CanSino Biologics Inc.'s (HKG:6185) Price Is Right But Growth Is Lacking After Shares Rocket 37%

Despite an already strong run, CanSino Biologics Inc. (HKG:6185) shares have been powering on, with a gain of 37% in the last thirty days. The last 30 days bring the annual gain to a very sharp 32%.

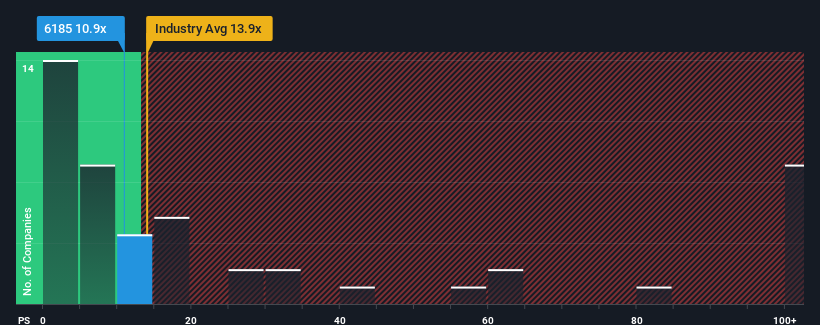

In spite of the firm bounce in price, CanSino Biologics' price-to-sales (or "P/S") ratio of 10.9x might still make it look like a buy right now compared to the Biotechs industry in Hong Kong, where around half of the companies have P/S ratios above 13.9x and even P/S above 56x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for CanSino Biologics

How Has CanSino Biologics Performed Recently?

Recent times haven't been great for CanSino Biologics as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on CanSino Biologics.How Is CanSino Biologics' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as CanSino Biologics' is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 49%. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 76% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 46% per annum as estimated by the five analysts watching the company. With the industry predicted to deliver 54% growth per annum, the company is positioned for a weaker revenue result.

In light of this, it's understandable that CanSino Biologics' P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Despite CanSino Biologics' share price climbing recently, its P/S still lags most other companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that CanSino Biologics maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for CanSino Biologics with six simple checks.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6185

CanSino Biologics

Develops, manufactures, and commercializes vaccines in the People’s Republic of China.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives