- China

- /

- Healthcare Services

- /

- SZSE:002589

K. Wah International Holdings And 2 Other Asian Penny Stocks To Watch

Reviewed by Simply Wall St

As global markets navigate a complex landscape of easing trade tensions and fluctuating economic indicators, investors are increasingly exploring diverse opportunities beyond the major indices. Penny stocks, often representing smaller or newer companies, remain a relevant investment area despite being considered an outdated term. By focusing on those with robust financials and solid fundamentals, these stocks can offer growth potential at lower price points without many of the risks typically associated with this segment.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Advice IT Infinite (SET:ADVICE) | THB4.84 | THB3B | ✅ 4 ⚠️ 3 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.42 | SGD170.22M | ✅ 4 ⚠️ 3 View Analysis > |

| YKGI (Catalist:YK9) | SGD0.104 | SGD44.2M | ✅ 2 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.19 | SGD37.85M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.11 | SGD8.3B | ✅ 5 ⚠️ 0 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$1.93 | HK$3.34B | ✅ 5 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.06 | HK$46.48B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.06 | HK$668.81M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.15 | HK$1.92B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$1.95 | HK$1.62B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,175 stocks from our Asian Penny Stocks screener.

Let's dive into some prime choices out of the screener.

K. Wah International Holdings (SEHK:173)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: K. Wah International Holdings Limited is an investment holding company involved in property development and investment in Hong Kong and Mainland China, with a market capitalization of approximately HK$5.55 billion.

Operations: The company's revenue is primarily derived from property development in Mainland China (HK$5.91 billion) and Hong Kong (HK$540.49 million), along with property investment activities amounting to HK$642.97 million.

Market Cap: HK$5.55B

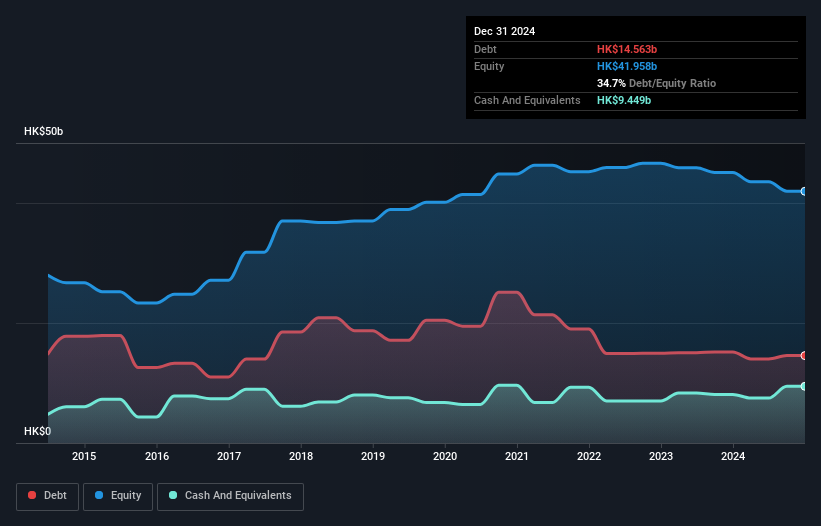

K. Wah International Holdings, with a market cap of HK$5.55 billion, reported revenues of HK$7.19 billion for 2024, primarily from property development in Mainland China and Hong Kong. Despite a decline in net income to HK$335.07 million from the previous year, the company maintains strong asset coverage over liabilities with short-term assets at HK$30.1 billion exceeding both short-term and long-term liabilities combined. However, challenges include negative operating cash flow and reduced profit margins (4.7% down from 13.1%). Recent executive changes aim to address these issues amidst an unstable dividend track record and low return on equity (0.9%).

- Click here to discover the nuances of K. Wah International Holdings with our detailed analytical financial health report.

- Explore K. Wah International Holdings' analyst forecasts in our growth report.

Raffles Medical Group (SGX:BSL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Raffles Medical Group Ltd offers integrated private healthcare services across Singapore, Greater China, Vietnam, Cambodia, and Japan with a market capitalization of SGD1.93 billion.

Operations: The company generates revenue from its Hospital Services (SGD345.65 million), Insurance Services (SGD177.99 million), and Healthcare Services (SGD295.05 million) segments, along with Investment Holdings contributing SGD44.89 million.

Market Cap: SGD1.93B

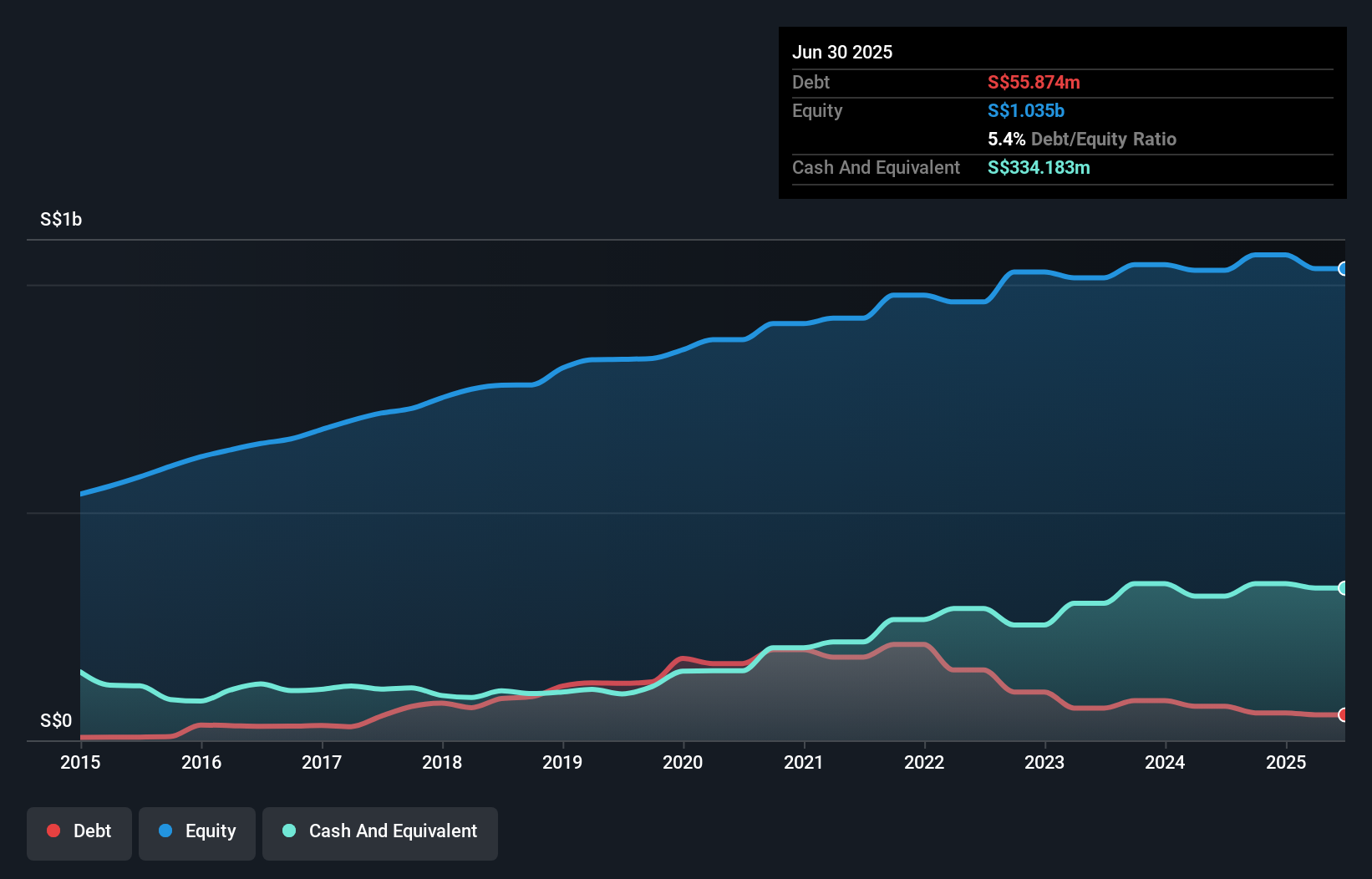

Raffles Medical Group, with a market cap of SGD1.93 billion, is strategically expanding its footprint through a partnership with Renji Hospital in Shanghai, aiming to enhance cross-border healthcare services and leverage international medical tourism opportunities. While the company reported decreased net income of SGD62.24 million for 2024 compared to the previous year, it maintains strong asset coverage over liabilities and has initiated share buybacks authorized by shareholders. Despite facing challenges such as declining profit margins from 12.7% to 8.3%, Raffles Medical's strategic alliances and experienced management team could bolster its competitive positioning in Asia's healthcare sector.

- Unlock comprehensive insights into our analysis of Raffles Medical Group stock in this financial health report.

- Assess Raffles Medical Group's future earnings estimates with our detailed growth reports.

Realcan Pharmaceutical Group (SZSE:002589)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Realcan Pharmaceutical Group Co., Ltd. is engaged in the sale of medicines, medical devices, and medical consumables to medical institutions worldwide, with a market cap of CN¥4.41 billion.

Operations: There are no specific revenue segments reported for the company.

Market Cap: CN¥4.41B

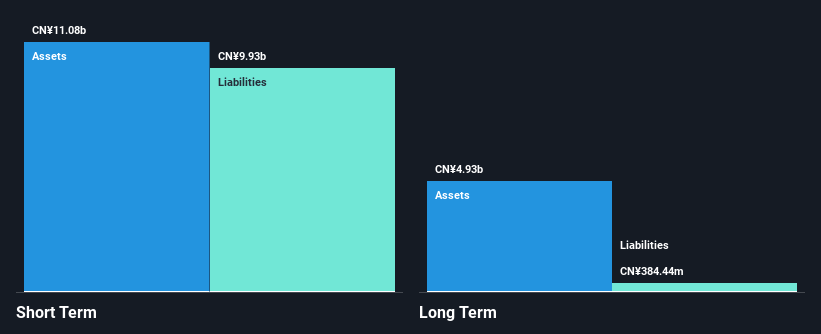

Realcan Pharmaceutical Group, with a market cap of CN¥4.41 billion, has demonstrated stable financial management despite recent revenue declines from CN¥8.03 billion to CN¥7.97 billion in 2024 and first-quarter earnings dipping year-on-year. The company maintains strong asset coverage over both short-term and long-term liabilities, although its debt is not well covered by operating cash flow. Earnings growth has accelerated significantly at 37% over the past year compared to a five-year average of 3.7%, outpacing industry trends despite low net profit margins of 0.3%. Recent share buybacks and dividend affirmations signal confidence in its financial health amidst volatility concerns.

- Get an in-depth perspective on Realcan Pharmaceutical Group's performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Realcan Pharmaceutical Group's track record.

Turning Ideas Into Actions

- Embark on your investment journey to our 1,175 Asian Penny Stocks selection here.

- Contemplating Other Strategies? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002589

Realcan Pharmaceutical Group

Sells medicines, medical devices, and medical consumables to medical institution worldwide.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives