Hansoh Pharmaceutical Group (HKG:3692) shareholders have earned a 97% return over the last year

If you want to compound wealth in the stock market, you can do so by buying an index fund. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). To wit, the Hansoh Pharmaceutical Group Company Limited (HKG:3692) share price is 96% higher than it was a year ago, much better than the market decline of around 3.1% (not including dividends) in the same period. If it can keep that out-performance up over the long term, investors will do very well! Zooming out, the stock is actually down 4.7% in the last three years.

Let's take a look at the underlying fundamentals over the longer term, and see if they've been consistent with shareholders returns.

View our latest analysis for Hansoh Pharmaceutical Group

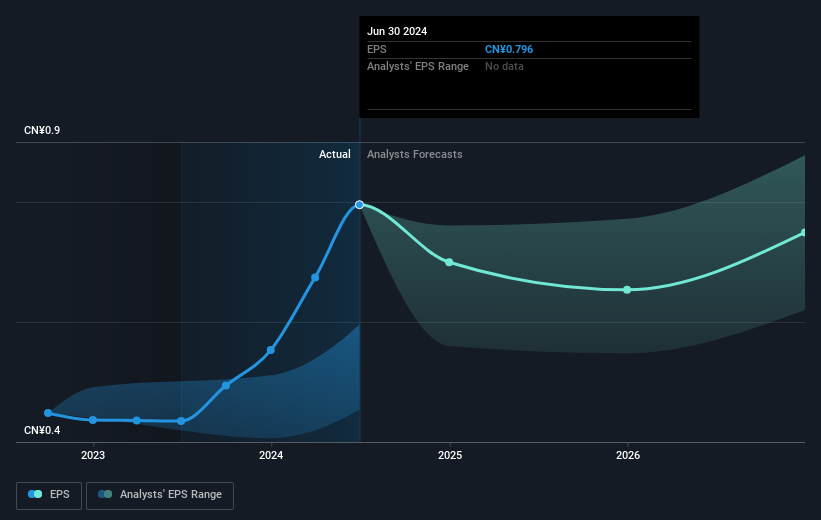

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year Hansoh Pharmaceutical Group grew its earnings per share (EPS) by 83%. This EPS growth is reasonably close to the 96% increase in the share price. So this implies that investor expectations of the company have remained pretty steady. It makes intuitive sense that the share price and EPS would grow at similar rates.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Hansoh Pharmaceutical Group has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

A Different Perspective

It's good to see that Hansoh Pharmaceutical Group has rewarded shareholders with a total shareholder return of 97% in the last twelve months. Of course, that includes the dividend. That certainly beats the loss of about 3% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. Before deciding if you like the current share price, check how Hansoh Pharmaceutical Group scores on these 3 valuation metrics.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hansoh Pharmaceutical Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3692

Hansoh Pharmaceutical Group

An investment holding company, engages in the research, development, manufacture, and sale of pharmaceutical products in the People’s Republic of China.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives