Could CARsgen (SEHK:2171) Redefine Its Innovation Edge After New Solid Tumor CAR T-Cell Data?

Reviewed by Sasha Jovanovic

- CARsgen Therapeutics Holdings presented Phase Ib clinical results for its CAR T-cell therapy satri-cel in Claudin18.2-positive pancreatic cancer at the ESMO Congress 2025, showing an 83.3% nine-month disease-free survival rate and a manageable safety profile.

- This trial marks the first proof-of-concept study for CAR T-cell therapy in the adjuvant solid tumor setting, highlighting CARsgen's advancement in innovative cancer therapeutics.

- We'll examine how these proof-of-concept clinical results for satri-cel could shape CARsgen's investment narrative, especially regarding solid tumor innovation.

Find companies with promising cash flow potential yet trading below their fair value.

What Is CARsgen Therapeutics Holdings' Investment Narrative?

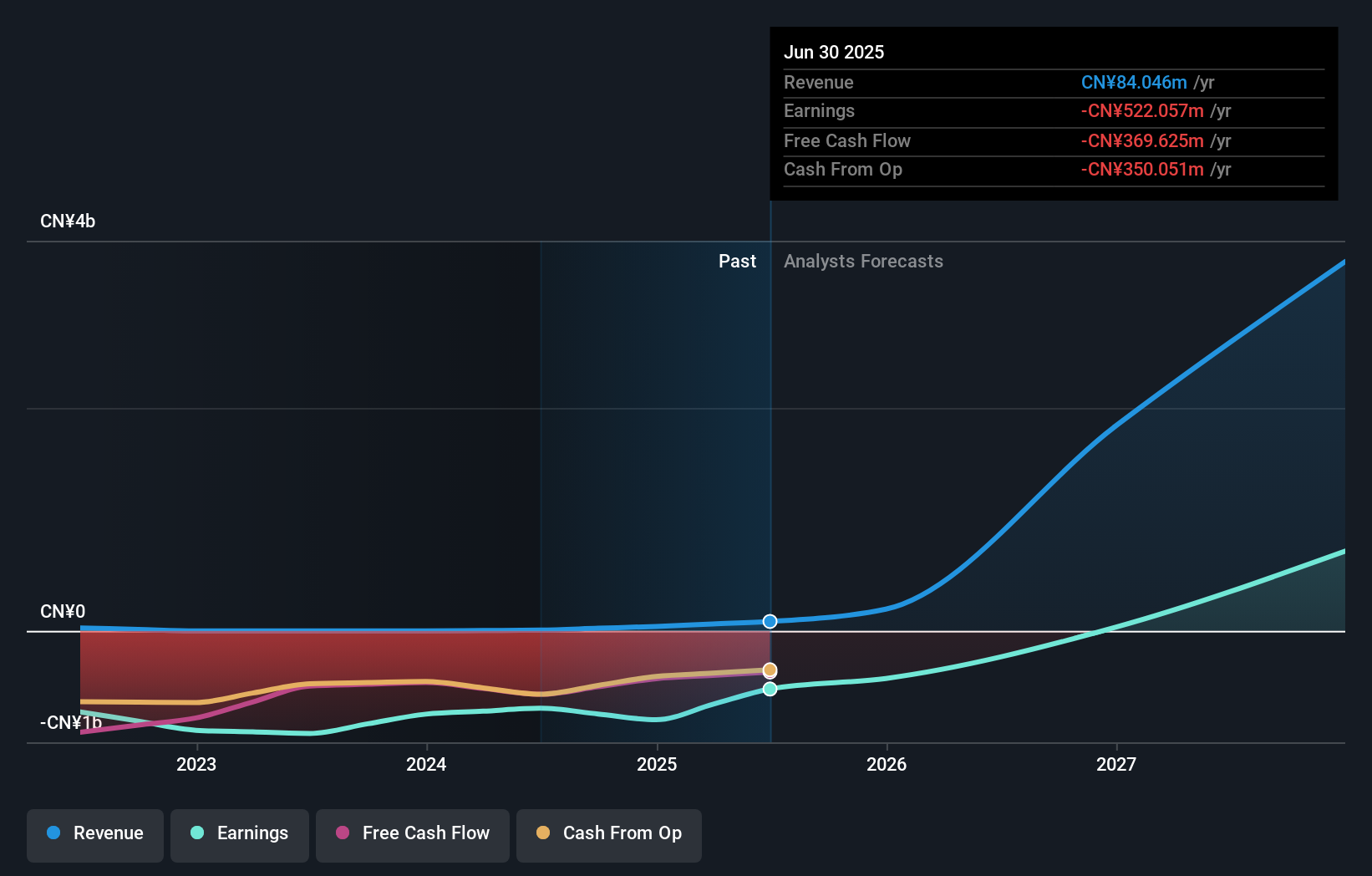

For anyone considering CARsgen Therapeutics Holdings, the big picture centers on pioneering progress in CAR T-cell therapy, especially for hard-to-treat solid tumors. The just-announced Phase Ib results for satri-cel in Claudin18.2-positive pancreatic cancer make this a meaningful moment, as the data marks the world's first proof-of-concept in the adjuvant solid tumor setting. This new clinical milestone could add credibility to the company’s pipeline and may bring attention to regulatory and commercial catalysts, particularly the pending New Drug Application for satri-cel in China and the upcoming Phase II studies. However, the company remains unprofitable, its revenue base is still modest, and share price volatility has persisted. In the short term, encouraging trial data could provide a boost, but execution risks, clinical uncertainties, and the challenge of translating clinical success into commercial adoption remain front and center. Yet with regulatory hurdles ahead, successful commercialization is still uncertain.

Upon reviewing our latest valuation report, CARsgen Therapeutics Holdings' share price might be too optimistic.Exploring Other Perspectives

Explore 2 other fair value estimates on CARsgen Therapeutics Holdings - why the stock might be worth over 5x more than the current price!

Build Your Own CARsgen Therapeutics Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CARsgen Therapeutics Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CARsgen Therapeutics Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CARsgen Therapeutics Holdings' overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2171

CARsgen Therapeutics Holdings

An investment holding company, engages in discovering, developing, and commercializing chimeric antigen receptor T (CAR-T) cell therapies for the treatment of hematological malignancies, solid tumors, and autoimmune diseases in China.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives