As global markets navigate a period of mixed performance, with the Nasdaq hitting record highs while most other major indexes decline, investors are closely watching central bank actions and economic indicators that suggest potential interest rate cuts. In this environment of fluctuating market dynamics and economic uncertainty, dividend stocks can offer a measure of stability and income potential for investors seeking reliable returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.05% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.58% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.03% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.35% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.96% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.66% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.88% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.67% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.42% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.12% | ★★★★★★ |

Click here to see the full list of 1851 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Dawnrays Pharmaceutical (Holdings) (SEHK:2348)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dawnrays Pharmaceutical (Holdings) Limited is an investment holding company that develops, manufactures, and sells non-patented pharmaceutical medicines in Mainland China and internationally, with a market cap of HK$1.77 billion.

Operations: Dawnrays Pharmaceutical (Holdings) Limited generates revenue from Finished Drugs amounting to CN¥1.04 billion and Intermediates and Bulk Medicines totaling CN¥130.31 million.

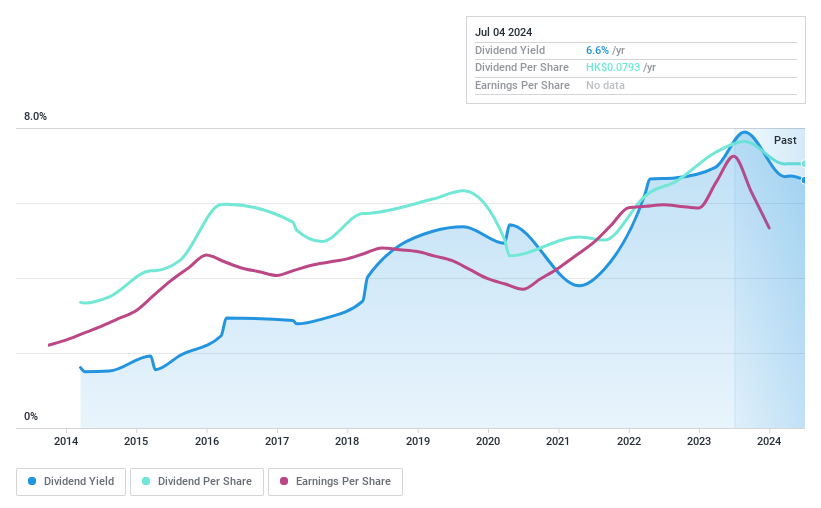

Dividend Yield: 6.4%

Dawnrays Pharmaceutical's dividend payments are covered by earnings with a low payout ratio of 19.4%, indicating sustainability, though cash flow coverage is tighter at an 86.3% cash payout ratio. Despite a decade-long increase in dividends, the payments have been volatile and unreliable, experiencing significant drops. The dividend yield of 6.41% lags behind top-tier Hong Kong payers. However, its price-to-earnings ratio of 3x suggests good value relative to the market average.

- Navigate through the intricacies of Dawnrays Pharmaceutical (Holdings) with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Dawnrays Pharmaceutical (Holdings) is trading beyond its estimated value.

Takuma (TSE:6013)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Takuma Co., Ltd. specializes in the design, construction, and supervision of boilers, plant machinery, pollution prevention and environmental equipment plants, as well as heating, cooling, and sanitation facilities in Japan with a market cap of ¥130.21 billion.

Operations: Takuma Co., Ltd.'s revenue is primarily derived from its Domestic Environment and Energy Business at ¥119.62 billion, followed by the Package Boiler Business at ¥18.61 billion, Equipment and Systems Business at ¥10.62 billion, and Overseas Environment and Energy Business at ¥2.89 billion.

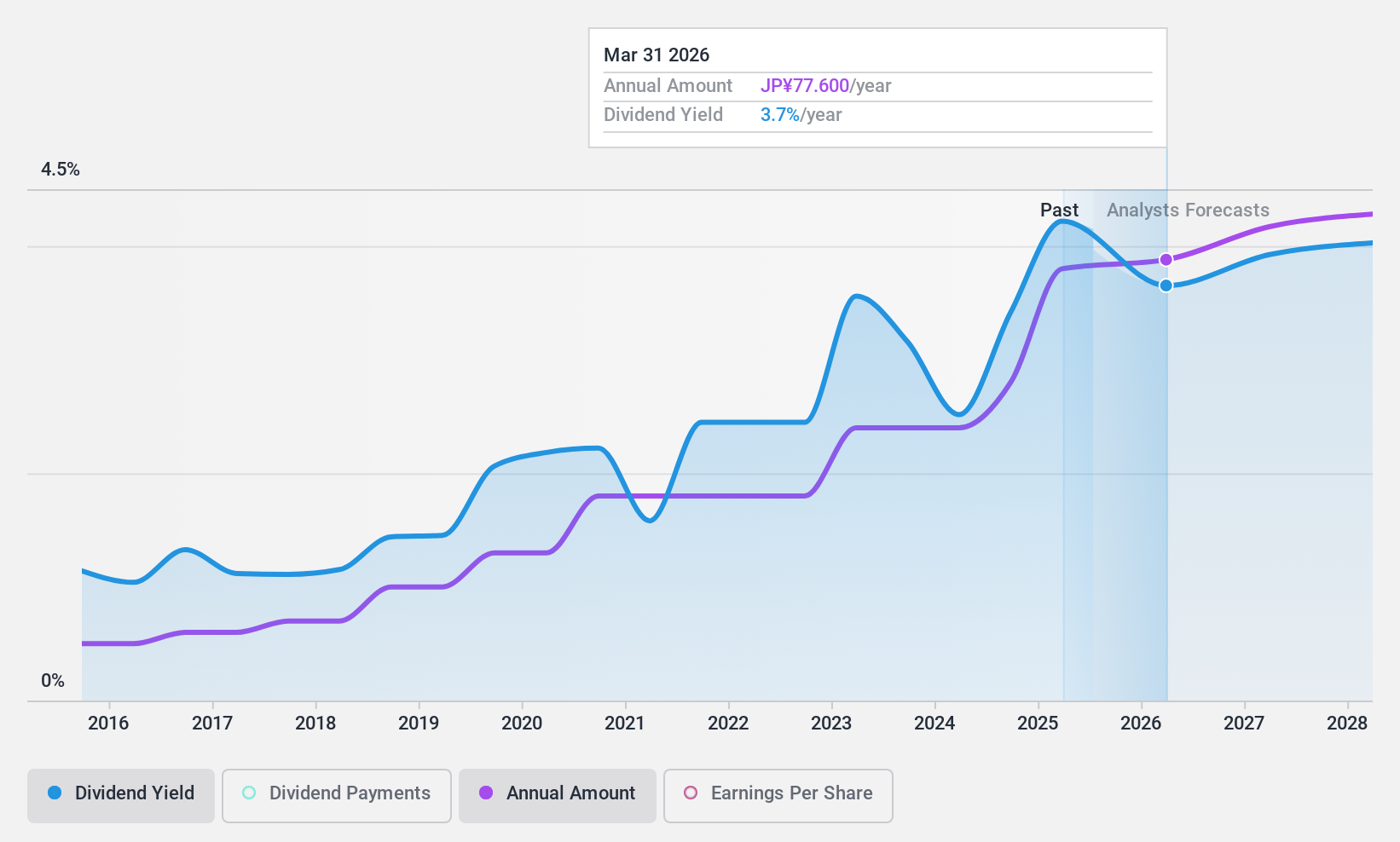

Dividend Yield: 3.4%

Takuma Co., Ltd. reported half-year sales of ¥68.06 billion and net income of ¥4.11 billion, with earnings per share at ¥51.79. The company completed a share buyback, enhancing shareholder value by repurchasing 1,394,800 shares for ¥2.27 billion since May 2024. Although Takuma's dividend yield is below top-tier JP payers at 3.4%, dividends have grown steadily over the past decade and are well-covered by earnings despite lacking free cash flow coverage.

- Unlock comprehensive insights into our analysis of Takuma stock in this dividend report.

- According our valuation report, there's an indication that Takuma's share price might be on the cheaper side.

Paramount Bed Holdings (TSE:7817)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Paramount Bed Holdings Co., Ltd. manufactures and sells beds, mattresses, and equipment for medical and nursing care in Japan with a market cap of ¥150.10 billion.

Operations: Paramount Bed Holdings Co., Ltd. generates revenue primarily from its Healthcare-Related Business segment, which accounts for ¥104.97 billion.

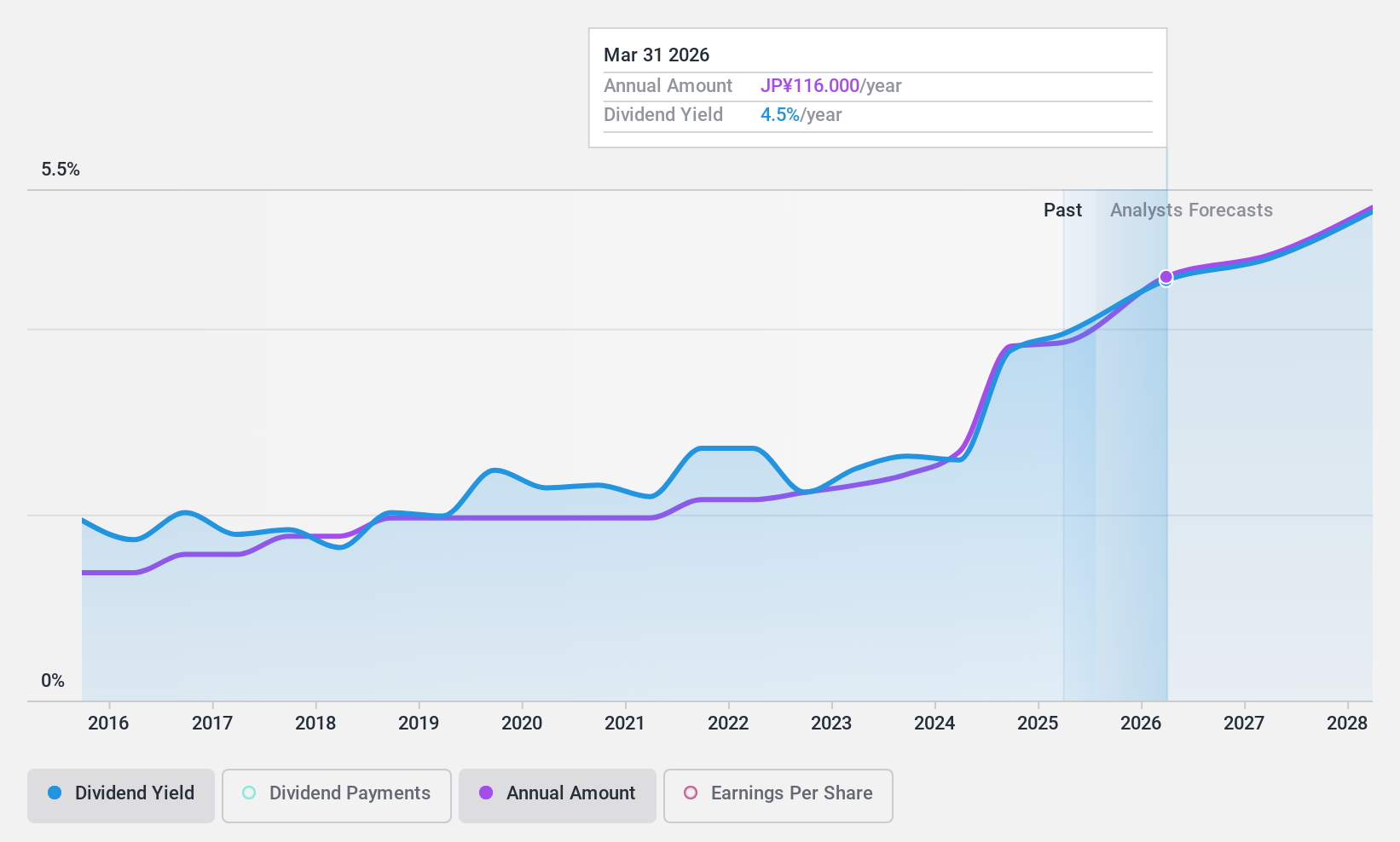

Dividend Yield: 3.7%

Paramount Bed Holdings offers a stable dividend history over the past decade, with dividends increasing consistently. However, its current 3.67% yield is slightly below top-tier Japanese payers and not well-covered by free cash flow due to a high cash payout ratio of 120.1%. A recent share repurchase plan worth ¥4 billion aims to enhance shareholder returns and capital efficiency, reflecting strategic financial management despite challenges in dividend coverage from earnings and cash flows.

- Click here and access our complete dividend analysis report to understand the dynamics of Paramount Bed Holdings.

- Our valuation report here indicates Paramount Bed Holdings may be undervalued.

Make It Happen

- Unlock our comprehensive list of 1851 Top Dividend Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Takuma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6013

Takuma

Engages in the design, construction, and superintendence of various boilers, plant machineries, pollution prevention and environmental equipment plants, heating and cooling equipment, and feed water/drainage sanitation equipment and facilities in Japan.

Solid track record established dividend payer.

Market Insights

Community Narratives