- Hong Kong

- /

- Real Estate

- /

- SEHK:158

Melbourne Enterprises' (HKG:158) Shareholders Will Receive A Smaller Dividend Than Last Year

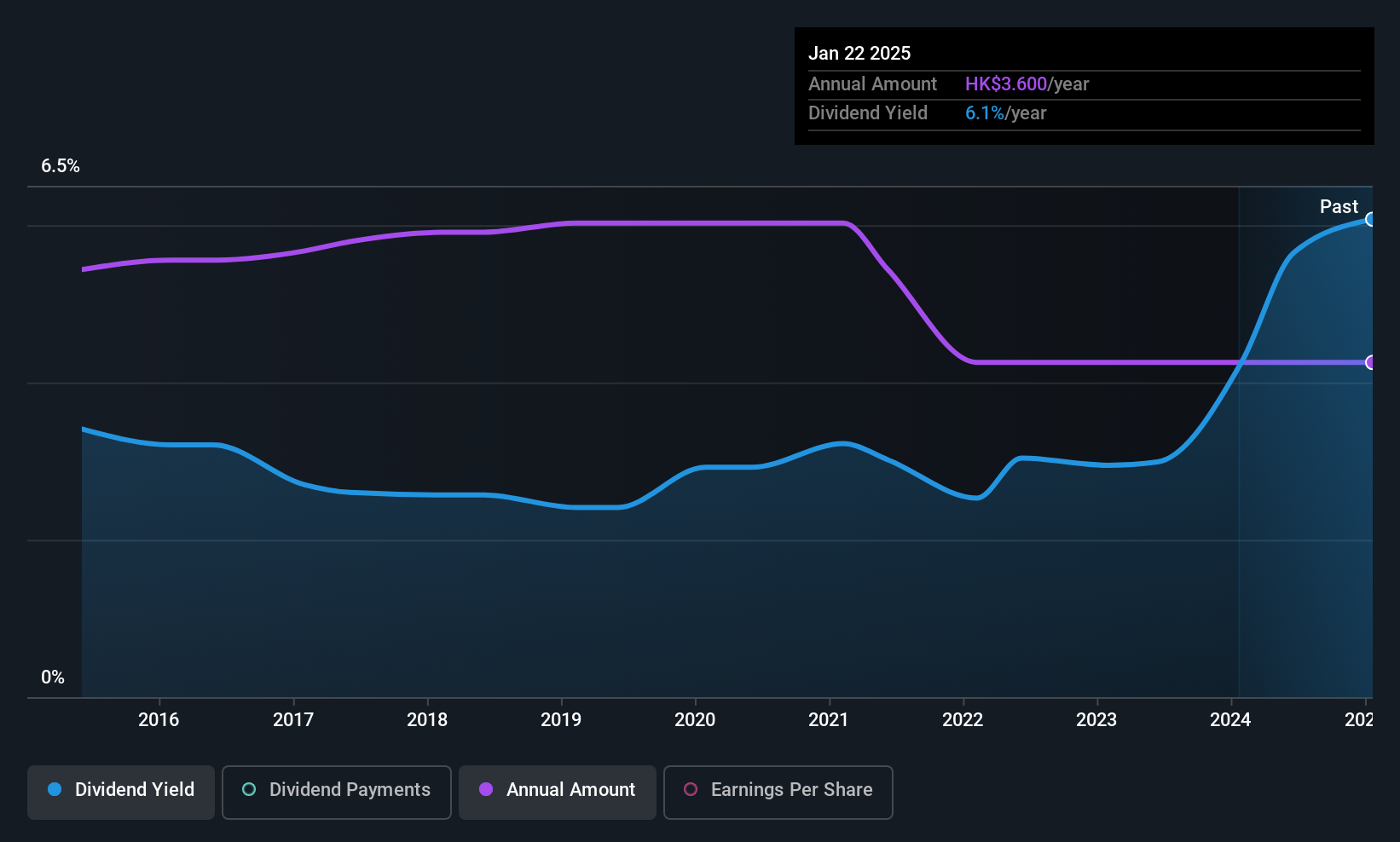

The board of Melbourne Enterprises Limited (HKG:158) has announced that the dividend on 7th of July will be reduced by 5.6% from last year's HK$1.80 to HK$1.70. This means that the annual payment will be 5.9% of the current stock price, which is in line with the average for the industry.

Melbourne Enterprises Might Find It Hard To Continue The Dividend

Unless the payments are sustainable, the dividend yield doesn't mean too much. Melbourne Enterprises is not generating a profit, and despite this is paying out most of its free cash flow as a dividend. Generally it is unsustainable for a company to be paying a dividend while unprofitable, and with limited reinvestment into the business growth may be slow.

Looking forward, earnings per share could rise by 51.1% over the next year if the trend from the last few years continues. The company seems to be going down the right path, but it will probably take a little bit longer than a year to cross over into profitability. Unless this can be done in short order, the dividend might be difficult to sustain.

Check out our latest analysis for Melbourne Enterprises

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. The annual payment during the last 10 years was HK$4.60 in 2015, and the most recent fiscal year payment was HK$3.60. Doing the maths, this is a decline of about 2.4% per year. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

The Company Could Face Some Challenges Growing The Dividend

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. Melbourne Enterprises has seen EPS rising for the last five years, at 51% per annum. While the company hasn't yet recorded a profit, the growth rates are healthy. If the company can turn a profit relatively soon, we can see this becoming a reliable income stock.

Melbourne Enterprises' Dividend Doesn't Look Sustainable

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. In general, the distributions are a little bit higher than we would like, but we can't ignore the fact the quickly growing earnings gives this stock great potential in the future. We would probably look elsewhere for an income investment.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've picked out 1 warning sign for Melbourne Enterprises that investors should know about before committing capital to this stock. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:158

Melbourne Enterprises

An investment holding company, engages in property investment business in Hong Kong.

Flawless balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A buy recommendation

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026