- Hong Kong

- /

- Life Sciences

- /

- SEHK:2269

Some WuXi Biologics (Cayman) Inc. (HKG:2269) Shareholders Look For Exit As Shares Take 25% Pounding

To the annoyance of some shareholders, WuXi Biologics (Cayman) Inc. (HKG:2269) shares are down a considerable 25% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 75% loss during that time.

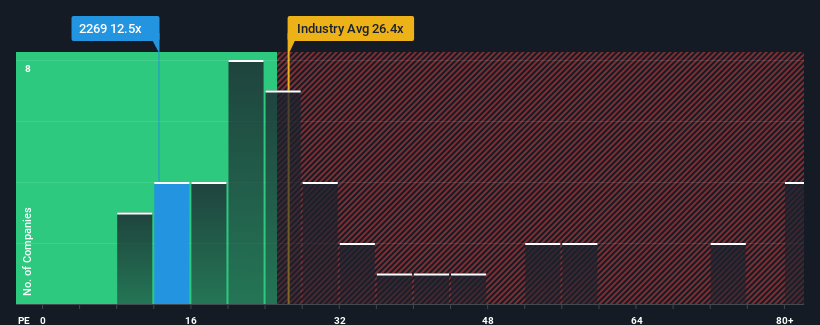

Even after such a large drop in price, WuXi Biologics (Cayman) may still be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 12.5x, since almost half of all companies in Hong Kong have P/E ratios under 9x and even P/E's lower than 5x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

WuXi Biologics (Cayman) hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

See our latest analysis for WuXi Biologics (Cayman)

How Is WuXi Biologics (Cayman)'s Growth Trending?

There's an inherent assumption that a company should outperform the market for P/E ratios like WuXi Biologics (Cayman)'s to be considered reasonable.

Retrospectively, the last year delivered a frustrating 23% decrease to the company's bottom line. Even so, admirably EPS has lifted 92% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 16% each year as estimated by the analysts watching the company. That's shaping up to be similar to the 16% per year growth forecast for the broader market.

In light of this, it's curious that WuXi Biologics (Cayman)'s P/E sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

What We Can Learn From WuXi Biologics (Cayman)'s P/E?

There's still some solid strength behind WuXi Biologics (Cayman)'s P/E, if not its share price lately. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of WuXi Biologics (Cayman)'s analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You always need to take note of risks, for example - WuXi Biologics (Cayman) has 1 warning sign we think you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade WuXi Biologics (Cayman), open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if WuXi Biologics (Cayman) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2269

WuXi Biologics (Cayman)

An investment holding company, provides end-to-end solutions and services for biologics discovery, development, and manufacturing for biologics industry in the People’s Republic of China, North America, Europe, Singapore, Japan, South Korea, and Australia.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives