- Hong Kong

- /

- Real Estate

- /

- SEHK:1238

Some Powerlong Real Estate Holdings Limited (HKG:1238) Shareholders Look For Exit As Shares Take 25% Pounding

The Powerlong Real Estate Holdings Limited (HKG:1238) share price has softened a substantial 25% over the previous 30 days, handing back much of the gains the stock has made lately. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 33% in that time.

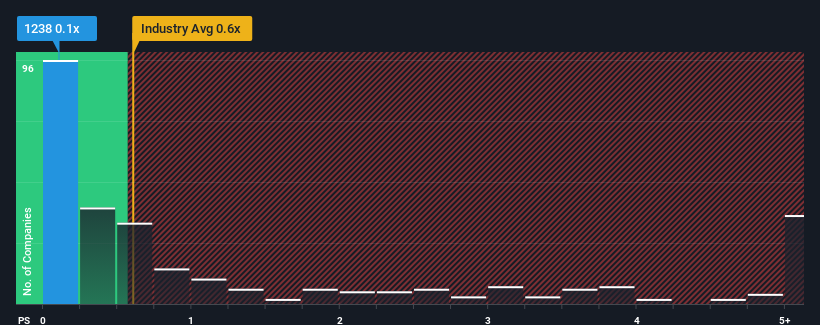

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Powerlong Real Estate Holdings' P/S ratio of 0.1x, since the median price-to-sales (or "P/S") ratio for the Real Estate industry in Hong Kong is also close to 0.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Powerlong Real Estate Holdings

What Does Powerlong Real Estate Holdings' P/S Mean For Shareholders?

Powerlong Real Estate Holdings could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Powerlong Real Estate Holdings.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Powerlong Real Estate Holdings' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 27% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 35% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the only analyst covering the company suggest revenue growth is heading into negative territory, declining 4.4% per annum over the next three years. With the industry predicted to deliver 5.7% growth each year, that's a disappointing outcome.

In light of this, it's somewhat alarming that Powerlong Real Estate Holdings' P/S sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Bottom Line On Powerlong Real Estate Holdings' P/S

With its share price dropping off a cliff, the P/S for Powerlong Real Estate Holdings looks to be in line with the rest of the Real Estate industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our check of Powerlong Real Estate Holdings' analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Powerlong Real Estate Holdings (at least 2 which are significant), and understanding them should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1238

Powerlong Real Estate Holdings

An investment holding company, invests in, develops, operates, and manages commercial real estate projects in the People’s Republic of China.

Good value with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives