- Hong Kong

- /

- Life Sciences

- /

- SEHK:2269

Some Confidence Is Lacking In WuXi Biologics (Cayman) Inc. (HKG:2269) As Shares Slide 25%

Unfortunately for some shareholders, the WuXi Biologics (Cayman) Inc. (HKG:2269) share price has dived 25% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 75% share price decline.

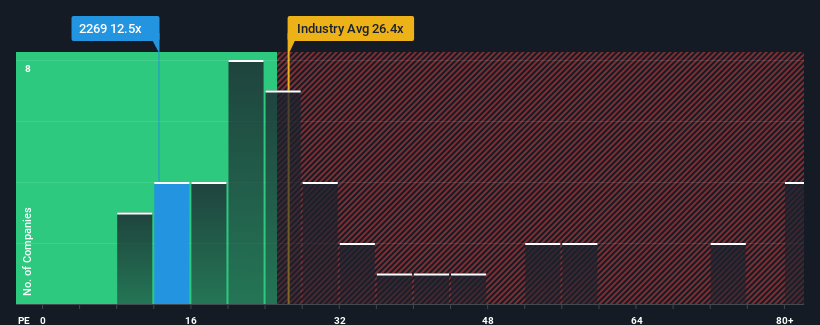

Although its price has dipped substantially, WuXi Biologics (Cayman)'s price-to-earnings (or "P/E") ratio of 12.5x might still make it look like a sell right now compared to the market in Hong Kong, where around half of the companies have P/E ratios below 9x and even P/E's below 5x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

WuXi Biologics (Cayman) could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for WuXi Biologics (Cayman)

Does Growth Match The High P/E?

WuXi Biologics (Cayman)'s P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 23%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 92% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 16% per year during the coming three years according to the analysts following the company. With the market predicted to deliver 16% growth per annum, the company is positioned for a comparable earnings result.

In light of this, it's curious that WuXi Biologics (Cayman)'s P/E sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Key Takeaway

WuXi Biologics (Cayman)'s P/E hasn't come down all the way after its stock plunged. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of WuXi Biologics (Cayman)'s analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you take the next step, you should know about the 1 warning sign for WuXi Biologics (Cayman) that we have uncovered.

If these risks are making you reconsider your opinion on WuXi Biologics (Cayman), explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade WuXi Biologics (Cayman), open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if WuXi Biologics (Cayman) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2269

WuXi Biologics (Cayman)

An investment holding company, provides end-to-end solutions and services for biologics discovery, development, and manufacturing for biologics industry in the People’s Republic of China, North America, Europe, Singapore, Japan, South Korea, and Australia.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives