As global markets navigate a landscape of rate cuts and mixed economic signals, the technology-heavy Nasdaq Composite has reached new heights, contrasting with broader declines in major stock indexes. In this environment, high-growth tech stocks stand out as potential opportunities for investors seeking innovation-driven growth, especially as growth stocks continue to outperform value counterparts amidst evolving monetary policies and market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1249 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Nordhealth (OB:NORDH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nordhealth AS offers healthcare software solutions across Norway, Finland, Sweden, Denmark, Germany, and internationally with a market capitalization of NOK3.20 billion.

Operations: The company generates revenue primarily through its healthcare software solutions, serving multiple countries including Norway, Finland, and Germany.

Nordhealth, a player in the healthcare tech sector, showcased significant resilience with its recent financial performance. In Q3 2024, the company's revenue surged to €11.25 million from €8.85 million year-over-year, marking a robust growth trajectory. Despite a net loss of €0.807 million for the quarter, this figure has notably improved from a loss of €1.88 million in the same period last year. The firm is navigating through its unprofitable phase with an expected annual revenue growth rate of 16.7%, outpacing the Norwegian market's average of 2.2%. This growth is underpinned by strategic R&D investments aimed at fostering innovation and securing a competitive edge in the evolving tech landscape of healthcare services.

- Take a closer look at Nordhealth's potential here in our health report.

Gain insights into Nordhealth's historical performance by reviewing our past performance report.

Alphamab Oncology (SEHK:9966)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Alphamab Oncology is a clinical stage biopharmaceutical company focused on the research, development, manufacture, and commercialization of oncology biologics with a market cap of HK$3.28 billion.

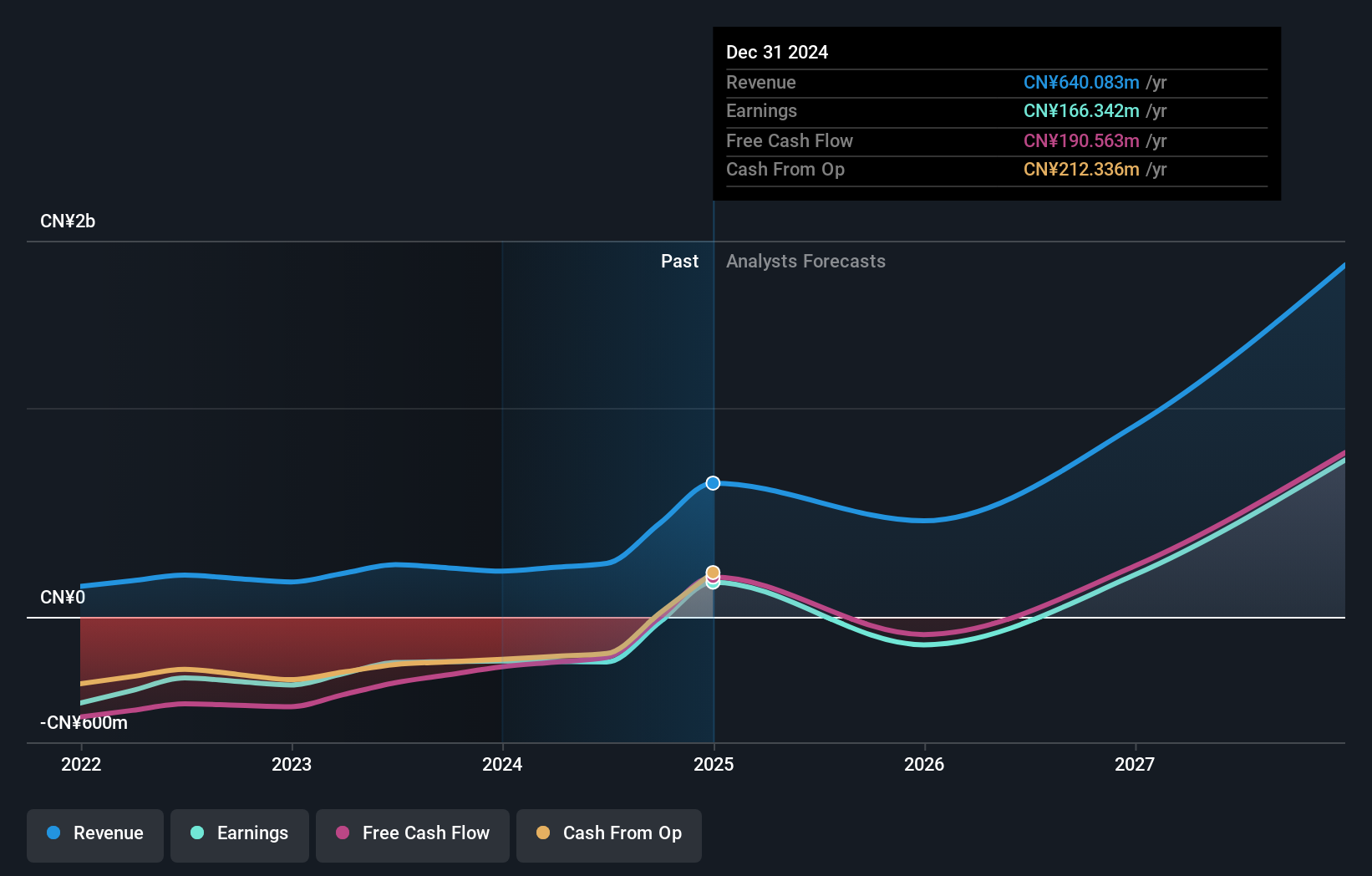

Operations: The company generates revenue primarily from its pharmaceuticals segment, amounting to CN¥255.87 million. It operates within the biopharmaceutical sector, focusing on oncology biologics development and commercialization.

Alphamab Oncology, amid a challenging landscape, stands out with its innovative approach in cancer treatment. The company's recent presentation at the ESMO-IO Congress 2024 highlighted promising results from their phase II study of KN046, a novel bispecific antibody for advanced non-small cell lung cancer. This aligns with their strategic focus on R&D, which is robustly supported by an annual revenue growth forecast of 39.4% and earnings projected to surge by 70.1% annually. Their commitment to innovation is further underscored by substantial investments in research, positioning them well for future breakthroughs in oncology therapeutics despite current unprofitability and market volatility.

- Unlock comprehensive insights into our analysis of Alphamab Oncology stock in this health report.

Explore historical data to track Alphamab Oncology's performance over time in our Past section.

China Resources Boya Bio-pharmaceutical GroupLtd (SZSE:300294)

Simply Wall St Growth Rating: ★★★★☆☆

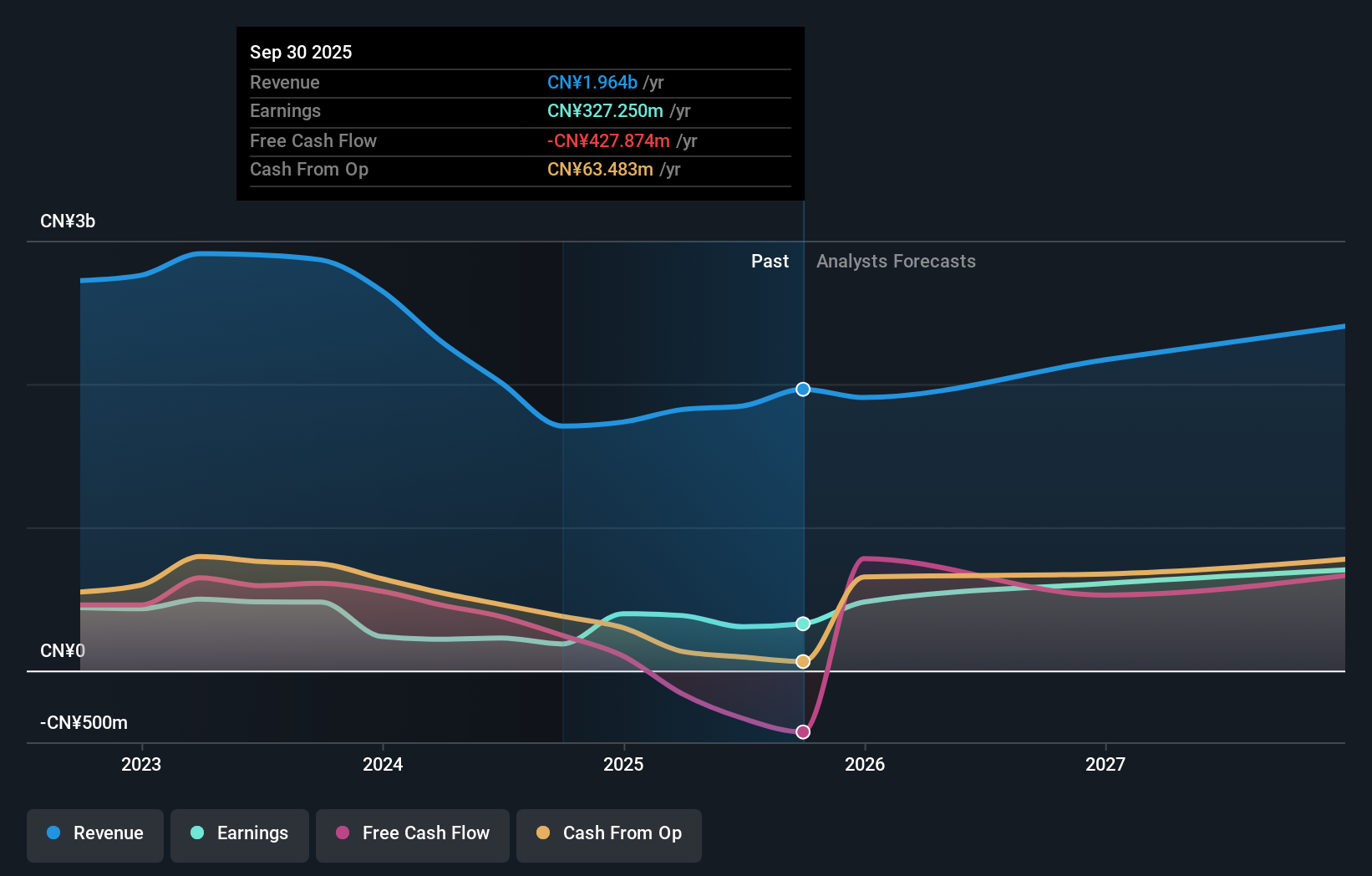

Overview: China Resources Boya Bio-pharmaceutical Group Co., Ltd operates in the blood product industry within China and has a market cap of CN¥15.46 billion.

Operations: China Resources Boya Bio-pharmaceutical Group Co., Ltd focuses on the blood product sector in China, generating significant revenue from its diverse range of plasma-derived therapies. The company has shown a notable trend in its gross profit margin, reflecting operational efficiency within this specialized market.

China Resources Boya Bio-pharmaceutical GroupLtd has demonstrated resilience with a strategic focus on enhancing shareholder value, as evidenced by its recent dividend affirmation and a special meeting to elect directors. Despite facing challenges such as a significant one-off loss of CN¥325.5M impacting its financials, the company's commitment to growth is clear with an expected annual earnings increase of 44.4% and revenue growth at 13.9%. This positions it favorably against the broader Chinese market's growth rates in both revenue and earnings, underscoring its potential in a competitive biotech landscape.

Turning Ideas Into Actions

- Gain an insight into the universe of 1249 High Growth Tech and AI Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9966

Alphamab Oncology

A clinical stage biopharmaceutical company, engages in the research and development, manufacture, and commercialization of oncology biologics.

High growth potential with excellent balance sheet.