Assessing Akeso (SEHK:9926) After Its Strong Year-to-Date Rally and Recent Share Price Pullback

Reviewed by Simply Wall St

Akeso (SEHK:9926) has quietly turned into one of those stocks long term investors keep revisiting, with strong year to date gains despite recent pullbacks. This makes its current valuation worth a closer look.

See our latest analysis for Akeso.

That backdrop helps explain why a recent cool off in the share price, including a 4.0% one day share price pullback to HK$119.4, sits alongside a powerful year to date share price return of roughly 104%. Longer term total shareholder returns are still firmly positive, suggesting momentum has cooled but not broken.

If Akeso has caught your eye, it is also worth seeing what else is moving in healthcare right now, including healthcare stocks that could be next on your watchlist.

With shares still trading at a steep discount to analyst targets, despite rapid top line growth but ongoing losses, investors now face a key question: is Akeso a genuine value opportunity, or is the market already pricing in its future growth?

Most Popular Narrative Narrative: 30.6% Undervalued

With Akeso last closing at HK$119.4 against a narrative fair value near HK$172, the story hinges on aggressive growth translating into future profitability.

The analysts are assuming Akeso's revenue will grow by 55.4% annually over the next 3 years.

Analysts assume that profit margins will increase from -24.2% today to 25.4% in 3 years time.

Curious how a loss making biotech can command this kind of future valuation multiple, and what profit profile it needs to get there? Read on to see the full narrative and the bold assumptions driving that HK$172 fair value.

Result: Fair Value of $172.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained operating losses and heavy reliance on just a few flagship drugs mean that any trial setback or pricing pressure could quickly challenge this upbeat narrative.

Find out about the key risks to this Akeso narrative.

Another Lens On Valuation

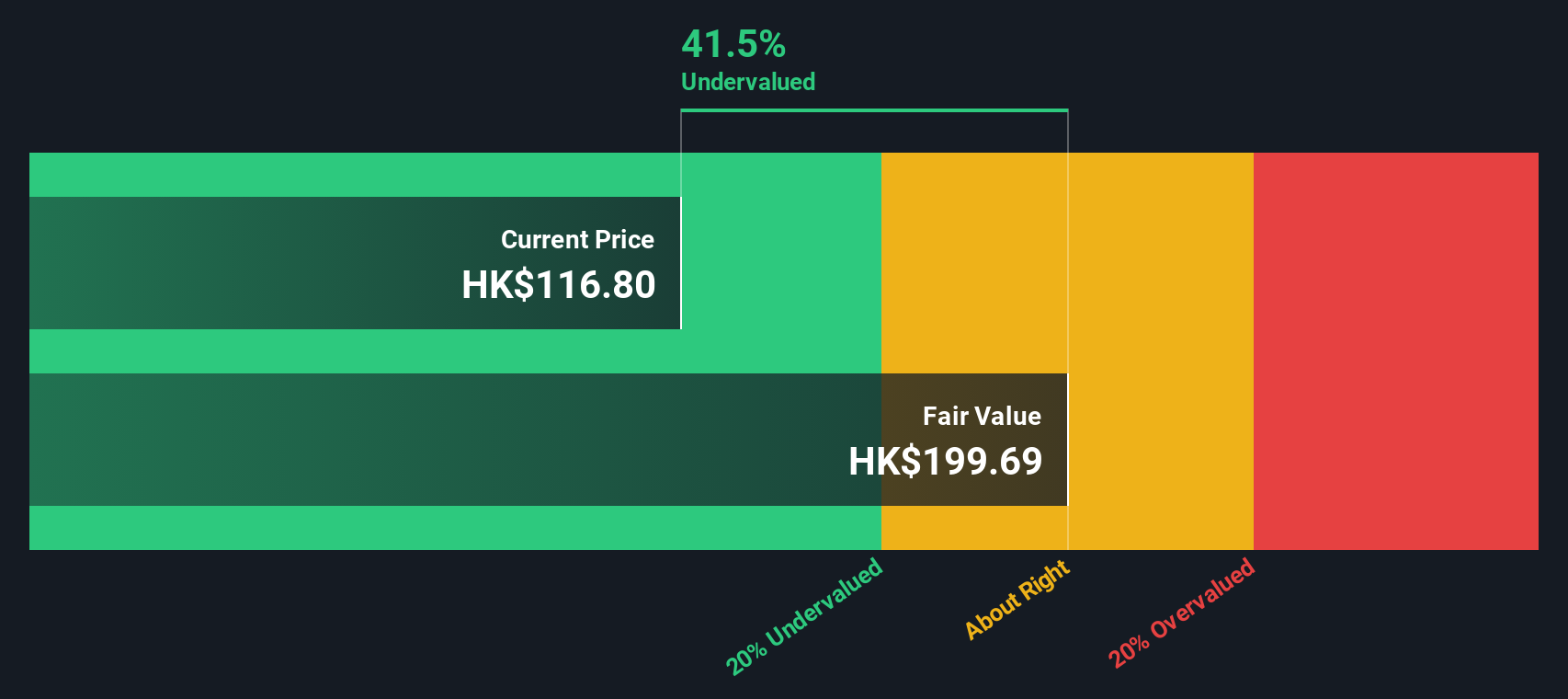

Despite trading about 40% below our estimate of fair value at HK$199.24 using the SWS DCF model, Akeso also looks expensive on a simple price to sales basis, at 39.8x versus a 19.9x fair ratio. Is that a rare growth bargain, or just a lot of optimism upfront?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Akeso Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalised view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Akeso.

Looking for more investment ideas?

Akeso might be compelling, but you will kick yourself later if you ignore other opportunities Simply Wall St has already filtered with powerful, data driven screeners.

- Capture early stage potential by reviewing these 3588 penny stocks with strong financials that already pair tiny share prices with solid underlying fundamentals.

- Position your portfolio for the next productivity wave by targeting these 27 AI penny stocks pushing real world applications of artificial intelligence.

- Lock in attractive entry points with these 903 undervalued stocks based on cash flows that our models flag as trading below their cash flow based fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9926

Akeso

A biopharmaceutical company, engages in the research, development, manufacture, and commercialization of antibody drugs worldwide.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026