- Hong Kong

- /

- Real Estate

- /

- SEHK:131

Cheuk Nang (Holdings) (HKG:131) Will Pay A Smaller Dividend Than Last Year

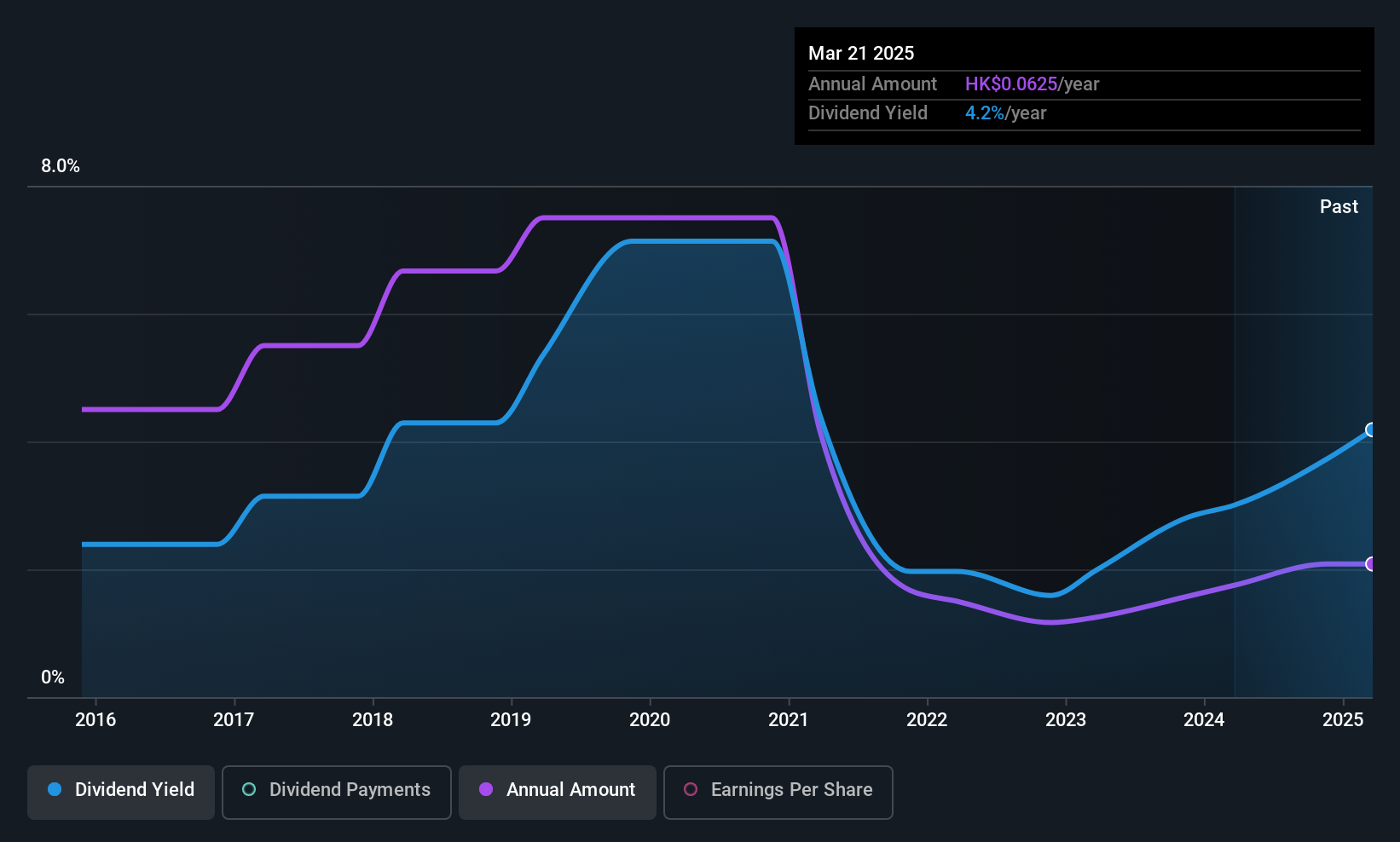

Cheuk Nang (Holdings) Limited's (HKG:131) dividend is being reduced from last year's payment covering the same period to HK$0.02 on the 15th of December. This means that the dividend yield is 3.1%, which is a bit low when comparing to other companies in the industry.

Cheuk Nang (Holdings) Might Find It Hard To Continue The Dividend

It would be nice for the yield to be higher, but we should also check if higher levels of dividend payment would be sustainable. Even though Cheuk Nang (Holdings) isn't generating a profit, it is generating healthy free cash flows that easily cover the dividend. We generally think that cash flow is more important than accounting measures of profit, so we are fairly comfortable with the dividend at this level.

Over the next year, EPS might fall by 43.0% based on recent performance. This will push the company into unprofitability, which means the managers will have to choose between suspending the dividend, or paying it out of cash reserves.

Check out our latest analysis for Cheuk Nang (Holdings)

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. Since 2015, the annual payment back then was HK$0.135, compared to the most recent full-year payment of HK$0.0425. The dividend has fallen 69% over that period. A company that decreases its dividend over time generally isn't what we are looking for.

The Dividend Has Limited Growth Potential

Dividends have been going in the wrong direction, so we definitely want to see a different trend in the earnings per share. Over the past five years, it looks as though Cheuk Nang (Holdings)'s EPS has declined at around 43% a year. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future.

The Dividend Could Prove To Be Unreliable

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We don't think Cheuk Nang (Holdings) is a great stock to add to your portfolio if income is your focus.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Case in point: We've spotted 2 warning signs for Cheuk Nang (Holdings) (of which 1 shouldn't be ignored!) you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:131

Cheuk Nang (Holdings)

An investment holding company, engages in the investment, development, and management of properties in Hong Kong, Macau, the People’s Republic of China, and Malaysia.

Mediocre balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026