- Hong Kong

- /

- Real Estate

- /

- SEHK:16

Here's Why Sun Hung Kai Properties Limited's (HKG:16) CEO Compensation Is The Least Of Shareholders Concerns

Key Insights

- Sun Hung Kai Properties to hold its Annual General Meeting on 2nd of November

- Salary of HK$2.92m is part of CEO Raymond Kwok's total remuneration

- The total compensation is 55% less than the average for the industry

- Over the past three years, Sun Hung Kai Properties' EPS grew by 0.5% and over the past three years, the total loss to shareholders 6.5%

Shareholders may be wondering what CEO Raymond Kwok plans to do to improve the less than great performance at Sun Hung Kai Properties Limited (HKG:16) recently. One way they can exercise their influence on management is through voting on resolutions, such as executive remuneration at the next AGM, coming up on 2nd of November. Setting appropriate executive remuneration to align with the interests of shareholders may also be a way to influence the company performance in the long run. We think CEO compensation looks appropriate given the data we have put together.

See our latest analysis for Sun Hung Kai Properties

Comparing Sun Hung Kai Properties Limited's CEO Compensation With The Industry

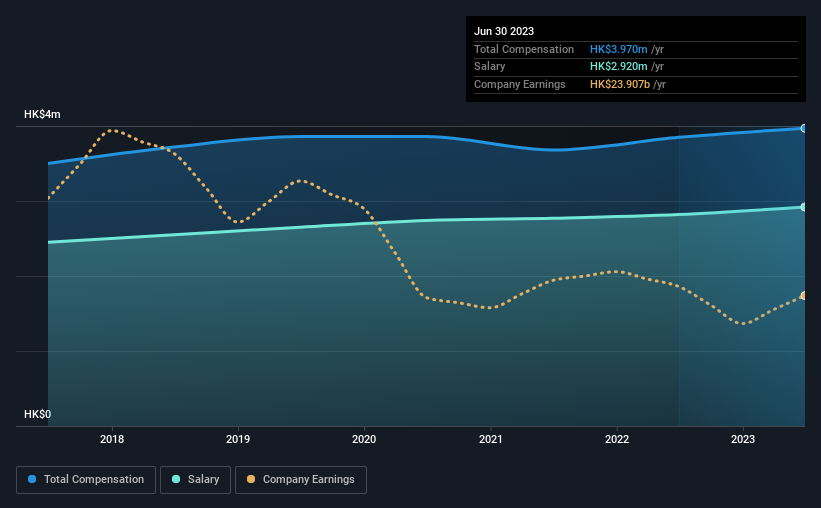

Our data indicates that Sun Hung Kai Properties Limited has a market capitalization of HK$229b, and total annual CEO compensation was reported as HK$4.0m for the year to June 2023. That's just a smallish increase of 3.1% on last year. We note that the salary portion, which stands at HK$2.92m constitutes the majority of total compensation received by the CEO.

On comparing similar companies in the Hong Kong Real Estate industry with market capitalizations above HK$63b, we found that the median total CEO compensation was HK$8.9m. In other words, Sun Hung Kai Properties pays its CEO lower than the industry median. What's more, Raymond Kwok holds HK$5.4b worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | HK$2.9m | HK$2.8m | 74% |

| Other | HK$1.1m | HK$1.0m | 26% |

| Total Compensation | HK$4.0m | HK$3.9m | 100% |

Talking in terms of the industry, salary represented approximately 77% of total compensation out of all the companies we analyzed, while other remuneration made up 23% of the pie. Although there is a difference in how total compensation is set, Sun Hung Kai Properties more or less reflects the market in terms of setting the salary. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Sun Hung Kai Properties Limited's Growth Numbers

Sun Hung Kai Properties Limited saw earnings per share stay pretty flat over the last three years. In the last year, its revenue is down 8.4%.

We generally like to see a little revenue growth, but the modest improvement in EPS is good. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Sun Hung Kai Properties Limited Been A Good Investment?

Given the total shareholder loss of 6.5% over three years, many shareholders in Sun Hung Kai Properties Limited are probably rather dissatisfied, to say the least. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

The lack lustre share price performance may have something to do with the flat earnings growth. Shareholders will get the chance to question the board on key concerns and revisit their investment thesis with regards to the company.

So you may want to check if insiders are buying Sun Hung Kai Properties shares with their own money (free access).

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you're looking to trade Sun Hung Kai Properties, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:16

Sun Hung Kai Properties

Develops and invests in properties for sale and rent in Hong Kong, Mainland China, and internationally.

Flawless balance sheet average dividend payer.