- Hong Kong

- /

- Real Estate

- /

- SEHK:1030

Shareholders in Seazen Group (HKG:1030) have lost 78%, as stock drops 11% this past week

While it may not be enough for some shareholders, we think it is good to see the Seazen Group Limited (HKG:1030) share price up 14% in a single quarter. But will that repair the damage for the weary investors who have owned this stock as it declined over half a decade? Probably not. Indeed, the share price is down a whopping 80% in that time. It's true that the recent bounce could signal the company is turning over a new leaf, but we are not so sure. The real question is whether the business can leave its past behind and improve itself over the years ahead.

Since Seazen Group has shed HK$1.6b from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Check out our latest analysis for Seazen Group

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Seazen Group has made a profit in the past. On the other hand, it reported a trailing twelve months loss, suggesting it isn't reliably profitable. Other metrics might give us a better handle on how its value is changing over time.

In contrast to the share price, revenue has actually increased by 4.5% a year in the five year period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

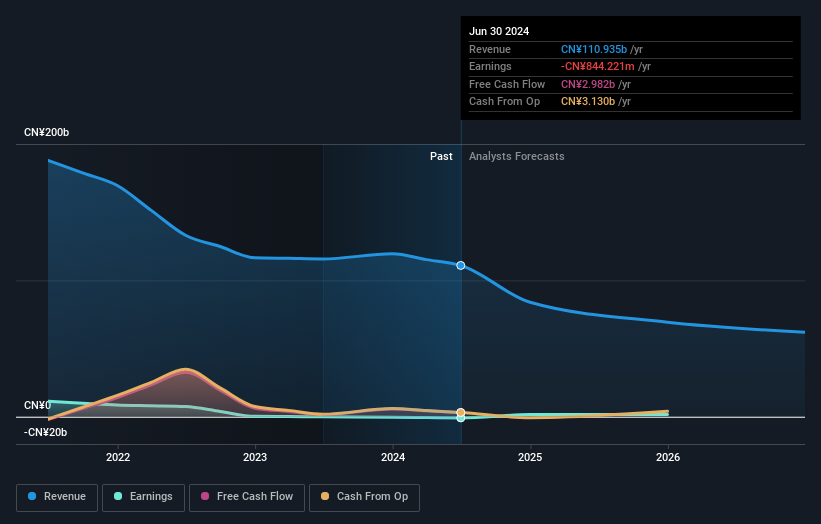

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling Seazen Group stock, you should check out this FREE detailed report on its balance sheet.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Seazen Group's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Seazen Group's TSR, which was a 78% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

We're pleased to report that Seazen Group shareholders have received a total shareholder return of 41% over one year. Notably the five-year annualised TSR loss of 12% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 2 warning signs we've spotted with Seazen Group (including 1 which shouldn't be ignored) .

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1030

Seazen Group

Engages in the investment, development, management, and sale of properties in the People’s Republic of China.

Moderate growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives