Shanghai Junshi Biosciences (SEHK:1877): Reassessing Valuation After a Sharp Pullback and Strong Year-to-Date Rally

Reviewed by Simply Wall St

Shanghai Junshi Biosciences (SEHK:1877) has quietly pulled back after a strong year to date, and that dip is starting to catch investors’ attention as they reassess the biotech’s growth profile and risks.

See our latest analysis for Shanghai Junshi Biosciences.

Despite the recent pullback, Shanghai Junshi Biosciences is still sitting on a strong year to date share price return. This suggests that earlier optimism about its drug pipeline and earnings trajectory is now cooling as investors reassess execution risk and valuation.

If this biotech rebound has caught your eye, it could be worth comparing it with other potential opportunities across healthcare stocks to see what else fits your strategy.

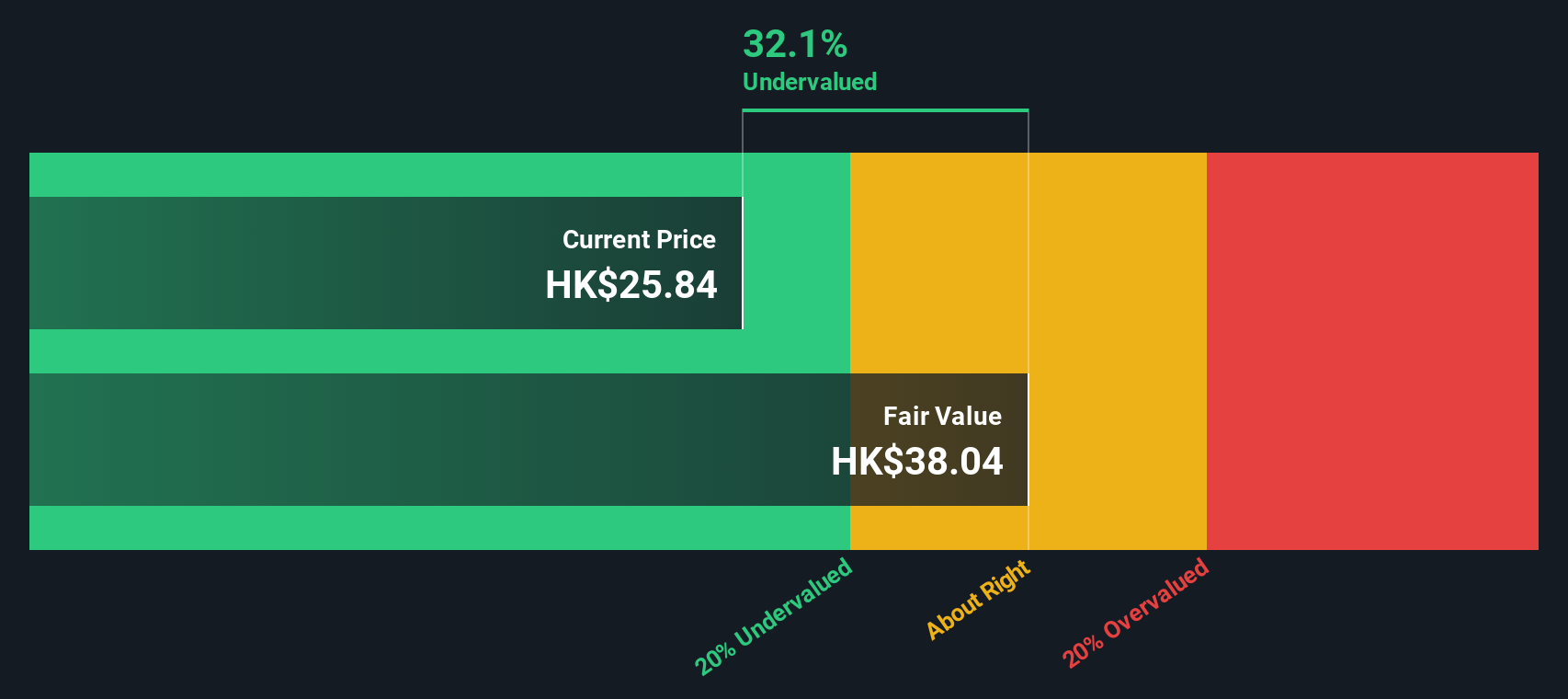

With the share price still well above last year’s lows but trading at a sizable discount to analyst targets and intrinsic value estimates, investors now face a key question: is Shanghai Junshi genuinely undervalued or already pricing in its future growth?

Price-to-Sales of 8.8x: Is it justified?

On a price-to-sales basis, Shanghai Junshi Biosciences trades on an 8.8x multiple, which screens as undervalued against both peers and the wider Hong Kong biotech space.

The price-to-sales ratio compares a company’s market value with its revenue, a useful lens for loss making biotechs where profits are not yet a reliable guide. For Shanghai Junshi Biosciences, this metric helps investors judge what the market is paying today for its growing top line and future commercial potential.

Here, the market is assigning a lower price-to-sales multiple than both the Hong Kong Biotechs industry average of 13.7x and the peer average of 13.4x, implying investors are paying less for each unit of revenue than they do for comparable names. It also sits below an estimated fair price-to-sales ratio of 11.2x, suggesting room for sentiment to shift higher if the company delivers on its growth ambitions and moves closer to the level the market typically rewards.

Explore the SWS fair ratio for Shanghai Junshi Biosciences

Result: Price-to-sales of 8.8x (UNDERVALUED)

However, execution risks remain, including ongoing losses and a sharp recent share price pullback, which could rapidly erode confidence if growth momentum stalls.

Find out about the key risks to this Shanghai Junshi Biosciences narrative.

Another angle: DCF says the discount is even deeper

While the price to sales screening points to value, our DCF model goes further, suggesting fair value around HK$37.25 versus the current HK$23.56. That is roughly a 37% gap, which looks like opportunity today but could also reflect real execution risk. Which side of that trade would you take?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Shanghai Junshi Biosciences for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Shanghai Junshi Biosciences Narrative

If you see the story differently or simply want to dig into the numbers yourself, you can build a personalised view in just a few minutes: Do it your way.

A great starting point for your Shanghai Junshi Biosciences research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop at one opportunity. Use the Simply Wall Street Screener to uncover focused stock ideas that match your strategy before the market fully catches on.

- Capture overlooked growth potential by scanning for these 908 undervalued stocks based on cash flows that the market has not fully priced in yet.

- Tap into powerful long term themes by targeting these 26 AI penny stocks poised to benefit from accelerating adoption of artificial intelligence.

- Lock in reliable income streams by hunting for these 15 dividend stocks with yields > 3% that may strengthen your portfolio’s cash flow through changing market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1877

Shanghai Junshi Biosciences

A biopharmaceutical company, engages in the discovery, development, and commercialization of various drugs in the therapeutic areas of malignant tumors, neurological, autoimmune, chronic metabolic, nervous system, and infectious diseases in the People's Republic of China.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026