- Hong Kong

- /

- Real Estate

- /

- SEHK:1528

Take Care Before Diving Into The Deep End On Red Star Macalline Group Corporation Ltd. (HKG:1528)

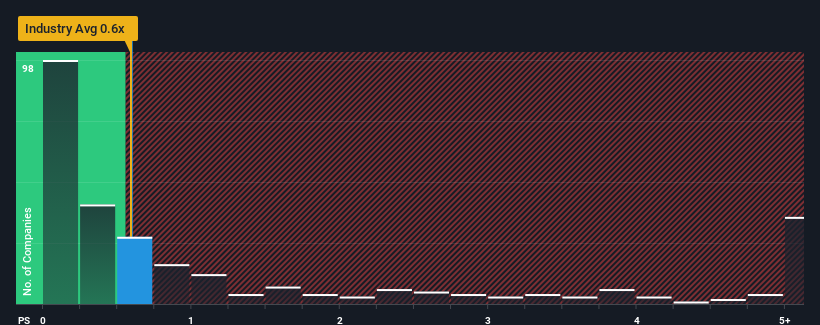

It's not a stretch to say that Red Star Macalline Group Corporation Ltd.'s (HKG:1528) price-to-sales (or "P/S") ratio of 0.6x seems quite "middle-of-the-road" for Real Estate companies in Hong Kong, seeing as it matches the P/S ratio of the wider industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Red Star Macalline Group

What Does Red Star Macalline Group's Recent Performance Look Like?

With revenue that's retreating more than the industry's average of late, Red Star Macalline Group has been very sluggish. It might be that many expect the dismal revenue performance to revert back to industry averages soon, which has kept the P/S from falling. You'd much rather the company improve its revenue if you still believe in the business. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Keen to find out how analysts think Red Star Macalline Group's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Red Star Macalline Group would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 16% decrease to the company's top line. As a result, revenue from three years ago have also fallen 13% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 14% as estimated by the four analysts watching the company. With the industry only predicted to deliver 8.6%, the company is positioned for a stronger revenue result.

With this information, we find it interesting that Red Star Macalline Group is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Red Star Macalline Group's P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite enticing revenue growth figures that outpace the industry, Red Star Macalline Group's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

You always need to take note of risks, for example - Red Star Macalline Group has 1 warning sign we think you should be aware of.

If you're unsure about the strength of Red Star Macalline Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1528

Reasonable growth potential and slightly overvalued.

Market Insights

Community Narratives