Investors Give Wai Yuen Tong Medicine Holdings Limited (HKG:897) Shares A 46% Hiding

The Wai Yuen Tong Medicine Holdings Limited (HKG:897) share price has fared very poorly over the last month, falling by a substantial 46%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 34% share price drop.

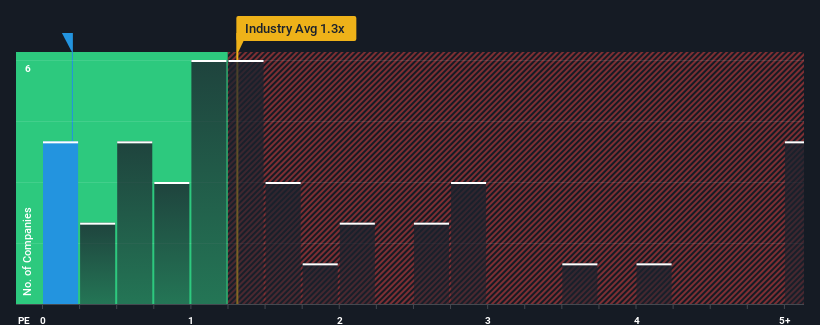

In spite of the heavy fall in price, considering around half the companies operating in Hong Kong's Pharmaceuticals industry have price-to-sales ratios (or "P/S") above 1.3x, you may still consider Wai Yuen Tong Medicine Holdings as an solid investment opportunity with its 0.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Wai Yuen Tong Medicine Holdings

What Does Wai Yuen Tong Medicine Holdings' P/S Mean For Shareholders?

We'd have to say that with no tangible growth over the last year, Wai Yuen Tong Medicine Holdings' revenue has been unimpressive. One possibility is that the P/S is low because investors think this benign revenue growth rate will likely underperform the broader industry in the near future. If not, then existing shareholders may be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Wai Yuen Tong Medicine Holdings' earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Wai Yuen Tong Medicine Holdings' to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Although pleasingly revenue has lifted 60% in aggregate from three years ago, notwithstanding the last 12 months. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

When compared to the industry's one-year growth forecast of 14%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we find it odd that Wai Yuen Tong Medicine Holdings is trading at a P/S lower than the industry. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Final Word

The southerly movements of Wai Yuen Tong Medicine Holdings' shares means its P/S is now sitting at a pretty low level. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Wai Yuen Tong Medicine Holdings revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

Plus, you should also learn about these 3 warning signs we've spotted with Wai Yuen Tong Medicine Holdings (including 1 which doesn't sit too well with us).

If these risks are making you reconsider your opinion on Wai Yuen Tong Medicine Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Wai Yuen Tong Medicine Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Wai Yuen Tong Medicine Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:897

Wai Yuen Tong Medicine Holdings

An investment holding company, engages in production and sale of Chinese and western pharmaceuticals and health food products in Mainland China and Hong Kong.

Flawless balance sheet and good value.