- Hong Kong

- /

- Healthcare Services

- /

- SEHK:874

Why We Think Guangzhou Baiyunshan Pharmaceutical Holdings Company Limited's (HKG:874) CEO Compensation Is Not Excessive At All

Shareholders may be wondering what CEO Hong Li plans to do to improve the less than great performance at Guangzhou Baiyunshan Pharmaceutical Holdings Company Limited (HKG:874) recently. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 03 June 2021. It has been shown that setting appropriate executive remuneration incentivises the management to act in the interests of shareholders. We have prepared some analysis below to show that CEO compensation looks to be reasonable.

See our latest analysis for Guangzhou Baiyunshan Pharmaceutical Holdings

Comparing Guangzhou Baiyunshan Pharmaceutical Holdings Company Limited's CEO Compensation With the industry

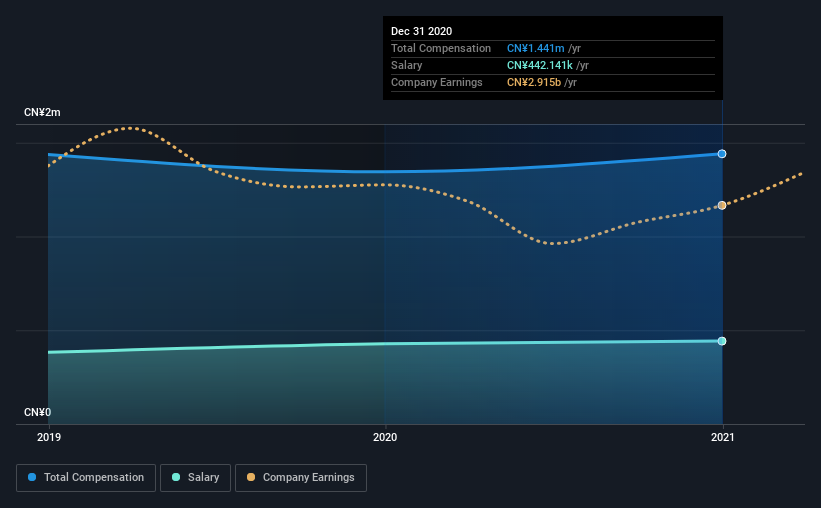

At the time of writing, our data shows that Guangzhou Baiyunshan Pharmaceutical Holdings Company Limited has a market capitalization of HK$60b, and reported total annual CEO compensation of CN¥1.4m for the year to December 2020. That's just a smallish increase of 7.1% on last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at CN¥442k.

In comparison with other companies in the industry with market capitalizations ranging from HK$31b to HK$93b, the reported median CEO total compensation was CN¥6.3m. Accordingly, Guangzhou Baiyunshan Pharmaceutical Holdings pays its CEO under the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CN¥442k | CN¥428k | 31% |

| Other | CN¥999k | CN¥917k | 69% |

| Total Compensation | CN¥1.4m | CN¥1.3m | 100% |

Speaking on an industry level, nearly 70% of total compensation represents salary, while the remainder of 30% is other remuneration. It's interesting to note that Guangzhou Baiyunshan Pharmaceutical Holdings allocates a smaller portion of compensation to salary in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Guangzhou Baiyunshan Pharmaceutical Holdings Company Limited's Growth

Guangzhou Baiyunshan Pharmaceutical Holdings Company Limited has seen its earnings per share (EPS) increase by 11% a year over the past three years. It achieved revenue growth of 1.3% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's also good to see modest revenue growth, suggesting the underlying business is healthy. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Guangzhou Baiyunshan Pharmaceutical Holdings Company Limited Been A Good Investment?

Few Guangzhou Baiyunshan Pharmaceutical Holdings Company Limited shareholders would feel satisfied with the return of -41% over three years. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

The fact that shareholders have earned a negative share price return is certainly disconcerting. The share price trend has diverged with the robust growth in EPS however, suggesting there may be other factors that could be driving the price performance. A key question may be why the fundamentals have not yet been reflected into the share price. In the upcoming AGM, shareholders should take this opportunity to raise these concerns with the board and revisit their investment thesis with regards to the company.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 2 warning signs for Guangzhou Baiyunshan Pharmaceutical Holdings (of which 1 makes us a bit uncomfortable!) that you should know about in order to have a holistic understanding of the stock.

Important note: Guangzhou Baiyunshan Pharmaceutical Holdings is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:874

Guangzhou Baiyunshan Pharmaceutical Holdings

Researches, develops, manufactures, and sells Chinese patent and Western medicines, chemical raw materials, natural and biological medicines, and intermediates of chemical raw materials in the People’s Republic of China and internationally.

Excellent balance sheet average dividend payer.