Cheuk Nang (Holdings) Limited's (HKG:131) dividend is being reduced by 50% to HK$0.02 per share on 15th of December, in comparison to last year's comparable payment of HK$0.04. This payment takes the dividend yield to 4.5%, which only provides a modest boost to overall returns.

Cheuk Nang (Holdings)'s Distributions May Be Difficult To Sustain

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. Even in the absence of profits, Cheuk Nang (Holdings) is paying a dividend. The company is also yet to generate cash flow, so the dividend sustainability is definitely questionable.

Looking forward, earnings per share could 43.1% over the next year if the trend of the last few years can't be broken. This will push the company into unprofitability, which means the managers will have to choose between suspending the dividend, or paying it out of cash reserves.

See our latest analysis for Cheuk Nang (Holdings)

Dividend Volatility

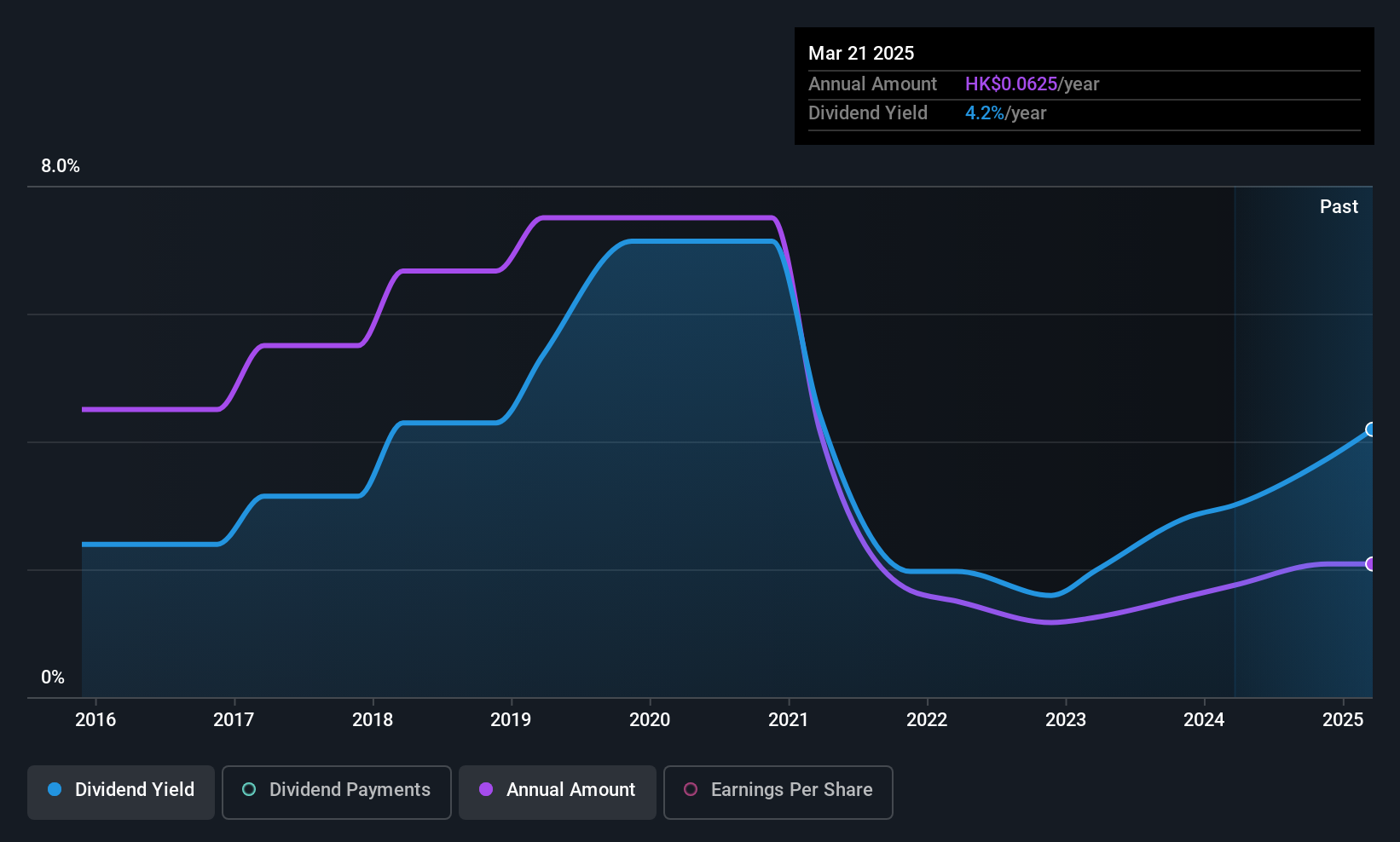

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. Since 2015, the dividend has gone from HK$0.16 total annually to HK$0.0625. Doing the maths, this is a decline of about 9.0% per year. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

The Dividend Has Limited Growth Potential

Dividends have been going in the wrong direction, so we definitely want to see a different trend in the earnings per share. Earnings per share has been sinking by 43% over the last five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future.

We're Not Big Fans Of Cheuk Nang (Holdings)'s Dividend

In summary, it's not great to see that the dividend is being cut, but it is probably understandable given that the current payment level was quite high. The company isn't making enough to be paying as much as it is, and the other factors don't look particularly promising either. The dividend doesn't inspire confidence that it will provide solid income in the future.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've picked out 2 warning signs for Cheuk Nang (Holdings) that investors should know about before committing capital to this stock. Is Cheuk Nang (Holdings) not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:131

Cheuk Nang (Holdings)

An investment holding company, engages in the investment, development, and management of properties in Hong Kong, Macau, the People’s Republic of China, and Malaysia.

Mediocre balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026