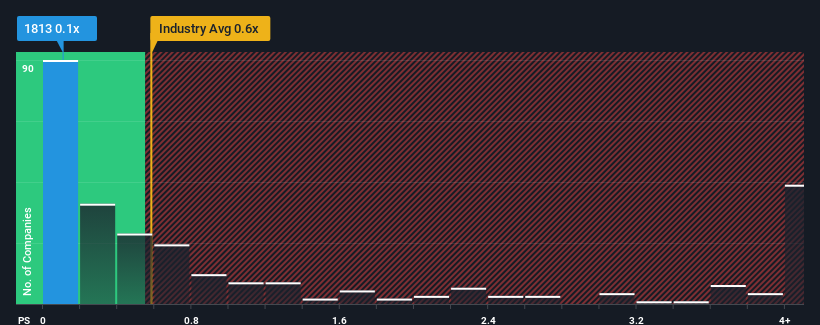

Although its price has dipped substantially, there still wouldn't be many who think KWG Group Holdings' price-to-sales (or "P/S") ratio of 0.1x is worth a mention when the median P/S in Hong Kong's Real Estate industry is similar at about 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for KWG Group Holdings

How Has KWG Group Holdings Performed Recently?

KWG Group Holdings could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think KWG Group Holdings' future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For KWG Group Holdings?

There's an inherent assumption that a company should be matching the industry for P/S ratios like KWG Group Holdings' to be considered reasonable.

Retrospectively, the last year delivered a decent 9.2% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 54% overall drop in revenue. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 9.5% as estimated by the dual analysts watching the company. With the industry predicted to deliver 6.7% growth, that's a disappointing outcome.

With this information, we find it concerning that KWG Group Holdings is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Key Takeaway

Following KWG Group Holdings' share price tumble, its P/S is just clinging on to the industry median P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It appears that KWG Group Holdings currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

Plus, you should also learn about these 3 warning signs we've spotted with KWG Group Holdings.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if KWG Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1813

KWG Group Holdings

Engages in the property development and investment, and hotel operation businesses in Mainland China and Hong Kong.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives