The Market Doesn't Like What It Sees From CStone Pharmaceuticals' (HKG:2616) Revenues Yet As Shares Tumble 26%

Unfortunately for some shareholders, the CStone Pharmaceuticals (HKG:2616) share price has dived 26% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 55% loss during that time.

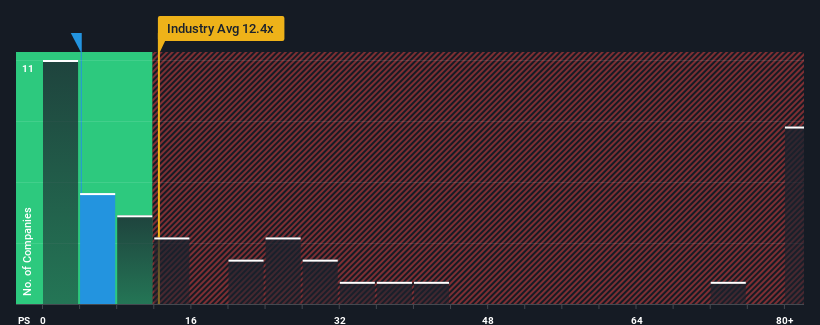

Since its price has dipped substantially, CStone Pharmaceuticals may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 4.1x, since almost half of all companies in the Biotechs industry in Hong Kong have P/S ratios greater than 12.4x and even P/S higher than 37x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for CStone Pharmaceuticals

What Does CStone Pharmaceuticals' Recent Performance Look Like?

Recent times haven't been great for CStone Pharmaceuticals as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on CStone Pharmaceuticals.Is There Any Revenue Growth Forecasted For CStone Pharmaceuticals?

The only time you'd be truly comfortable seeing a P/S as depressed as CStone Pharmaceuticals' is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a decent 13% gain to the company's revenues. Still, revenue has barely risen at all in aggregate from three years ago, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 82% as estimated by the four analysts watching the company. That's shaping up to be materially lower than the 99% growth forecast for the broader industry.

With this in consideration, its clear as to why CStone Pharmaceuticals' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On CStone Pharmaceuticals' P/S

Having almost fallen off a cliff, CStone Pharmaceuticals' share price has pulled its P/S way down as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that CStone Pharmaceuticals maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for CStone Pharmaceuticals that you should be aware of.

If you're unsure about the strength of CStone Pharmaceuticals' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2616

CStone Pharmaceuticals

A biopharmaceutical company, researches and develops anti-cancer therapies to address the unmet medical needs of cancer patients in China and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives