As geopolitical tensions in the Middle East escalate, global markets are experiencing heightened volatility, with oil prices climbing and influencing energy shares positively. Amidst this backdrop, Hong Kong's Hang Seng Index has shown resilience by climbing 10.2%, reflecting investor optimism towards Beijing's supportive economic measures. In such uncertain times, dividend stocks can offer a degree of stability and income potential, making them an attractive option for investors seeking to navigate these complex market conditions.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| Consun Pharmaceutical Group (SEHK:1681) | 7.74% | ★★★★★☆ |

| China Hongqiao Group (SEHK:1378) | 8.55% | ★★★★★☆ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 7.37% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 6.89% | ★★★★★☆ |

| Playmates Toys (SEHK:869) | 8.82% | ★★★★★☆ |

| Lion Rock Group (SEHK:1127) | 8.03% | ★★★★★☆ |

| China Construction Bank (SEHK:939) | 7.10% | ★★★★★☆ |

| PC Partner Group (SEHK:1263) | 8.06% | ★★★★★☆ |

| Tianjin Development Holdings (SEHK:882) | 6.89% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 4.20% | ★★★★★☆ |

Click here to see the full list of 93 stocks from our Top SEHK Dividend Stocks screener.

We'll examine a selection from our screener results.

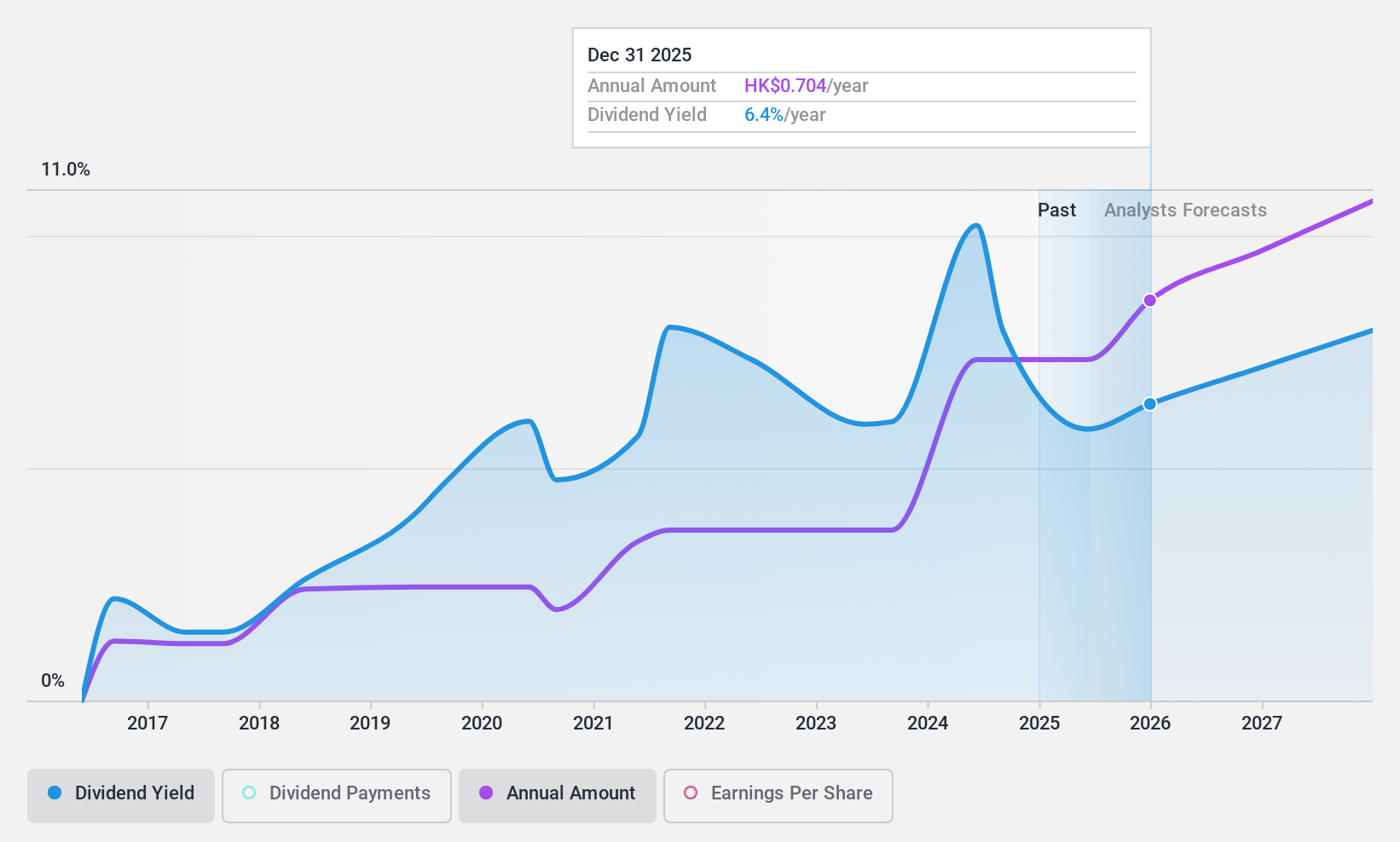

Consun Pharmaceutical Group (SEHK:1681)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Consun Pharmaceutical Group Limited is engaged in the research, development, manufacturing, and sale of Chinese medicines and medical contrast medium products in the People’s Republic of China, with a market cap of HK$6.35 billion.

Operations: Consun Pharmaceutical Group's revenue is primarily derived from the Consun Pharmaceutical Segment, which accounts for CN¥2.33 billion, and the Yulin Pharmaceutical Segment, contributing CN¥410 million.

Dividend Yield: 7.7%

Consun Pharmaceutical Group's dividend payments have been volatile over the past decade, though they recently increased with an interim dividend of HK$0.3 per share for 2024. Despite this volatility, dividends are sustainably covered by earnings and cash flows with payout ratios around 53%. The company trades below estimated fair value and offers a competitive yield in Hong Kong's market. Recent earnings growth and strategic developments, such as the SK-08 tablet clinical trial approval, may support future performance.

- Take a closer look at Consun Pharmaceutical Group's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Consun Pharmaceutical Group is trading behind its estimated value.

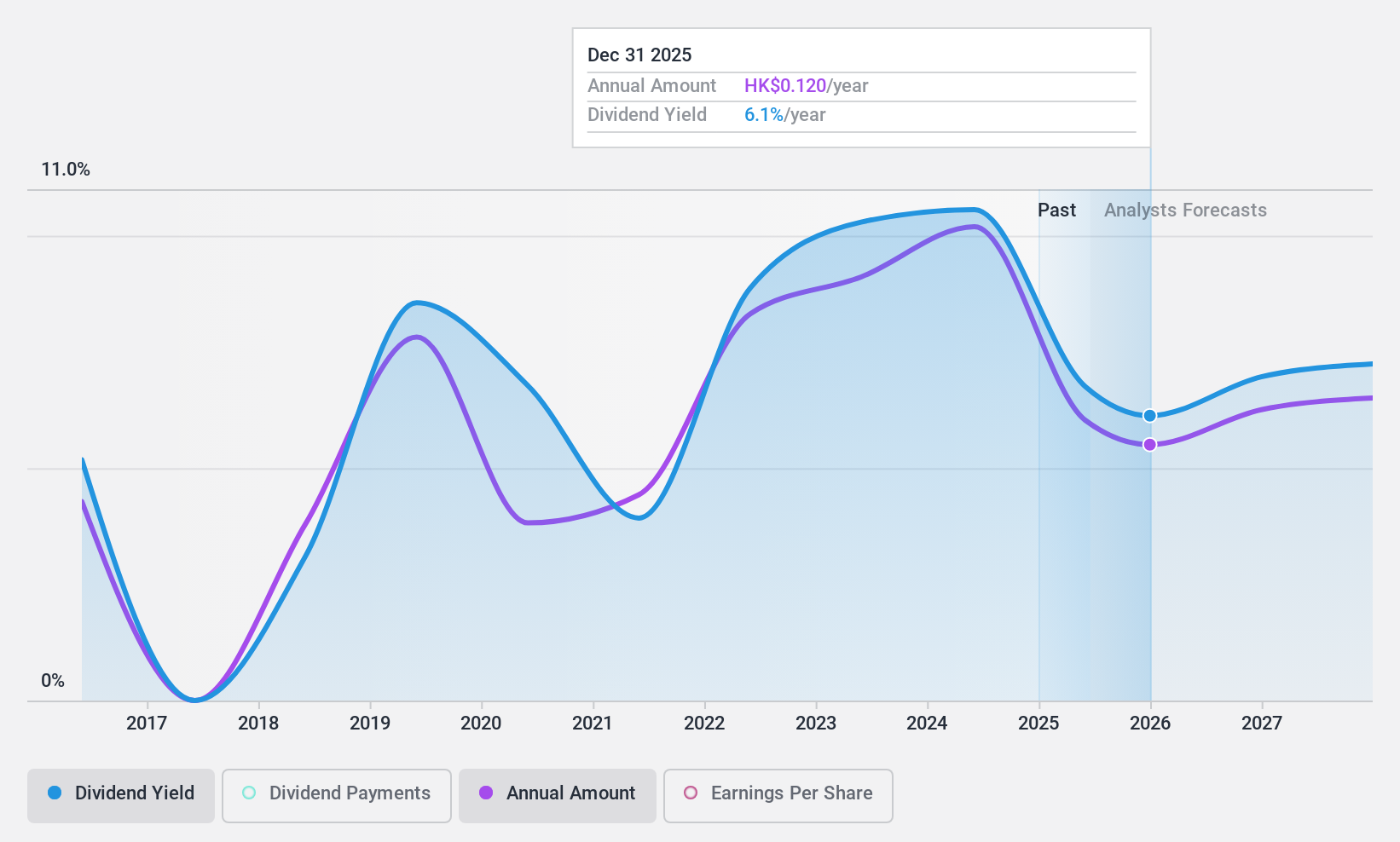

China Kepei Education Group (SEHK:1890)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Kepei Education Group Limited is an investment holding company that offers private vocational education services with a focus on profession-oriented and vocational training in China, and it has a market cap of HK$3.02 billion.

Operations: China Kepei Education Group Limited generates revenue of CN¥1.60 billion from its private vocational education services in China.

Dividend Yield: 9.3%

China Kepei Education Group's dividend payments have been inconsistent over the past five years, despite being well-covered by earnings and cash flows with low payout ratios of 16.7% and 33.1%, respectively. The company offers a high dividend yield, ranking in the top 25% of Hong Kong payers, but recent exclusion from the S&P Global BMI Index could impact investor perception. Trading significantly below estimated fair value suggests potential investment appeal relative to peers.

- Click here and access our complete dividend analysis report to understand the dynamics of China Kepei Education Group.

- According our valuation report, there's an indication that China Kepei Education Group's share price might be on the cheaper side.

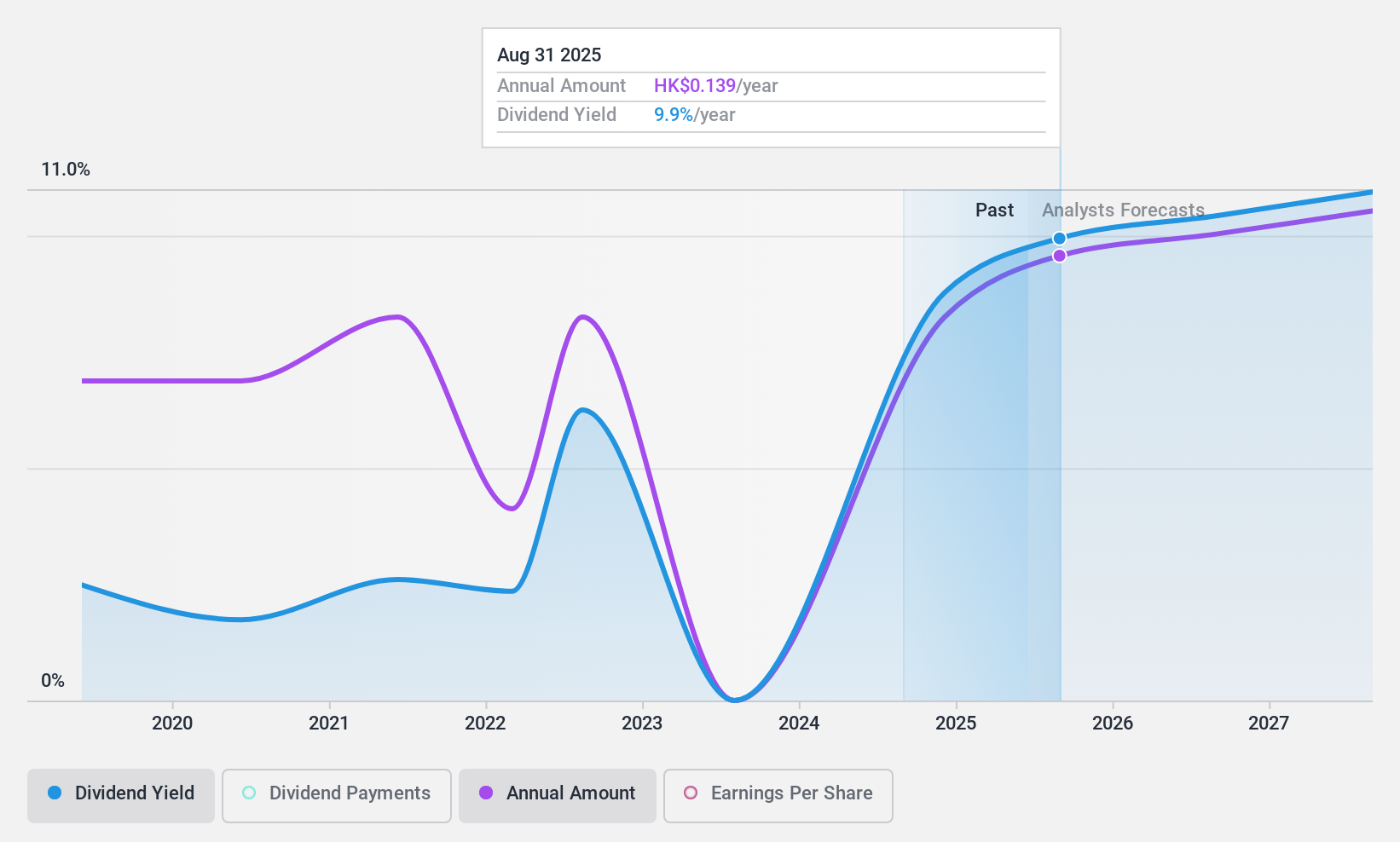

China BlueChemical (SEHK:3983)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: China BlueChemical Ltd. and its subsidiaries develop, produce, and sell mineral fertilizers and chemical products in China and internationally, with a market cap of HK$10.60 billion.

Operations: China BlueChemical Ltd.'s revenue is primarily derived from its Urea segment at CN¥4.26 billion, Methanol at CN¥3.11 billion, and Phosphorus and Compound Fertiliser at CN¥2.85 billion.

Dividend Yield: 9.9%

China BlueChemical offers a high dividend yield, ranking in the top 25% of Hong Kong payers, with dividends covered by both earnings and cash flows at reasonable payout ratios. However, its dividend track record has been volatile over the past decade. The company's recent earnings report showed a decline in net income to CNY 686.83 million for H1 2024 from CNY 1,715.4 million last year, influenced by lower sales and product price declines. Despite this, it trades below estimated fair value relative to peers.

- Click to explore a detailed breakdown of our findings in China BlueChemical's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of China BlueChemical shares in the market.

Seize The Opportunity

- Navigate through the entire inventory of 93 Top SEHK Dividend Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1681

Consun Pharmaceutical Group

Researches and develops, manufactures, and sells Chinese medicines and medical contrast medium products in the People’s Republic of China.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives