- Hong Kong

- /

- Real Estate

- /

- SEHK:147

The Price Is Right For International Business Settlement Holdings Limited (HKG:147) Even After Diving 26%

International Business Settlement Holdings Limited (HKG:147) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. Longer-term shareholders would now have taken a real hit with the stock declining 3.4% in the last year.

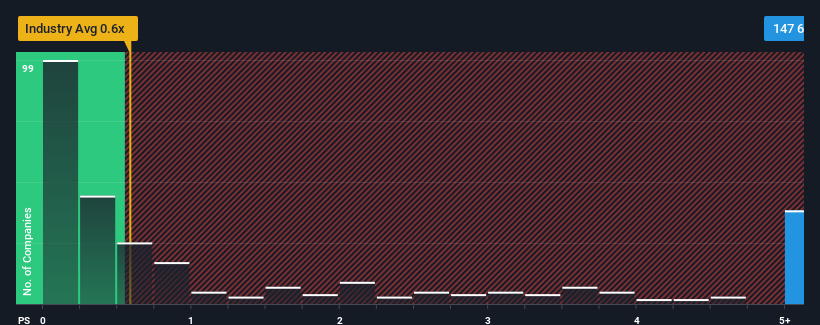

Although its price has dipped substantially, given around half the companies in Hong Kong's Real Estate industry have price-to-sales ratios (or "P/S") below 0.6x, you may still consider International Business Settlement Holdings as a stock to avoid entirely with its 6.6x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for International Business Settlement Holdings

How Has International Business Settlement Holdings Performed Recently?

For instance, International Business Settlement Holdings' receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on International Business Settlement Holdings will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like International Business Settlement Holdings' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 80% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 103% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 4.1%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's understandable that International Business Settlement Holdings' P/S sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What We Can Learn From International Business Settlement Holdings' P/S?

A significant share price dive has done very little to deflate International Business Settlement Holdings' very lofty P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It's no surprise that International Business Settlement Holdings can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 1 warning sign for International Business Settlement Holdings that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:147

International Business Settlement Holdings

An investment holding company, engages in the property development business in Mainland China and Hong Kong.

Adequate balance sheet minimal.

Market Insights

Community Narratives