We Think Shareholders May Want To Consider A Review Of China Medical System Holdings Limited's (HKG:867) CEO Compensation Package

Key Insights

- China Medical System Holdings will host its Annual General Meeting on 9th of May

- Total pay for CEO Kong Lam includes CN¥5.09m salary

- The total compensation is 80% higher than the average for the industry

- Over the past three years, China Medical System Holdings' EPS fell by 1.3% and over the past three years, the total loss to shareholders 53%

The results at China Medical System Holdings Limited (HKG:867) have been quite disappointing recently and CEO Kong Lam bears some responsibility for this. At the upcoming AGM on 9th of May, shareholders can hear from the board including their plans for turning around performance. It would also be an opportunity for shareholders to influence management through voting on company resolutions such as executive remuneration, which could impact the firm significantly. From our analysis, we think CEO compensation may need a review in light of the recent performance.

See our latest analysis for China Medical System Holdings

How Does Total Compensation For Kong Lam Compare With Other Companies In The Industry?

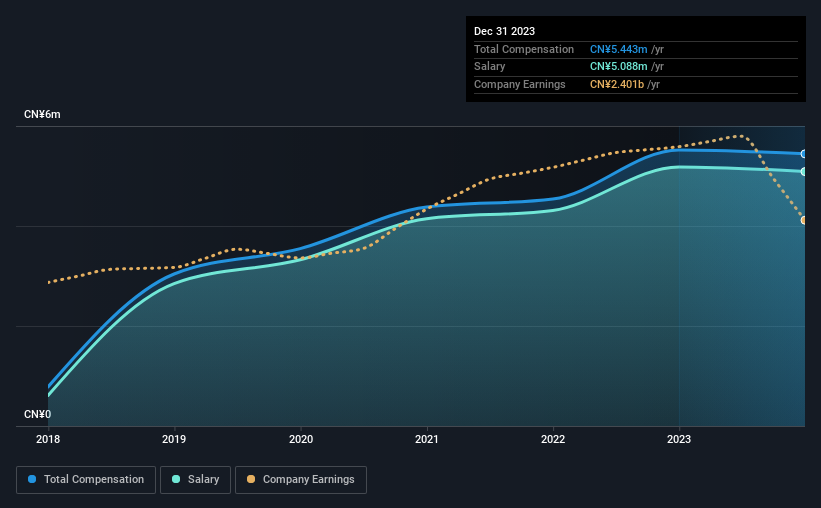

According to our data, China Medical System Holdings Limited has a market capitalization of HK$17b, and paid its CEO total annual compensation worth CN¥5.4m over the year to December 2023. That's mostly flat as compared to the prior year's compensation. In particular, the salary of CN¥5.09m, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the Hong Kong Pharmaceuticals industry with market capitalizations ranging between HK$7.8b and HK$25b had a median total CEO compensation of CN¥3.0m. This suggests that Kong Lam is paid more than the median for the industry. Furthermore, Kong Lam directly owns HK$8.4b worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CN¥5.1m | CN¥5.2m | 93% |

| Other | CN¥355k | CN¥339k | 7% |

| Total Compensation | CN¥5.4m | CN¥5.5m | 100% |

Speaking on an industry level, nearly 61% of total compensation represents salary, while the remainder of 39% is other remuneration. China Medical System Holdings is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at China Medical System Holdings Limited's Growth Numbers

China Medical System Holdings Limited has reduced its earnings per share by 1.3% a year over the last three years. In the last year, its revenue is down 12%.

A lack of EPS improvement is not good to see. This is compounded by the fact revenue is actually down on last year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has China Medical System Holdings Limited Been A Good Investment?

With a total shareholder return of -53% over three years, China Medical System Holdings Limited shareholders would by and large be disappointed. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 2 warning signs for China Medical System Holdings that you should be aware of before investing.

Switching gears from China Medical System Holdings, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:867

China Medical System Holdings

An investment holding company, manufactures, sells, markets, and promotes pharmaceutical products in the People’s Republic of China.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026