As global markets navigate a period of economic adjustment, the Hong Kong market has experienced fluctuations, with the Hang Seng Index recently facing a decline. Amidst these dynamics, dividend stocks remain a focal point for investors seeking steady income streams in uncertain times. In this article, we explore three notable dividend stocks on the Stock Exchange of Hong Kong (SEHK), including PC Partner Group, that exemplify resilience and potential for consistent returns in today's market environment.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| Luk Fook Holdings (International) (SEHK:590) | 9.09% | ★★★★★☆ |

| China Hongqiao Group (SEHK:1378) | 8.53% | ★★★★★☆ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 7.15% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 7.01% | ★★★★★☆ |

| Playmates Toys (SEHK:869) | 8.70% | ★★★★★☆ |

| Lion Rock Group (SEHK:1127) | 7.97% | ★★★★★☆ |

| China Construction Bank (SEHK:939) | 7.10% | ★★★★★☆ |

| PC Partner Group (SEHK:1263) | 8.37% | ★★★★★☆ |

| Tianjin Development Holdings (SEHK:882) | 6.92% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 4.66% | ★★★★★☆ |

Click here to see the full list of 91 stocks from our Top SEHK Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

PC Partner Group (SEHK:1263)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: PC Partner Group Limited is an investment holding company that designs, develops, manufactures, and sells computer electronics with a market cap of HK$1.85 billion.

Operations: The company's revenue primarily comes from the design, manufacturing, and trading of electronics and PC parts and accessories, amounting to HK$9.94 billion.

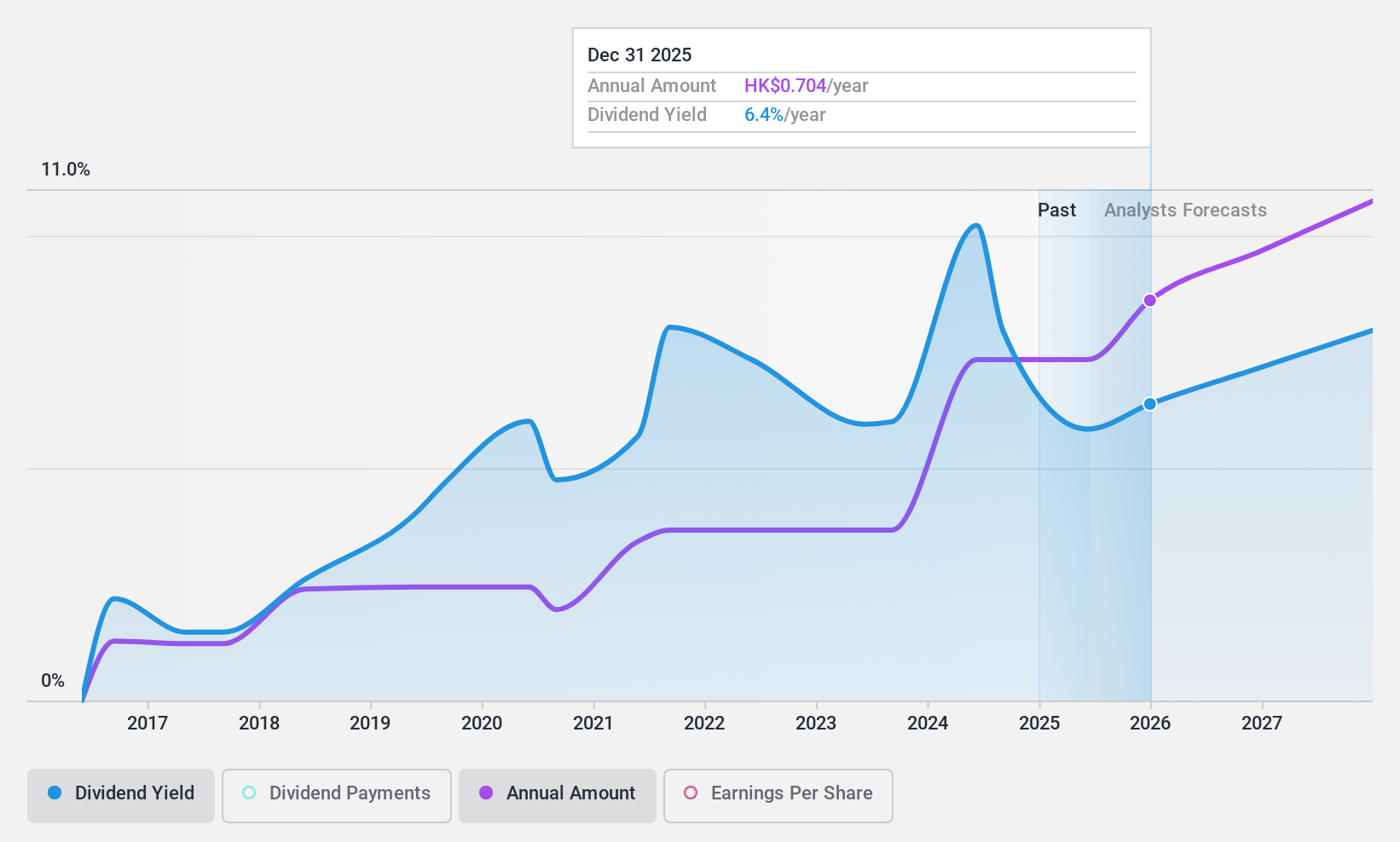

Dividend Yield: 8.4%

PC Partner Group has shown a positive trend in dividend payments over the past decade, despite some volatility. The company's dividends are well-covered by both earnings and cash flows, with a payout ratio of 66.1% and a cash payout ratio of 7.8%. Recent financial results indicate improved profitability, with net income rising to HK$194.06 million for the first half of 2024. However, its removal from the S&P Global BMI Index may impact investor perception.

- Take a closer look at PC Partner Group's potential here in our dividend report.

- The analysis detailed in our PC Partner Group valuation report hints at an deflated share price compared to its estimated value.

Consun Pharmaceutical Group (SEHK:1681)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Consun Pharmaceutical Group Limited is engaged in the research, development, manufacturing, and sale of Chinese medicines and medical contrast medium products in the People’s Republic of China, with a market cap of HK$6.62 billion.

Operations: Consun Pharmaceutical Group's revenue is primarily derived from the Consun Pharmaceutical Segment, which accounts for CN¥2.33 billion, and the Yulin Pharmaceutical Segment, contributing CN¥410 million.

Dividend Yield: 7.4%

Consun Pharmaceutical Group has declared an interim dividend of HK$0.3 per share, supported by a reasonable payout ratio of 52.3% and cash payout ratio of 53.7%. Despite recent earnings growth to CNY 399.77 million for the first half of 2024, the company's dividend history is marked by volatility and unreliability over the past decade. Recent board changes with Mr. Gao Haien's appointment as Company Secretary may influence future strategic directions impacting dividends.

- Get an in-depth perspective on Consun Pharmaceutical Group's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Consun Pharmaceutical Group is priced lower than what may be justified by its financials.

Pico Far East Holdings (SEHK:752)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Pico Far East Holdings Limited is an investment holding company involved in exhibition, event, and brand activation, visual branding activation, museum and themed environment projects, and meeting architecture activation with a market cap of HK$2.38 billion.

Operations: Pico Far East Holdings Limited generates revenue primarily from exhibition, event and brand activation (HK$5.01 billion), followed by visual branding activation (HK$454.95 million), museum and themed entertainment (HK$444.37 million), and meeting architecture activation (HK$162.78 million).

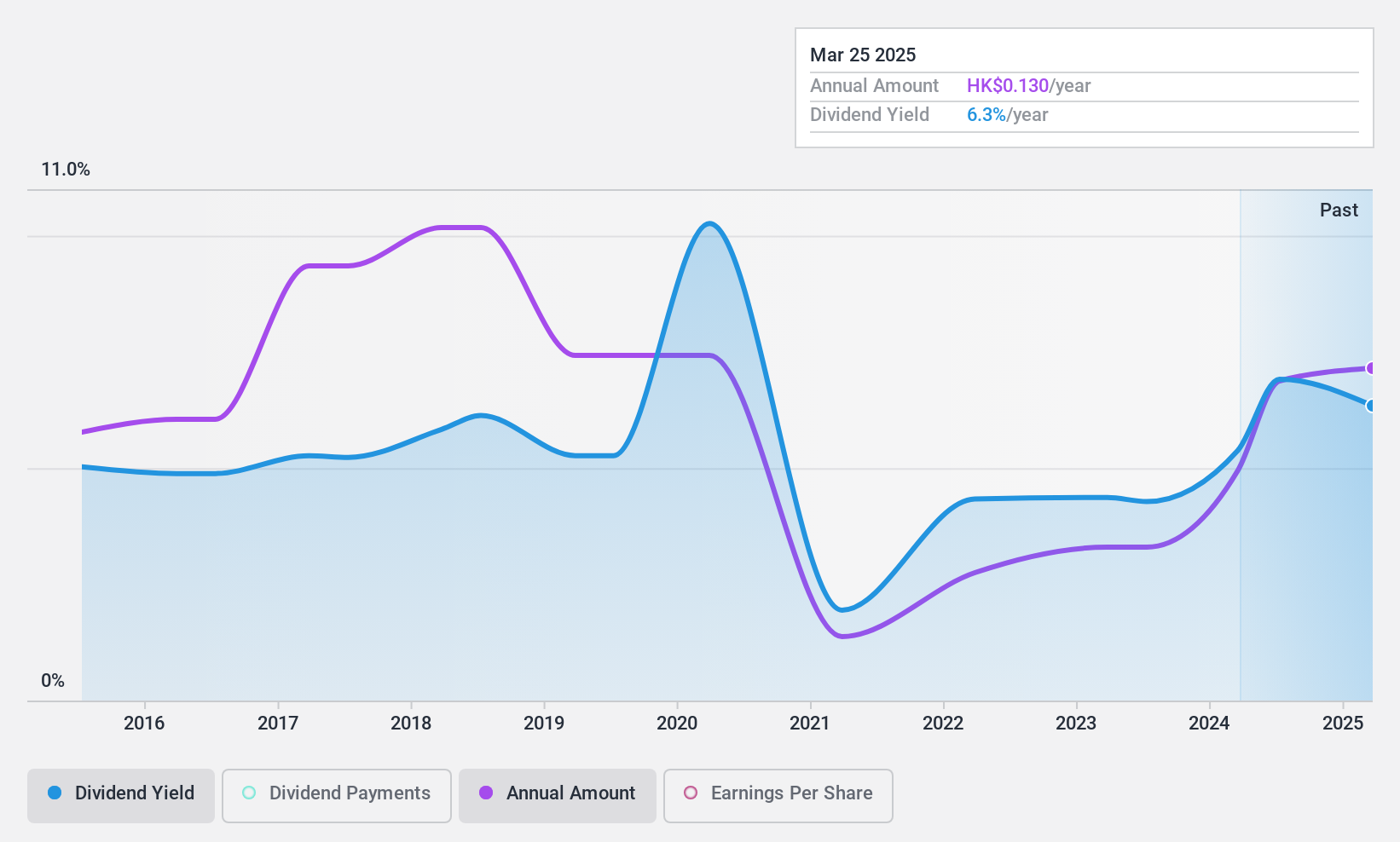

Dividend Yield: 6.5%

Pico Far East Holdings' dividend payments are well-supported by a low payout ratio of 48.6% and a cash payout ratio of 36.2%. However, the dividend yield of 6.51% is below the top quartile in Hong Kong, and its dividend history over the past decade has been volatile and unreliable, despite recent earnings growth of 63.5%. The company trades at a significant discount to its estimated fair value, which may interest value-focused investors.

- Click here to discover the nuances of Pico Far East Holdings with our detailed analytical dividend report.

- Our expertly prepared valuation report Pico Far East Holdings implies its share price may be lower than expected.

Where To Now?

- Access the full spectrum of 91 Top SEHK Dividend Stocks by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:752

Pico Far East Holdings

An investment holding company, engages in the exhibition, event, and brand activation; visual branding activation; museum and themed environment; meeting architecture activation; and related businesses.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives