Do China Grand Pharmaceutical and Healthcare Holdings's (HKG:512) Earnings Warrant Your Attention?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in China Grand Pharmaceutical and Healthcare Holdings (HKG:512). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for China Grand Pharmaceutical and Healthcare Holdings

How Fast Is China Grand Pharmaceutical and Healthcare Holdings Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. It's no surprise, then, that I like to invest in companies with EPS growth. Impressively, China Grand Pharmaceutical and Healthcare Holdings has grown EPS by 36% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

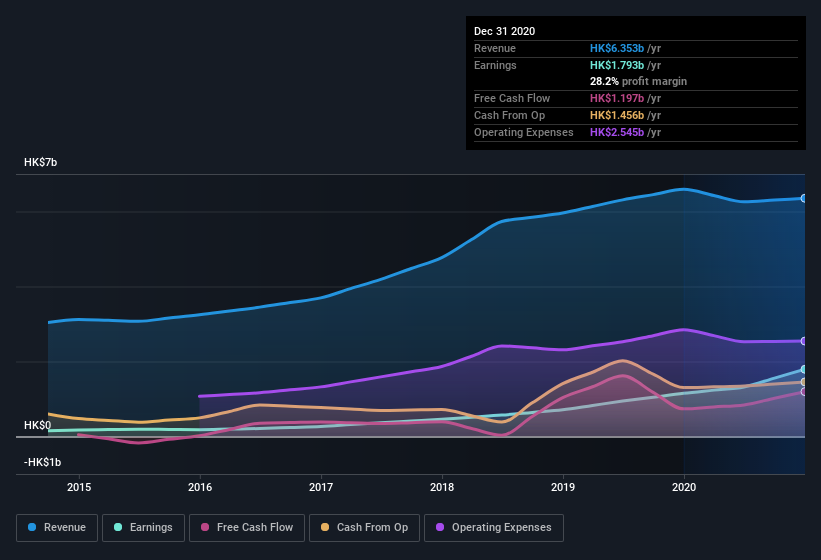

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. China Grand Pharmaceutical and Healthcare Holdings's EBIT margins have actually improved by 7.0 percentage points in the last year, to reach 28%, but, on the flip side, revenue was down 3.6%. That falls short of ideal.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for China Grand Pharmaceutical and Healthcare Holdings?

Are China Grand Pharmaceutical and Healthcare Holdings Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So we're pleased to report that China Grand Pharmaceutical and Healthcare Holdings insiders own a meaningful share of the business. In fact, they own 48% of the shares, making insiders a very influential shareholder group. I'm always comforted by solid insider ownership like this, as it implies that those running the business are genuinely motivated to create shareholder value. And their holding is extremely valuable at the current share price, totalling HK$12b. That means they have plenty of their own capital riding on the performance of the business!

Should You Add China Grand Pharmaceutical and Healthcare Holdings To Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about China Grand Pharmaceutical and Healthcare Holdings's strong EPS growth. I think that EPS growth is something to boast of, and it doesn't surprise me that insiders are holding on to a considerable chunk of shares. Fast growth and confident insiders should be enough to warrant further research. So the answer is that I do think this is a good stock to follow along with. Even so, be aware that China Grand Pharmaceutical and Healthcare Holdings is showing 1 warning sign in our investment analysis , you should know about...

Although China Grand Pharmaceutical and Healthcare Holdings certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:512

Grand Pharmaceutical Group

An investment holding company, engages in the research and development, manufacture, and sale of pharmaceutical preparations and medical devices, biotechnology and healthcare products, and pharmaceutical raw materials.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives