Here's Why We're Not Too Worried About JHBP (CY) Holdings' (HKG:6998) Cash Burn Situation

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

So, the natural question for JHBP (CY) Holdings (HKG:6998) shareholders is whether they should be concerned by its rate of cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

View our latest analysis for JHBP (CY) Holdings

Does JHBP (CY) Holdings Have A Long Cash Runway?

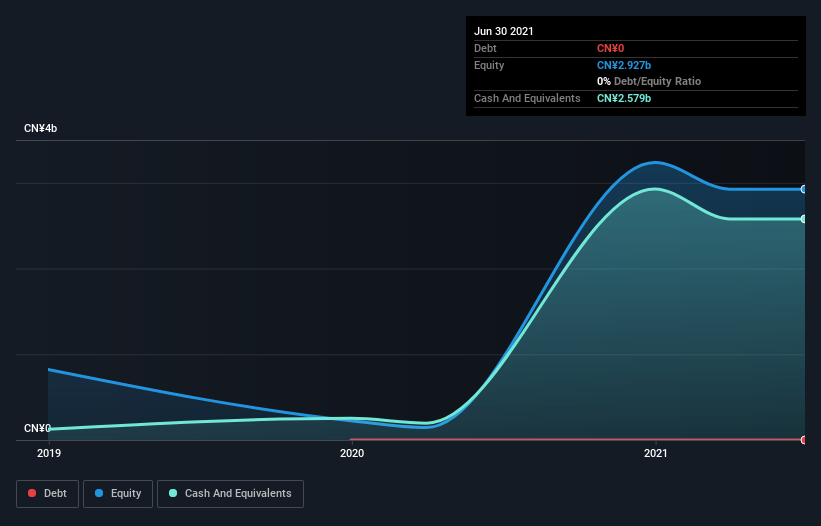

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. In June 2021, JHBP (CY) Holdings had CN¥2.6b in cash, and was debt-free. Importantly, its cash burn was CN¥885m over the trailing twelve months. So it had a cash runway of about 2.9 years from June 2021. That's decent, giving the company a couple years to develop its business. Depicted below, you can see how its cash holdings have changed over time.

How Is JHBP (CY) Holdings' Cash Burn Changing Over Time?

Whilst it's great to see that JHBP (CY) Holdings has already begun generating revenue from operations, last year it only produced CN¥6.6m, so we don't think it is generating significant revenue, at this point. As a result, we think it's a bit early to focus on the revenue growth, so we'll limit ourselves to looking at how the cash burn is changing over time. In fact, it ramped its spending strongly over the last year, increasing cash burn by 121%. That sort of spending growth rate can't continue for very long before it causes balance sheet weakness, generally speaking. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Hard Would It Be For JHBP (CY) Holdings To Raise More Cash For Growth?

Given its cash burn trajectory, JHBP (CY) Holdings shareholders may wish to consider how easily it could raise more cash, despite its solid cash runway. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

JHBP (CY) Holdings has a market capitalisation of CN¥4.4b and burnt through CN¥885m last year, which is 20% of the company's market value. That's fairly notable cash burn, so if the company had to sell shares to cover the cost of another year's operations, shareholders would suffer some costly dilution.

How Risky Is JHBP (CY) Holdings' Cash Burn Situation?

On this analysis of JHBP (CY) Holdings' cash burn, we think its cash runway was reassuring, while its increasing cash burn has us a bit worried. Cash burning companies are always on the riskier side of things, but after considering all of the factors discussed in this short piece, we're not too worried about its rate of cash burn. Its important for readers to be cognizant of the risks that can affect the company's operations, and we've picked out 3 warning signs for JHBP (CY) Holdings that investors should know when investing in the stock.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:6998

Genor Biopharma Holdings

A biopharmaceutical company, focuses on developing and commercializing oncology and autoimmune drugs in China and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives