Here's Why We Think Pak Fah Yeow International (HKG:239) Might Deserve Your Attention Today

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Pak Fah Yeow International (HKG:239), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Pak Fah Yeow International

How Fast Is Pak Fah Yeow International Growing Its Earnings Per Share?

Strong earnings per share (EPS) results are an indicator of a company achieving solid profits, which investors look upon favourably and so the share price tends to reflect great EPS performance. So a growing EPS generally brings attention to a company in the eyes of prospective investors. It is awe-striking that Pak Fah Yeow International's EPS went from HK$0.082 to HK$0.28 in just one year. Even though that growth rate may not be repeated, that looks like a breakout improvement. This could point to the business hitting a point of inflection.

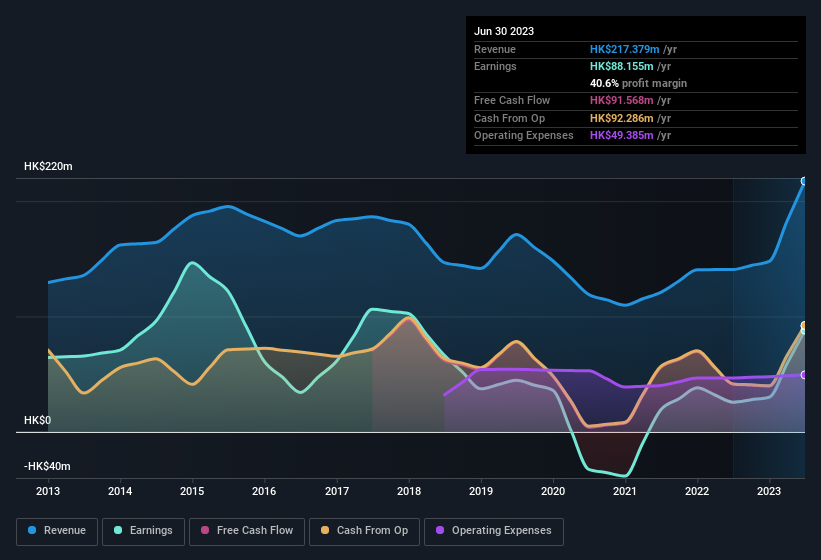

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Pak Fah Yeow International is growing revenues, and EBIT margins improved by 16.9 percentage points to 47%, over the last year. Both of which are great metrics to check off for potential growth.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Since Pak Fah Yeow International is no giant, with a market capitalisation of HK$598m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Pak Fah Yeow International Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

With strong conviction, Pak Fah Yeow International insiders have stood united by refusing to sell shares over the last year. But the real excitement comes from the HK$531k that Executive Director Fock Wai Gan spent buying shares (at an average price of about HK$1.77). It seems at least one insider has seen potential in the company's future - and they're willing to put money on the line.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Pak Fah Yeow International insiders own more than a third of the company. Owning 41% of the company, insiders have plenty riding on the performance of the the share price. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. With that sort of holding, insiders have about HK$248m riding on the stock, at current prices. So there's plenty there to keep them focused!

Should You Add Pak Fah Yeow International To Your Watchlist?

Pak Fah Yeow International's earnings have taken off in quite an impressive fashion. To sweeten the deal, insiders have significant skin in the game with one even acquiring more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Pak Fah Yeow International deserves timely attention. Even so, be aware that Pak Fah Yeow International is showing 2 warning signs in our investment analysis , you should know about...

Keen growth investors love to see insider buying. Thankfully, Pak Fah Yeow International isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:239

Pak Fah Yeow International

An investment holding, engages in manufacturing, marketing, and distributing healthcare products under the Hoe Hin brand name.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives