- Hong Kong

- /

- Real Estate

- /

- SEHK:160

Hon Kwok Land Investment Company (HKG:160) Is Due To Pay A Dividend Of HK$0.125

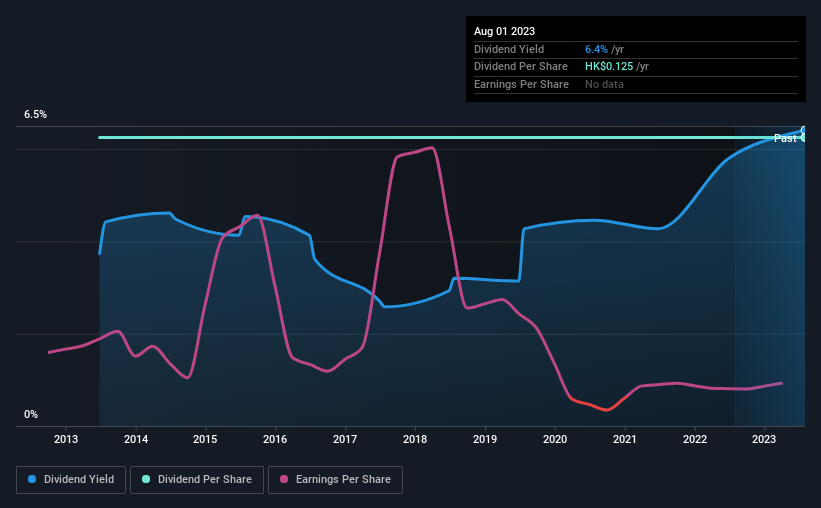

Hon Kwok Land Investment Company, Limited (HKG:160) will pay a dividend of HK$0.125 on the 4th of October. This means the annual payment is 6.4% of the current stock price, which is above the average for the industry.

Check out our latest analysis for Hon Kwok Land Investment Company

Hon Kwok Land Investment Company Doesn't Earn Enough To Cover Its Payments

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Based on the last payment, Hon Kwok Land Investment Company was quite comfortably earning enough to cover the dividend. This means that a large portion of its earnings are being retained to grow the business.

If the company can't turn things around, EPS could fall by 44.7% over the next year. If the dividend continues along the path it has been on recently, the payout ratio in 12 months could be 106%, which is definitely a bit high to be sustainable going forward.

Hon Kwok Land Investment Company Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. There hasn't been much of a change in the dividend over the last 10 years. Although we can't deny that the dividend has been remarkably stable in the past, the growth has been pretty muted.

Dividend Growth Potential Is Shaky

Investors could be attracted to the stock based on the quality of its payment history. Unfortunately things aren't as good as they seem. Hon Kwok Land Investment Company's EPS has fallen by approximately 45% per year during the past five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in.

Our Thoughts On Hon Kwok Land Investment Company's Dividend

Overall, a consistent dividend is a good thing, and we think that Hon Kwok Land Investment Company has the ability to continue this into the future. The earnings coverage is acceptable for now, but with earnings on the decline we would definitely keep an eye on the payout ratio. This looks like it could be a good dividend stock going forward, but we would note that the payout ratio has been at higher levels in the past so it could happen again.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For instance, we've picked out 1 warning sign for Hon Kwok Land Investment Company that investors should take into consideration. Is Hon Kwok Land Investment Company not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Hon Kwok Land Investment Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:160

Hon Kwok Land Investment Company

An investment holding company, engages in the property development, investment, and related activities in Hong Kong, Mainland China, and Japan.

Slight and overvalued.

Similar Companies

Market Insights

Community Narratives