Does RemeGen’s Narrowed Net Loss and Rising Revenue Shift Sentiment on SEHK:9995’s Recovery Potential?

Reviewed by Sasha Jovanovic

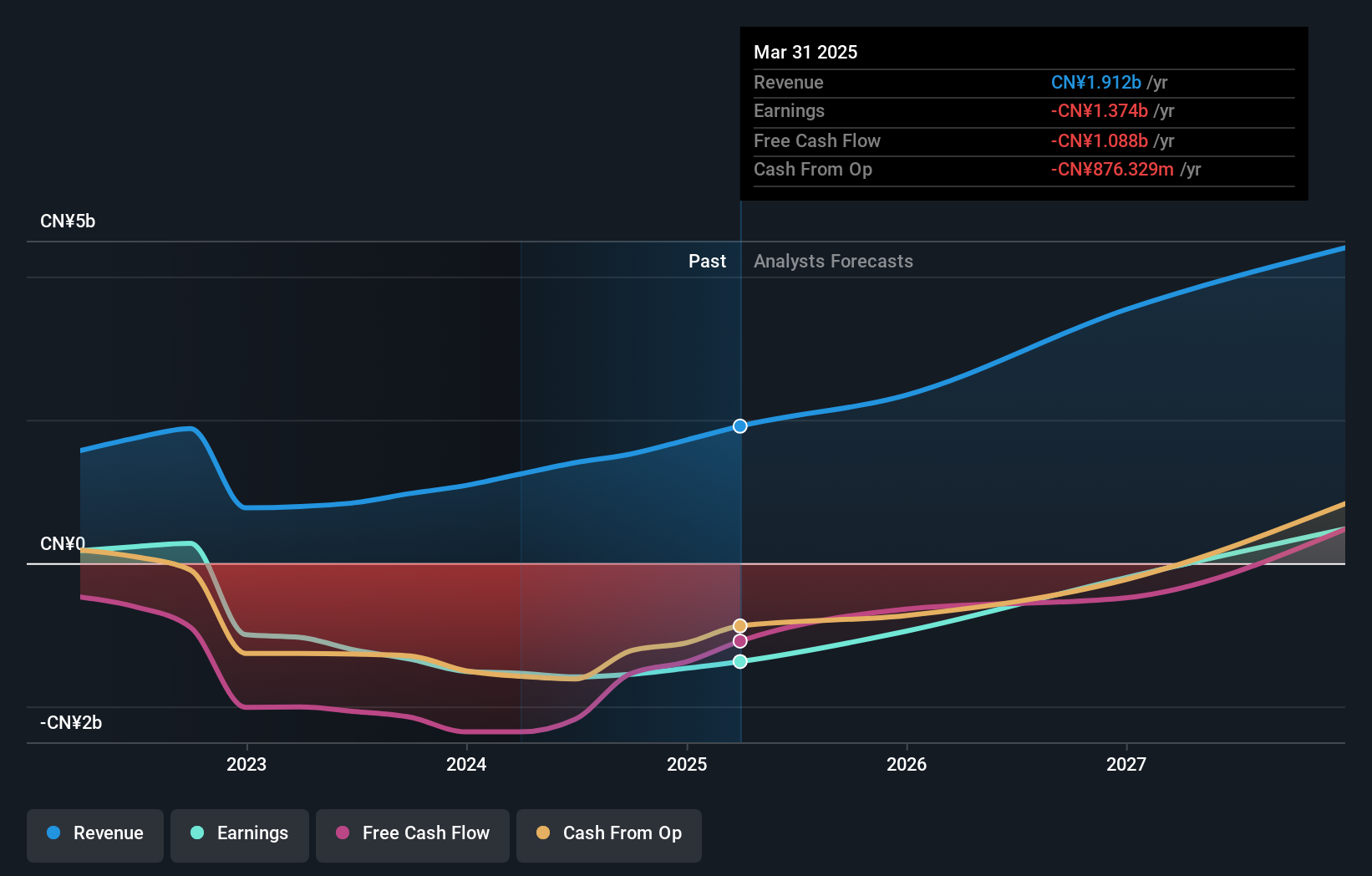

- RemeGen Co., Ltd. reported earnings for the nine months ended September 30, 2025, with sales and revenue rising to CNY 1,719.83 million from CNY 1,208.87 million a year earlier, while its net loss narrowed to CNY 550.7 million from CNY 1,071.43 million.

- The company also reported that its basic and diluted loss per share from continuing operations dropped to CNY 1.01 from CNY 1.99 in the previous year.

- We'll explore how RemeGen’s reduced net loss and improved revenue shape its investment narrative in light of these financial results.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is RemeGen's Investment Narrative?

To put RemeGen’s latest earnings in perspective, an investor must believe in the company’s progress toward profitability driven by strong revenue growth and ongoing advancements in its drug pipeline. The encouraging reduction in net loss and improved revenue are welcome developments for anyone following its clinical milestones, product launches, and licensing deals, especially after approvals for key drugs like telitacicept. This financial update could provide confidence around the short-term catalyst of bringing new products to market and expanding partnerships, both of which have been front and center in RemeGen’s recent news flow. However, risks such as continued heavy losses, insider selling, and board independence remain relevant. The magnitude of share price gains over the past year also raises questions about valuation. This latest financial performance may ease some concerns about near-term losses, but it doesn’t remove deeper risks around cost control and market competition.

But despite stronger revenue, insider selling remains a key risk for investors to keep in mind.

Exploring Other Perspectives

Explore another fair value estimate on RemeGen - why the stock might be worth as much as 26% more than the current price!

Build Your Own RemeGen Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RemeGen research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free RemeGen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RemeGen's overall financial health at a glance.

No Opportunity In RemeGen?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9995

RemeGen

A biopharmaceutical company, discovers, develops, produces, and commercializes biological drugs for the treatment of autoimmune, oncology, and ophthalmic diseases in Mainland China and the United States.

Exceptional growth potential and slightly overvalued.

Market Insights

Community Narratives