- Hong Kong

- /

- Real Estate

- /

- SEHK:17

Can Fresh Financing Offset Losses for New World Development (SEHK:17) Amid Hong Kong Property Headwinds?

Reviewed by Sasha Jovanovic

- New World Development Company Limited recently announced its full-year earnings for the year ended June 30, 2025, reporting HK$27,680.5 million in sales and a net loss of HK$15,313.2 million, alongside securing a new term loan facility of up to HK$5.9 billion backed by its flagship Victoria Dockside property.

- The financing agreement enhances the group's ability to support ongoing business operations and provides a potential buffer amid lower sales and ongoing net losses.

- We will explore how this combination of expanded secured financing and moderated net losses could influence New World Development's investment narrative moving forward.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

New World Development Investment Narrative Recap

To be a shareholder in New World Development, one needs conviction in the long-term value of the group’s Hong Kong and mainland China property portfolio, and confidence that recurring rental income and capital recovery initiatives can overcome ongoing market and funding challenges. The recent HK$5.9 billion secured loan provides near-term liquidity support but does not materially ease the company’s most pressing risk: high leverage and persistently high debt servicing costs. While the new financing is a buffer against further shocks, the key short-term catalyst, sustained improvement in core earnings, remains closely tied to market conditions and policy support in both the Hong Kong and mainland China property sectors. The new term loan facility secured against Victoria Dockside stands out among recent announcements as the clearest response to liquidity pressures, especially with ongoing losses and reduced sales offset only by slightly improved bottom-line results this year. For investors, the interplay between new liquidity sources and continued capital management efforts will be crucial to watch, particularly as asset sales and refinancing remain integral to supporting day-to-day operations. Yet in contrast to recent liquidity measures, investors should be aware of how elevated borrowing levels could ...

Read the full narrative on New World Development (it's free!)

New World Development's outlook anticipates HK$40.5 billion in revenue and HK$1.7 billion in earnings by 2028. This is based on an expected 4.5% annual revenue growth rate and a HK$20.2 billion increase in earnings from the current HK$-18.5 billion.

Uncover how New World Development's forecasts yield a HK$5.36 fair value, a 37% downside to its current price.

Exploring Other Perspectives

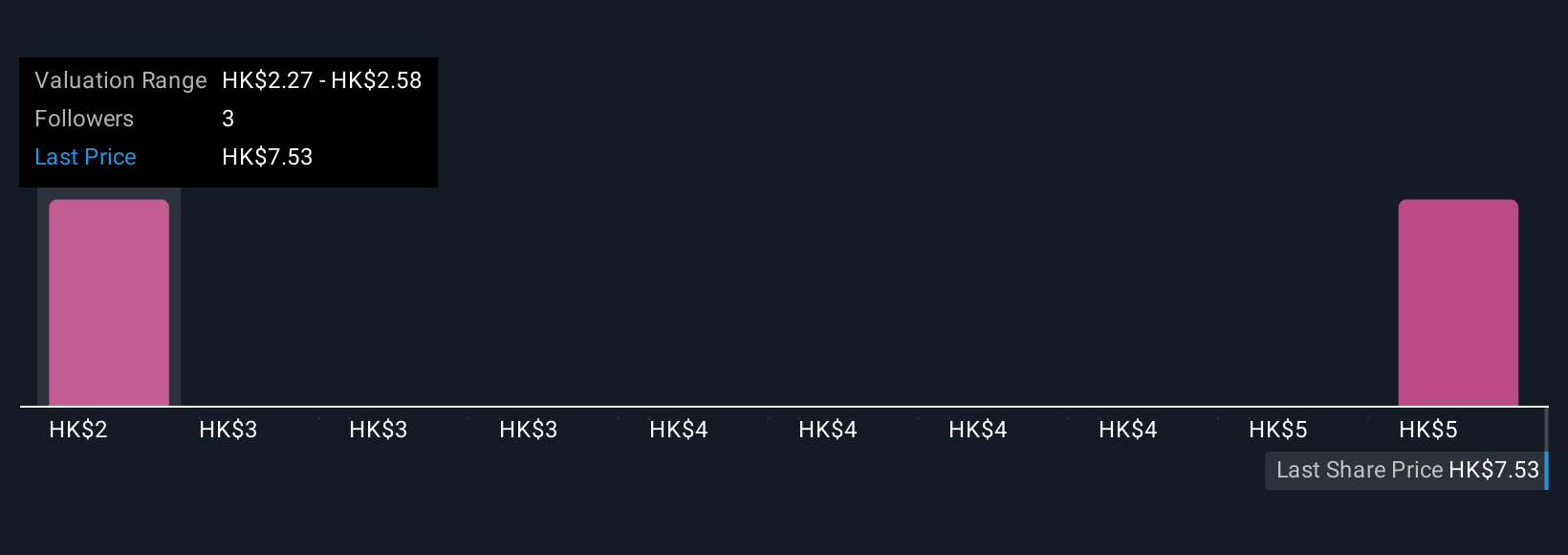

Fair value estimates from the Simply Wall St Community range from HK$2.27 to HK$5.36, reflecting divergent outlooks from two private investors. With high leverage still weighing on core profitability, shifts in debt markets and interest rates could have major implications for New World Development’s future performance.

Explore 2 other fair value estimates on New World Development - why the stock might be worth as much as HK$5.36!

Build Your Own New World Development Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your New World Development research is our analysis highlighting 1 important warning sign that could impact your investment decision.

- Our free New World Development research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate New World Development's overall financial health at a glance.

No Opportunity In New World Development?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New World Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:17

New World Development

An investment holding company, operates in the property development and investment business in Hong Kong and Mainland China.

Slightly overvalued with worrying balance sheet.

Similar Companies

Market Insights

Community Narratives