Benign Growth For Fusen Pharmaceutical Company Limited (HKG:1652) Underpins Stock's 42% Plummet

To the annoyance of some shareholders, Fusen Pharmaceutical Company Limited (HKG:1652) shares are down a considerable 42% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 70% loss during that time.

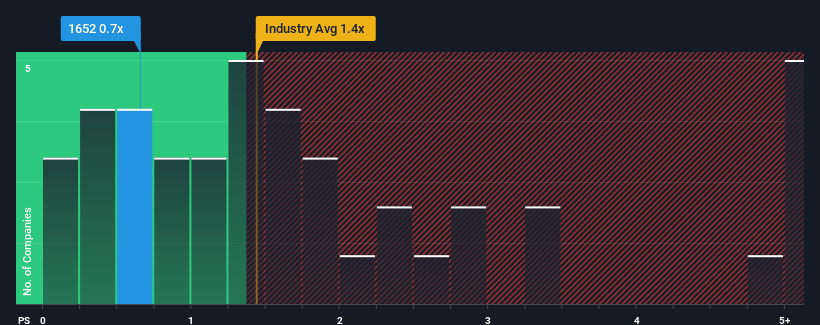

After such a large drop in price, given about half the companies operating in Hong Kong's Pharmaceuticals industry have price-to-sales ratios (or "P/S") above 1.4x, you may consider Fusen Pharmaceutical as an attractive investment with its 0.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Fusen Pharmaceutical

How Fusen Pharmaceutical Has Been Performing

As an illustration, revenue has deteriorated at Fusen Pharmaceutical over the last year, which is not ideal at all. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. Those who are bullish on Fusen Pharmaceutical will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Fusen Pharmaceutical, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Fusen Pharmaceutical would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 36% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 6.2% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 8.9% shows it's an unpleasant look.

With this information, we are not surprised that Fusen Pharmaceutical is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Key Takeaway

The southerly movements of Fusen Pharmaceutical's shares means its P/S is now sitting at a pretty low level. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It's no surprise that Fusen Pharmaceutical maintains its low P/S off the back of its sliding revenue over the medium-term. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

You need to take note of risks, for example - Fusen Pharmaceutical has 4 warning signs (and 2 which shouldn't be ignored) we think you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1652

Fusen Pharmaceutical

An investment holding company, researches and develops, manufactures, and sells pharmaceutical products in the People’s Republic of China.

Slight and slightly overvalued.

Market Insights

Community Narratives