- Hong Kong

- /

- Real Estate

- /

- SEHK:101

Hang Lung Properties Limited (HKG:101) Stock Rockets 26% As Investors Are Less Pessimistic Than Expected

Hang Lung Properties Limited (HKG:101) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Taking a wider view, although not as strong as the last month, the full year gain of 17% is also fairly reasonable.

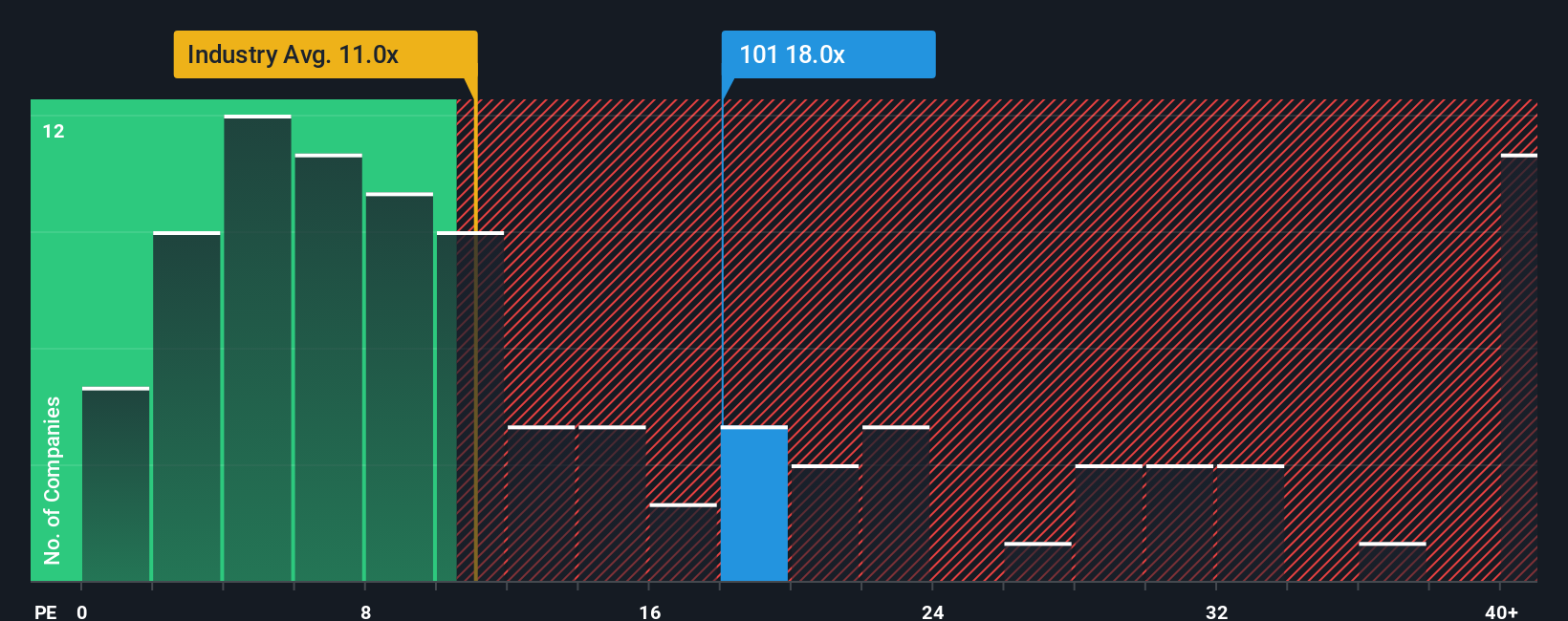

After such a large jump in price, Hang Lung Properties may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 18x, since almost half of all companies in Hong Kong have P/E ratios under 11x and even P/E's lower than 6x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

While the market has experienced earnings growth lately, Hang Lung Properties' earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

See our latest analysis for Hang Lung Properties

Is There Enough Growth For Hang Lung Properties?

In order to justify its P/E ratio, Hang Lung Properties would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 47%. As a result, earnings from three years ago have also fallen 50% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 16% per annum over the next three years. That's shaping up to be similar to the 14% each year growth forecast for the broader market.

With this information, we find it interesting that Hang Lung Properties is trading at a high P/E compared to the market. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

The strong share price surge has got Hang Lung Properties' P/E rushing to great heights as well. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Hang Lung Properties currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You should always think about risks. Case in point, we've spotted 2 warning signs for Hang Lung Properties you should be aware of.

If these risks are making you reconsider your opinion on Hang Lung Properties, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Hang Lung Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:101

Hang Lung Properties

An investment holding company, engages in the property investment, development, and management activities in Hong Kong and Mainland China.

Mediocre balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026