As global markets continue to reach new heights, with indices like the S&P 500 and Russell 2000 hitting record intraday highs, investors are increasingly exploring diverse opportunities. Penny stocks, a term that may seem outdated yet remains relevant, typically refer to smaller or newer companies offering potential growth at lower price points. By focusing on those with strong financials and clear growth trajectories, investors can uncover hidden gems in this sector.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.485 | MYR2.41B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.40 | MYR1.11B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.875 | MYR290.45M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.19 | £825.11M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.05 | HK$44.6B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.275 | £425.17M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.69 | £70.37M | ★★★★☆☆ |

Click here to see the full list of 5,702 stocks from our Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Sunac Services Holdings (SEHK:1516)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sunac Services Holdings Limited is an investment holding company offering property development, cultural tourism city construction and operation, and property management services in the People's Republic of China with a market cap of HK$5.47 billion.

Operations: The company's revenue is primarily derived from Property Management and Operational Services (CN¥6.38 billion), Community Living Services (CN¥440.70 million), and Value-Added Services to Non-Property Owners (CN¥271.82 million).

Market Cap: HK$5.47B

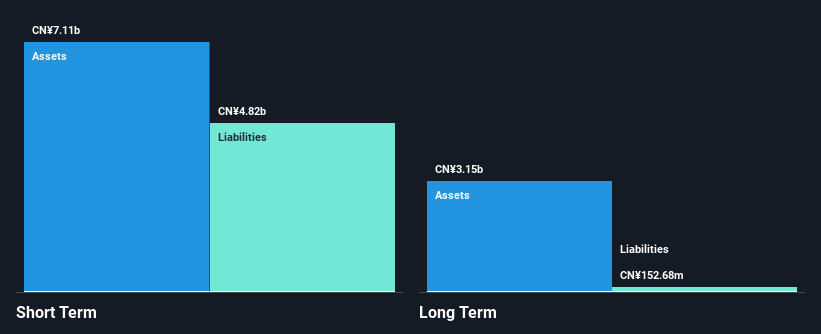

Sunac Services Holdings, with a market cap of HK$5.47 billion, faces challenges as it is currently unprofitable and has seen losses increase over the past five years. Despite its financial struggles, the company benefits from having no debt and short-term assets (CN¥7.1 billion) that exceed both its short-term (CN¥4.8 billion) and long-term liabilities (CN¥152.7 million). It trades significantly below estimated fair value, suggesting potential for upside if profitability improves. The management team is experienced with an average tenure of 4.3 years, providing some stability amidst financial volatility.

- Unlock comprehensive insights into our analysis of Sunac Services Holdings stock in this financial health report.

- Examine Sunac Services Holdings' earnings growth report to understand how analysts expect it to perform.

Sinopec Shanghai Petrochemical (SEHK:338)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sinopec Shanghai Petrochemical Company Limited, along with its subsidiaries, is engaged in the manufacturing and sale of petroleum and chemical products in the People’s Republic of China, with a market cap of approximately HK$27.69 billion.

Operations: Sinopec Shanghai Petrochemical Company Limited does not report specific revenue segments.

Market Cap: HK$27.69B

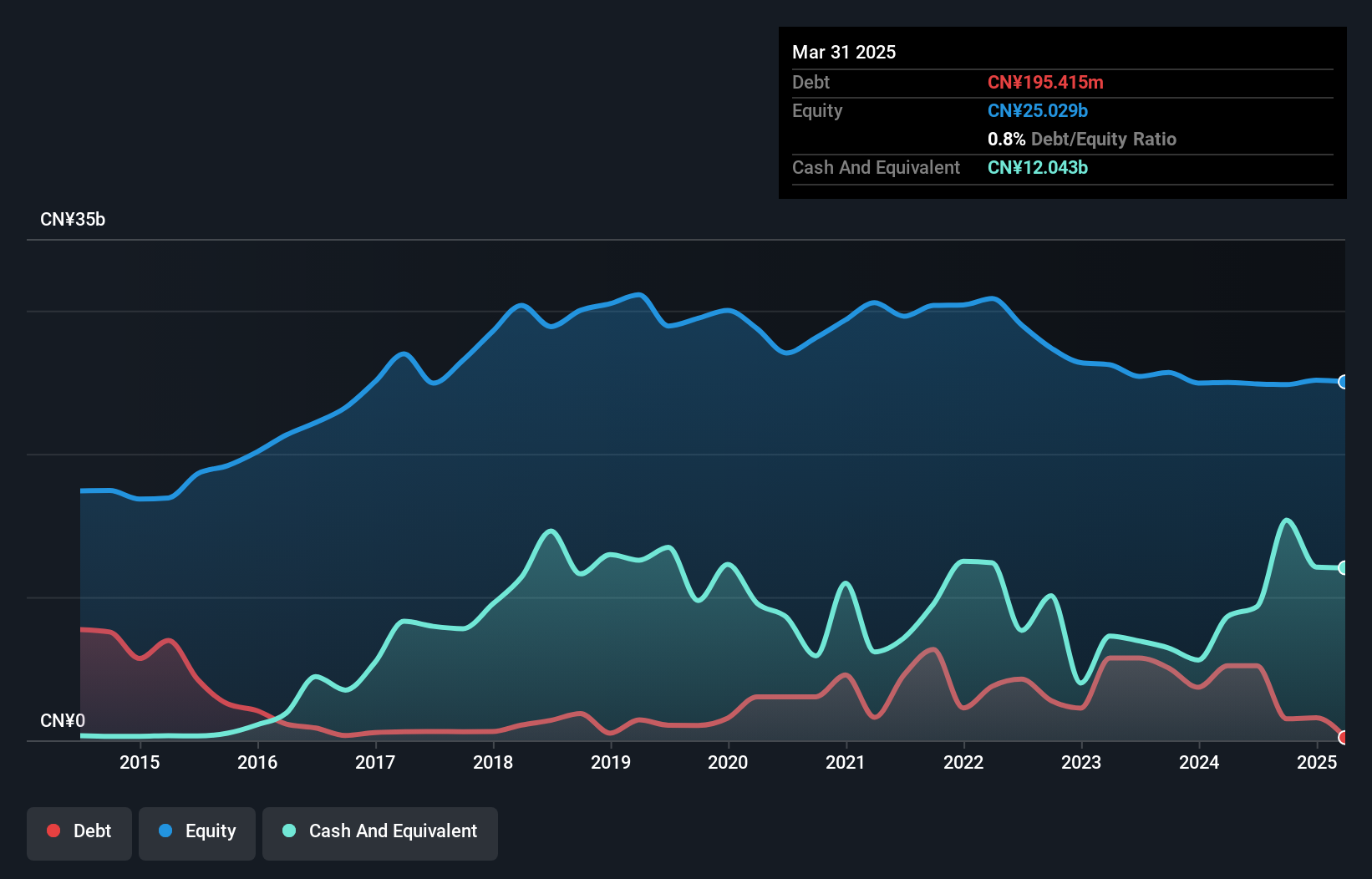

Sinopec Shanghai Petrochemical, with a market cap of HK$27.69 billion, is experiencing financial challenges as it remains unprofitable and its losses have increased over the past five years. The company reported net income of CNY 34.54 million for the first nine months of 2024, a turnaround from a net loss in the previous year. Despite these challenges, Sinopec Shanghai Petrochemical has more cash than total debt and its short-term assets exceed both short-term and long-term liabilities, providing some financial stability. Additionally, it trades at good value compared to peers in the industry.

- Navigate through the intricacies of Sinopec Shanghai Petrochemical with our comprehensive balance sheet health report here.

- Gain insights into Sinopec Shanghai Petrochemical's outlook and expected performance with our report on the company's earnings estimates.

Wolong Resources Group (SHSE:600173)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Wolong Resources Group Co., Ltd. focuses on the development and sale of real estate properties in China, with a market cap of approximately CN¥3.11 billion.

Operations: The company has not reported any specific revenue segments.

Market Cap: CN¥3.11B

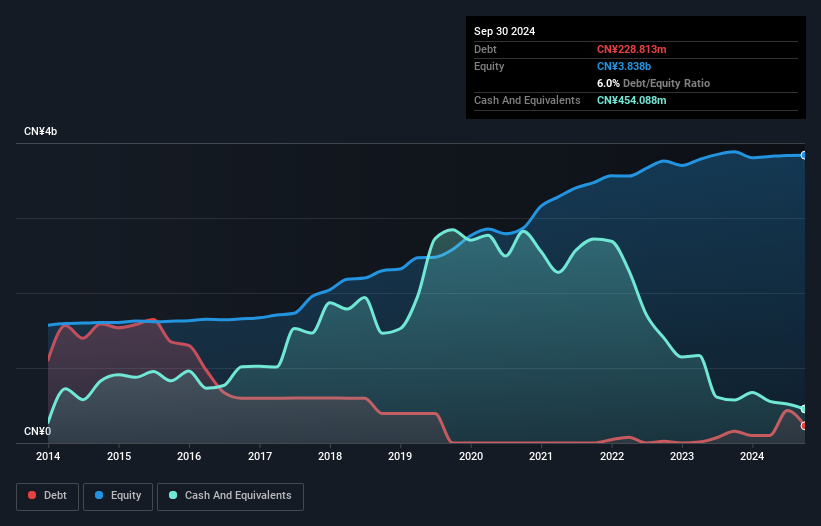

Wolong Resources Group, with a market cap of CN¥3.11 billion, faces challenges as its earnings and profit margins have declined significantly over the past year. The company reported sales of CN¥2,416.86 million for the first nine months of 2024, down from CN¥4,316.64 million a year ago. Despite having more cash than debt and covering interest payments comfortably, its net profit margin has decreased to 1.2% from 3.4%. A large one-off loss impacted recent results negatively; however, short-term assets exceed both short-term and long-term liabilities by a substantial margin offering some financial resilience amidst volatility concerns.

- Click to explore a detailed breakdown of our findings in Wolong Resources Group's financial health report.

- Understand Wolong Resources Group's track record by examining our performance history report.

Seize The Opportunity

- Reveal the 5,702 hidden gems among our Penny Stocks screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:338

Sinopec Shanghai Petrochemical

Manufactures and sells petroleum and chemical products in the People’s Republic of China.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives