- Australia

- /

- Construction

- /

- ASX:LYL

Exploring 3 Undervalued Small Caps In The Asian Market With Insider Activity

Reviewed by Simply Wall St

The Asian market has been experiencing a mix of cautious optimism and strategic shifts, with small-cap indices showing resilience amid broader economic uncertainties and trade developments. As investors navigate this complex landscape, identifying potential opportunities in the small-cap sector requires a keen understanding of market dynamics and insider activity that may signal underlying value.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.5x | 1.0x | 39.41% | ★★★★★★ |

| Puregold Price Club | 8.8x | 0.4x | 29.94% | ★★★★★☆ |

| Atturra | 29.9x | 1.2x | 33.12% | ★★★★★☆ |

| Hansen Technologies | 292.4x | 2.8x | 22.38% | ★★★★★☆ |

| Viva Energy Group | NA | 0.1x | 46.93% | ★★★★★☆ |

| Dicker Data | 19.8x | 0.7x | -40.39% | ★★★★☆☆ |

| Sing Investments & Finance | 7.1x | 3.6x | 42.74% | ★★★★☆☆ |

| Smart Parking | 73.4x | 6.5x | 46.35% | ★★★☆☆☆ |

| PWR Holdings | 35.7x | 4.9x | 22.91% | ★★★☆☆☆ |

| Charter Hall Long WALE REIT | NA | 11.3x | 23.40% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Lycopodium (ASX:LYL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Lycopodium is an engineering and project management consultancy specializing in the resources, process industries, and rail infrastructure sectors with a market cap of A$0.39 billion.

Operations: The company's revenue is primarily driven by its Resources segment, contributing significantly to its total revenue. The gross profit margin has shown a notable trend, reaching 28.56% as of December 2024, indicating an improvement in cost management relative to revenue. Operating expenses are consistently managed around A$30 million, with general and administrative expenses being a smaller component of this cost structure.

PE: 9.2x

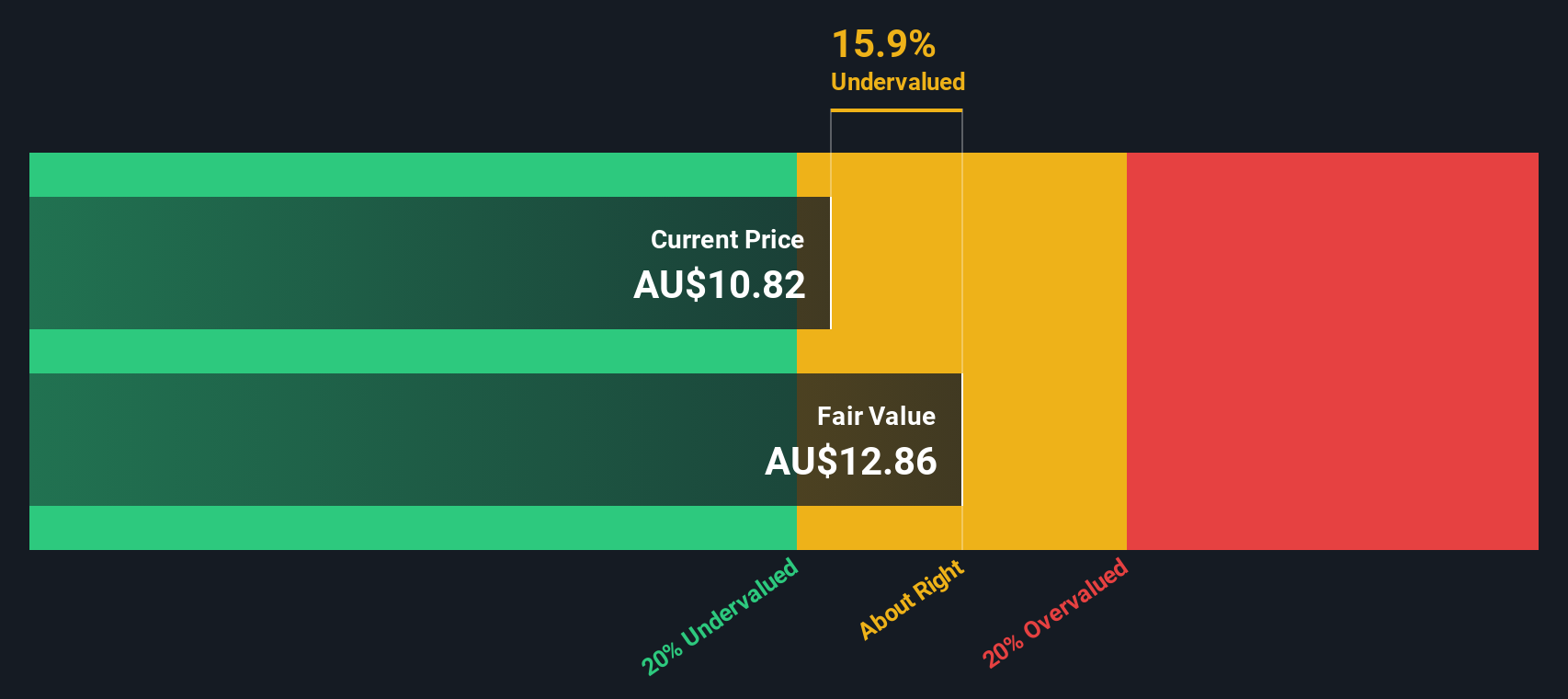

Lycopodium, recently added to the S&P/ASX Emerging Companies Index, is gaining attention as an undervalued stock in Asia. They updated fiscal year 2025 guidance with projected revenue between A$320 million and A$340 million, alongside NPAT of A$37 million to A$43 million. Insider confidence is evident as Steven Chadwick increased their shareholding by 40%, investing over A$97,000. Despite a decrease in dividends and reliance on external borrowing, the company maintains a promising growth trajectory.

- Navigate through the intricacies of Lycopodium with our comprehensive valuation report here.

Understand Lycopodium's track record by examining our Past report.

Abbisko Cayman (SEHK:2256)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Abbisko Cayman is a biopharmaceutical company focused on the development of innovative medicines, with a market cap of approximately HK$3.46 billion.

Operations: The company primarily generates revenue from the development of innovative medicines, with recent figures reaching CN¥503.99 million. Operating expenses are significant, driven largely by R&D costs, which were CN¥451.38 million in the latest period. The gross profit margin consistently stands at 1.00%, indicating that cost of goods sold is not separately reported or is negligible relative to revenue. Net income has shown improvement over time, transitioning from losses to a positive figure of CN¥28.30 million in recent periods, reflecting changes in non-operating expenses and operating efficiency improvements.

PE: 167.9x

Abbisko Cayman, a company with a focus on innovative cancer therapies, recently showcased promising results from its phase 2 study of irpagratinib for hepatocellular carcinoma. The potential breakthrough treatment targets FGF19+ patients, representing about 30% of HCC cases globally. Notably, insider confidence is reflected in recent share purchases. Despite volatile share prices and reliance on external borrowing for funding, Abbisko's strategic partnerships with Merck and ongoing clinical advancements position it for future growth in the competitive biotech industry.

- Click to explore a detailed breakdown of our findings in Abbisko Cayman's valuation report.

Gain insights into Abbisko Cayman's past trends and performance with our Past report.

ValueMax Group (SGX:T6I)

Simply Wall St Value Rating: ★★★★☆☆

Overview: ValueMax Group operates in pawnbroking, moneylending, and the retail and trading of jewellery and gold, with a market capitalization of approximately SGD 0.47 billion.

Operations: The company's primary revenue streams are from the retail and trading of jewellery and gold, which generated SGD 343.78 million, followed by pawnbroking at SGD 82.01 million, and moneylending at SGD 63.46 million. Over recent periods, the gross profit margin has shown an upward trend, reaching 30.28% as of December 2024. Operating expenses have been consistently significant with general and administrative expenses being a major component.

PE: 5.5x

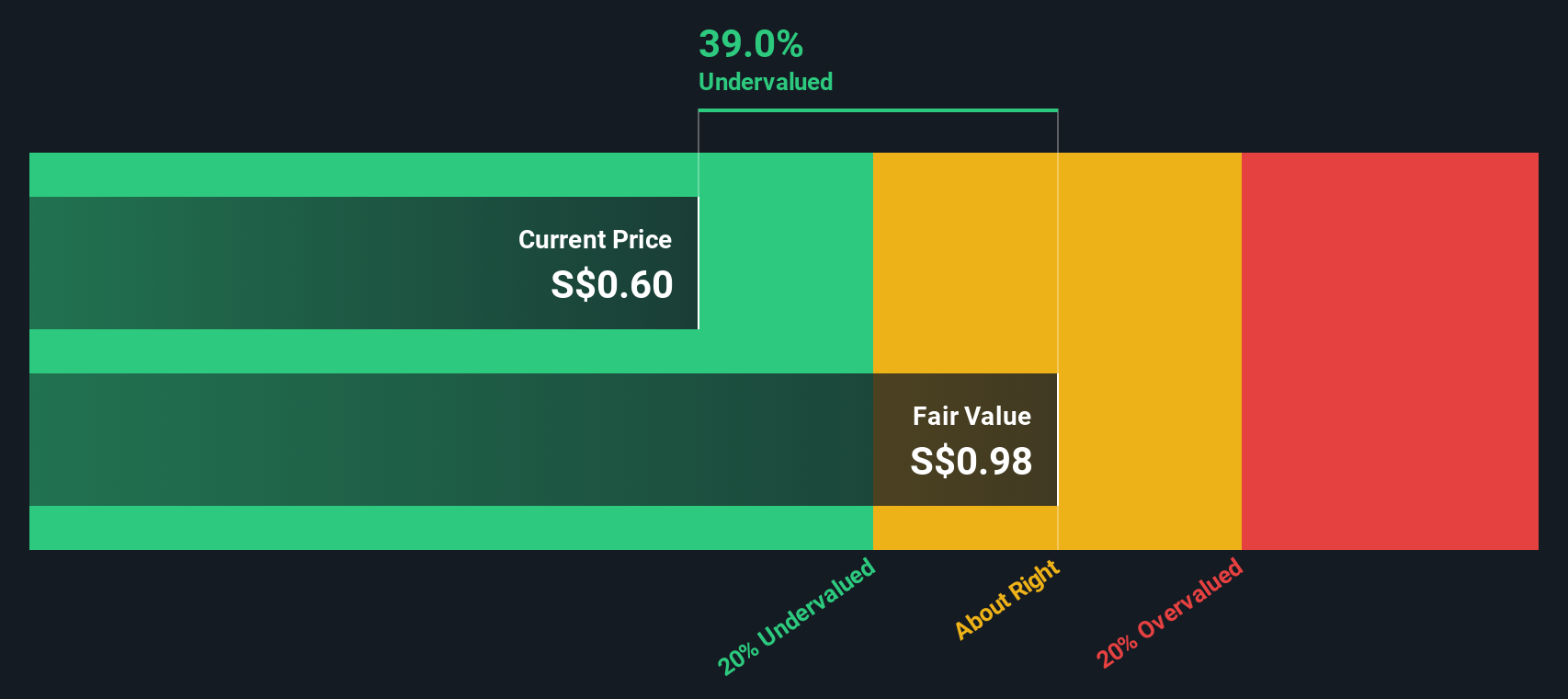

ValueMax Group, a smaller company in Asia's financial sector, has caught attention with its recent financial performance and strategic moves. Reporting sales of S$456 million and net income of S$82.83 million for 2024, the company shows potential despite relying on external borrowing for funding. Insider confidence is reflected as they increased their stakes recently. The launch of a digital securities issuance to raise up to S$25 million further underscores their proactive approach in securing capital.

- Take a closer look at ValueMax Group's potential here in our valuation report.

Examine ValueMax Group's past performance report to understand how it has performed in the past.

Key Takeaways

- Dive into all 67 of the Undervalued Asian Small Caps With Insider Buying we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LYL

Lycopodium

Provides engineering and project delivery services in the resources, rail infrastructure, and industrial processes sectors in Australia.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives