Does the Recent 7.7% Price Jump Signal a New Outlook for Luye Pharma Group in 2025?

Reviewed by Bailey Pemberton

If you are looking at Luye Pharma Group’s stock and wondering whether now is the right time to buy, hold, or even take some profit, you are not alone. The company’s recent price swings have caught the attention of both seasoned investors and cautious newcomers. In just the past week, the stock climbed by an impressive 7.7%, a move that stands out after a volatile month that saw shares drop by 7.4%. Despite these ups and downs, long-term holders are likely noticing the big picture. Since the start of the year, Luye Pharma Group has delivered a 65.6% return, far outpacing the typical pharma peer, although its five-year journey remains rocky with a 24.7% decline and only a modest 0.6% gain over the past twelve months.

These swings are not all about investor sentiment or sector trends. Recent market developments, including increased interest in Luye Pharma’s specialty treatments and optimism around new drug approvals, have certainly played a role in this renewed momentum. However, stronger price action can also mean higher risks and shifting expectations, making a closer look at valuation more important than ever.

So, how does Luye Pharma actually stack up on value? If we use six common valuation checks, the company comes out as undervalued in 2 of them, earning a valuation score of 2 out of 6. But do these numbers tell the full story? In the next section, we will break down each valuation method and see exactly where Luye Pharma shines and where it may still be overpriced. Stick around for an even sharper way to judge value that investors often overlook.

Luye Pharma Group scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Luye Pharma Group Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to their value in today's money. This approach helps investors understand what the business is truly worth based on the cash it is expected to generate, rather than just current earnings or book value.

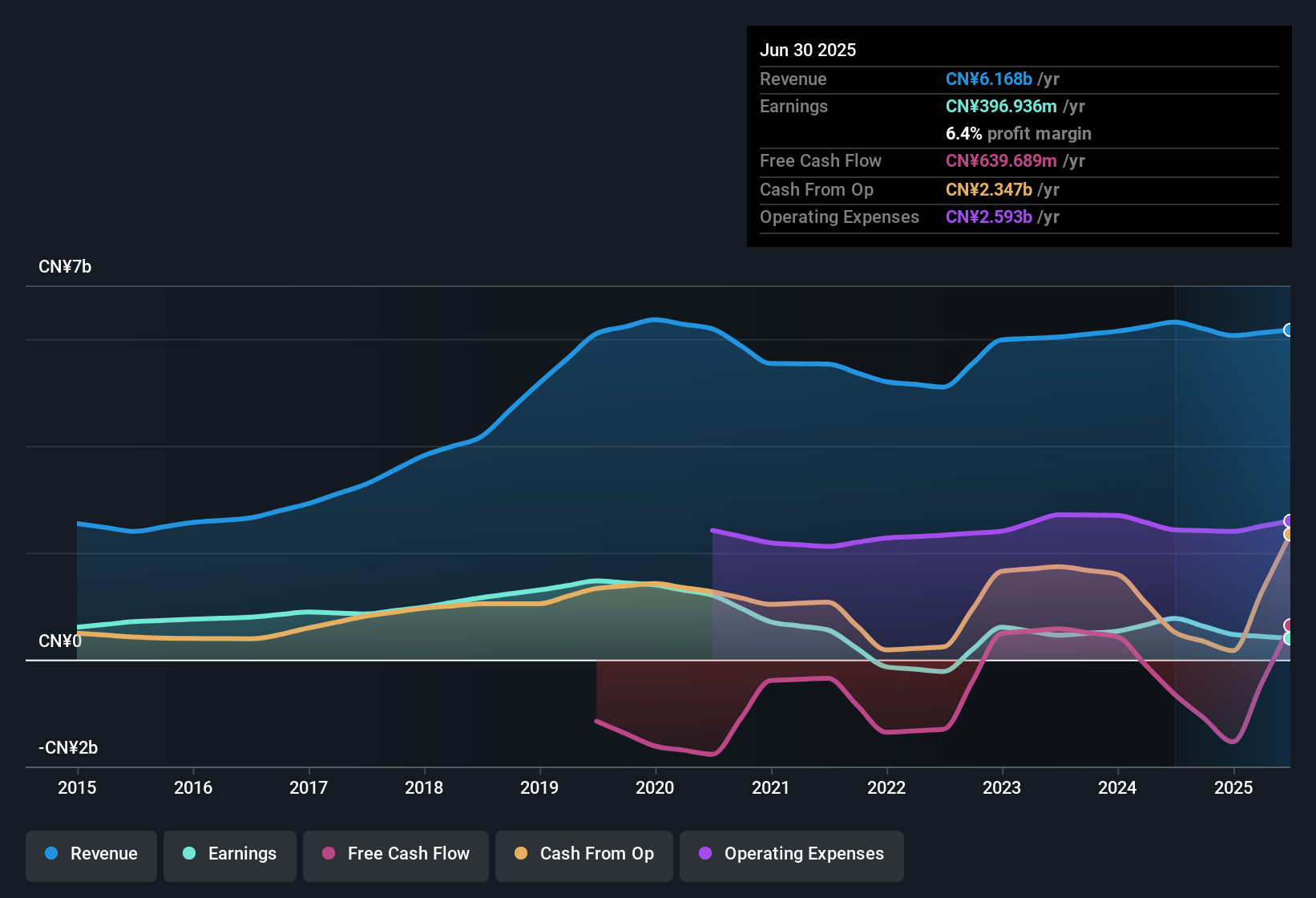

For Luye Pharma Group, the most recent twelve months of Free Cash Flow (FCF) was approximately CN¥1.0 billion. Analysts expect this figure to rise steadily, with the DCF analysis projecting Free Cash Flow to reach about CN¥2.7 billion by 2035. Over the next ten years, simplywall.st forecasts consistent annual growth, though the exact rate slows over time as is typical for mature companies in the Pharmaceuticals industry.

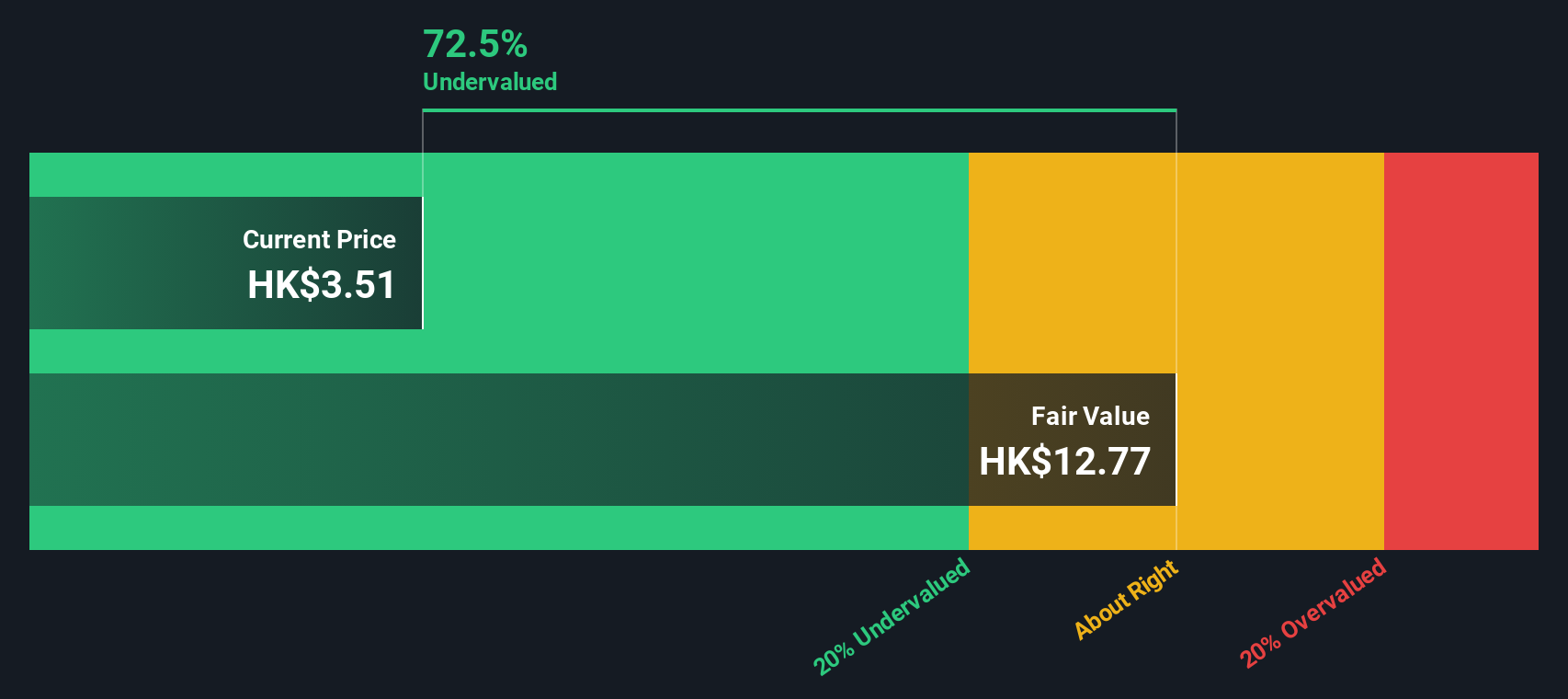

The DCF model applied here estimates an intrinsic fair value of HK$12.78 per share. Compared to the company’s recent price, this suggests the stock is trading at a 72.5% discount to its underlying value. In other words, Luye Pharma Group appears significantly undervalued based on cash flow fundamentals.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Luye Pharma Group is undervalued by 72.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Luye Pharma Group Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is one of the most widely used metrics for valuing profitable companies because it directly compares a company's stock price to its earnings. For firms with steady profits like Luye Pharma Group, the PE ratio helps investors quickly gauge how much the market is willing to pay for each dollar of earnings, making it useful for comparing with industry standards.

Growth prospects and perceived risks play a big role in what constitutes a “normal” or “fair” PE ratio. Companies expected to grow faster or with lower perceived risk typically justify a higher PE, while slower-growing or riskier firms tend to trade at lower valuations.

Currently, Luye Pharma Group trades on a PE ratio of 32.3x, which is considerably higher than the Pharmaceuticals industry average of 13.7x and its peers’ average of 12.7x. At first glance, this might raise concerns about overvaluation. However, Simply Wall St introduces the idea of a “Fair Ratio,” which is 26.0x for Luye Pharma. This approach takes a more nuanced view. The Fair Ratio weighs not just peer and industry benchmarks, but also incorporates company-specific growth rates, profit margins, overall sector trends, and relative risks, providing a more complete picture of what the stock should be worth.

When we compare Luye Pharma’s actual PE of 32.3x to the Fair Ratio of 26.0x, the market appears to be pricing in more optimism than fundamentals support. This suggests that Luye Pharma Group’s shares are overvalued by this measure, even if the DCF analysis looked attractive.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Luye Pharma Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple way for investors to connect a company’s story, their big-picture perspective and beliefs, directly to the numbers, such as expected revenue, earnings, margins, and what they think the company is actually worth.

Narratives link your view of a company’s future to a transparent set of financial forecasts and calculate a fair value based on those inputs. Available on Simply Wall St’s Community page, Narratives empower millions of investors to craft and compare their own forecasts, making it easy to see whose view is closest to reality as new news or earnings arrive. The calculations update automatically in real time.

By building your own Narrative and comparing its Fair Value to the current share price, you can quickly decide if now is the right time to buy or sell, with more context than a single ratio or model can offer. For example, one investor’s Narrative for Luye Pharma Group might see fair value as high as HK$14.50, while another might estimate it as low as HK$9.60, demonstrating how outlooks can differ even with the same set of facts.

Do you think there's more to the story for Luye Pharma Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2186

Luye Pharma Group

Develops, produces, markets, and sells pharmaceutical products in the People’s Republic of China, the United States, Europe, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives