- Hong Kong

- /

- Real Estate

- /

- SEHK:1109

A Look at China Resources Land (SEHK:1109) Valuation After Latest Operating Update Highlights Recurring Revenue Strength

Reviewed by Simply Wall St

China Resources Land (SEHK:1109) just shared its operating results through September, revealing that although overall contracted sales and floor area dropped year-over-year, recurring revenue and rental income both moved higher. This hints at a resilient investment property business.

See our latest analysis for China Resources Land.

China Resources Land’s investment property strength appears to have caught investors’ attention, with shares up more than 34% year to date and a 20% total shareholder return over the past year. While momentum softened a bit in recent weeks, the bigger picture still points to steady long-term gains.

If you’re interested in what other major property players are up to, this is a great opportunity to explore fast growing stocks with high insider ownership.

With shares advancing strongly and the company trading at a sizable discount to analyst price targets, investors may be wondering whether China Resources Land is offering a genuine bargain or if the market has already factored in future upside.

Price-to-Earnings of 7.2x: Is it justified?

China Resources Land is trading at a price-to-earnings (PE) ratio of 7.2x, which is significantly lower than both its sector and peer averages. This suggests strong value at the current price of HK$29.94.

The price-to-earnings ratio measures how much investors are willing to pay today for each dollar of earnings. For real estate companies, this is a widely used metric as it reflects how the market values a firm's capacity to generate profits relative to its current share price.

At 7.2x PE, the market appears to be undervaluing China Resources Land’s ability to convert sales into profits compared to the sector average of 13.9x and the peer group average of 16.8x. The multiple is also well below the estimated fair PE ratio of 14.3x, which suggests that the current price could offer considerable upside should sentiment or fundamentals shift closer to the fair level the market typically rewards.

Explore the SWS fair ratio for China Resources Land

Result: Price-to-Earnings of 7.2x (UNDERVALUED)

However, slower revenue growth or shifts in market sentiment could limit near-term upside. This may keep investors cautious despite attractive valuation signals.

Find out about the key risks to this China Resources Land narrative.

Another View: What Does Our DCF Model Say?

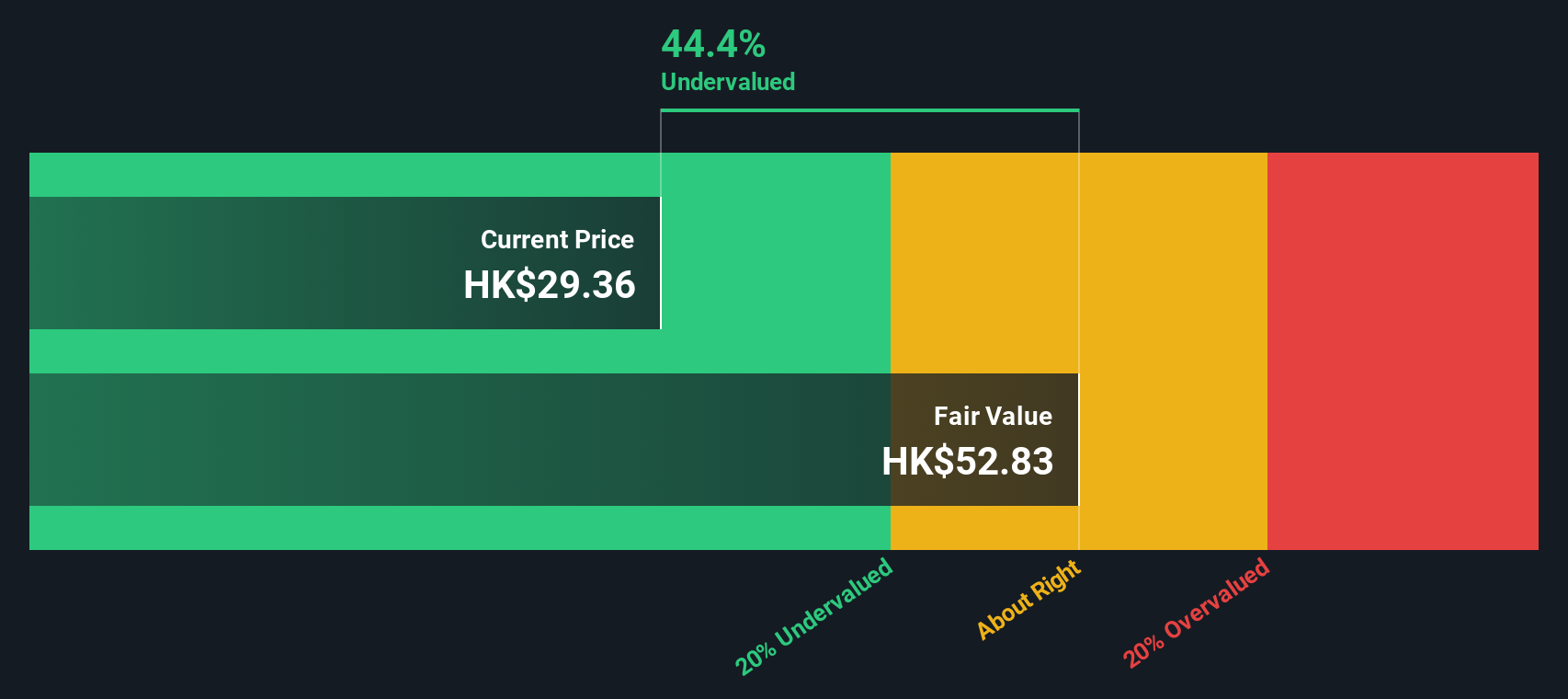

While the price-to-earnings ratio suggests China Resources Land looks undervalued, the SWS DCF model paints an even more upbeat picture. According to our DCF analysis, the stock is trading 43.3% below its estimated fair value. This signals a potentially significant upside. But does the market agree with this outlook, or is there unseen risk holding the price back?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out China Resources Land for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own China Resources Land Narrative

If you have your own perspective or want to dig into the data yourself, you’re free to shape your own view in just minutes. Do it your way.

A great starting point for your China Resources Land research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let tremendous opportunities pass by. Expand your strategy and secure your edge with powerful stock screens specifically tailored for today’s market environment.

- Unlock potential gains by targeting undervalued companies through these 875 undervalued stocks based on cash flows, where strong fundamentals and attractive prices meet real opportunity.

- Capture steady income and boost your portfolio’s resilience by choosing top picks in these 17 dividend stocks with yields > 3%, focused on reliable yields above 3%.

- Capitalize on the next big leap in digital finance with these 79 cryptocurrency and blockchain stocks, highlighting companies advancing cryptocurrency and blockchain technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1109

China Resources Land

An investment holding company, engages in the investment, development, management, and sale of properties in the People’s Republic of China.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives