As global markets navigate a landscape marked by interest rate adjustments and mixed performances across major indices, small-cap stocks have faced particular challenges, with the Russell 2000 Index underperforming against larger counterparts like the S&P 500. In this environment of economic shifts and evolving market sentiment, identifying promising investments often involves looking beyond immediate trends to uncover potential in lesser-known companies that demonstrate resilience and growth capabilities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Nitto Fuji Flour MillingLtd | 0.86% | 6.39% | 4.69% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Lithium Chile | NA | nan | 42.01% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Akis Gayrimenkul Yatirim Ortakligi (IBSE:AKSGY)

Simply Wall St Value Rating: ★★★★★☆

Overview: Akis Gayrimenkul Yatirim Ortakligi, based in Turkey with a market cap of TRY17.53 billion, focuses on real estate investment and development projects.

Operations: Akis Gayrimenkul Yatirim A.S generates revenue primarily through its Akasya Project, contributing TRY1.52 billion, and the Akbati Project, adding TRY624.36 million. The company's net profit margin is a key financial indicator to consider when evaluating its profitability in the real estate sector.

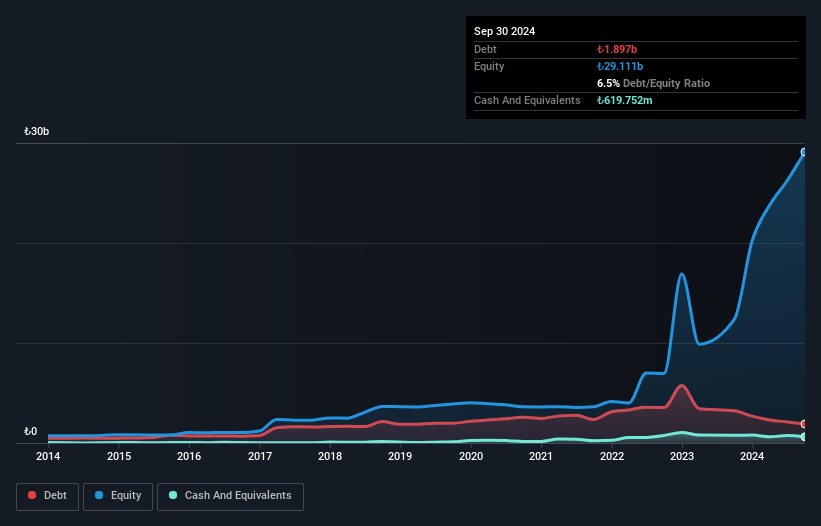

Akis Gayrimenkul Yatirim Ortakligi, a smaller player in the real estate investment sector, has demonstrated financial resilience despite recent challenges. Over the past five years, its debt to equity ratio impressively decreased from 50.9% to 6.5%, reflecting prudent financial management. The company is trading at 18.5% below its estimated fair value, suggesting potential upside for investors seeking undervalued opportunities. Despite a slight negative earnings growth of -0.9% over the past year, Akis maintains high-quality earnings and positive free cash flow, positioning it well against industry peers with significantly larger declines in earnings growth at -50.3%.

ATP Yazilim ve Teknoloji Anonim Sirketi (IBSE:ATATP)

Simply Wall St Value Rating: ★★★★★★

Overview: ATP Yazilim ve Teknoloji Anonim Sirketi specializes in developing software and infrastructure solutions for the finance, hospitality, and various other industries both within Turkey and internationally, with a market capitalization of TRY9.52 billion.

Operations: ATP's primary revenue stream comes from its Software & Programming segment, generating TRY1.51 billion. The company has a market capitalization of TRY9.52 billion.

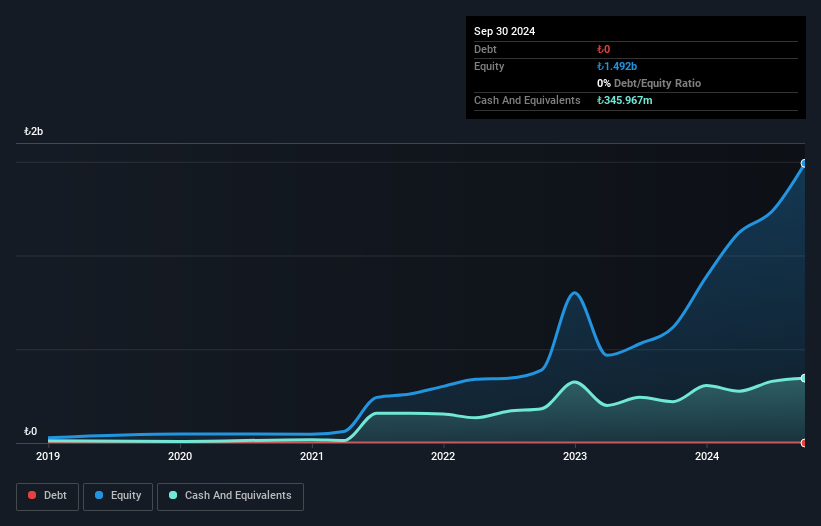

ATP Yazilim ve Teknoloji Anonim Sirketi showcases a compelling profile with its recent financial results and strategic positioning in the software industry. The company reported a notable earnings growth of 653% over the past year, significantly outpacing the industry's average growth of 103%. Its Price-To-Earnings ratio stands at 33x, favorable compared to the sector's average of 43x. With net income reaching TRY 142 million for Q3, up from TRY 4 million a year ago, ATP demonstrates robust profitability. Being debt-free further enhances its financial stability, while its free cash flow remains positive despite substantial capital expenditures.

YiChang HEC ChangJiang Pharmaceutical (SEHK:1558)

Simply Wall St Value Rating: ★★★★★★

Overview: YiChang HEC ChangJiang Pharmaceutical Co., Ltd. is a pharmaceutical company with a market cap of approximately HK$9.10 billion, focusing on the research, development, production, and sale of pharmaceutical products.

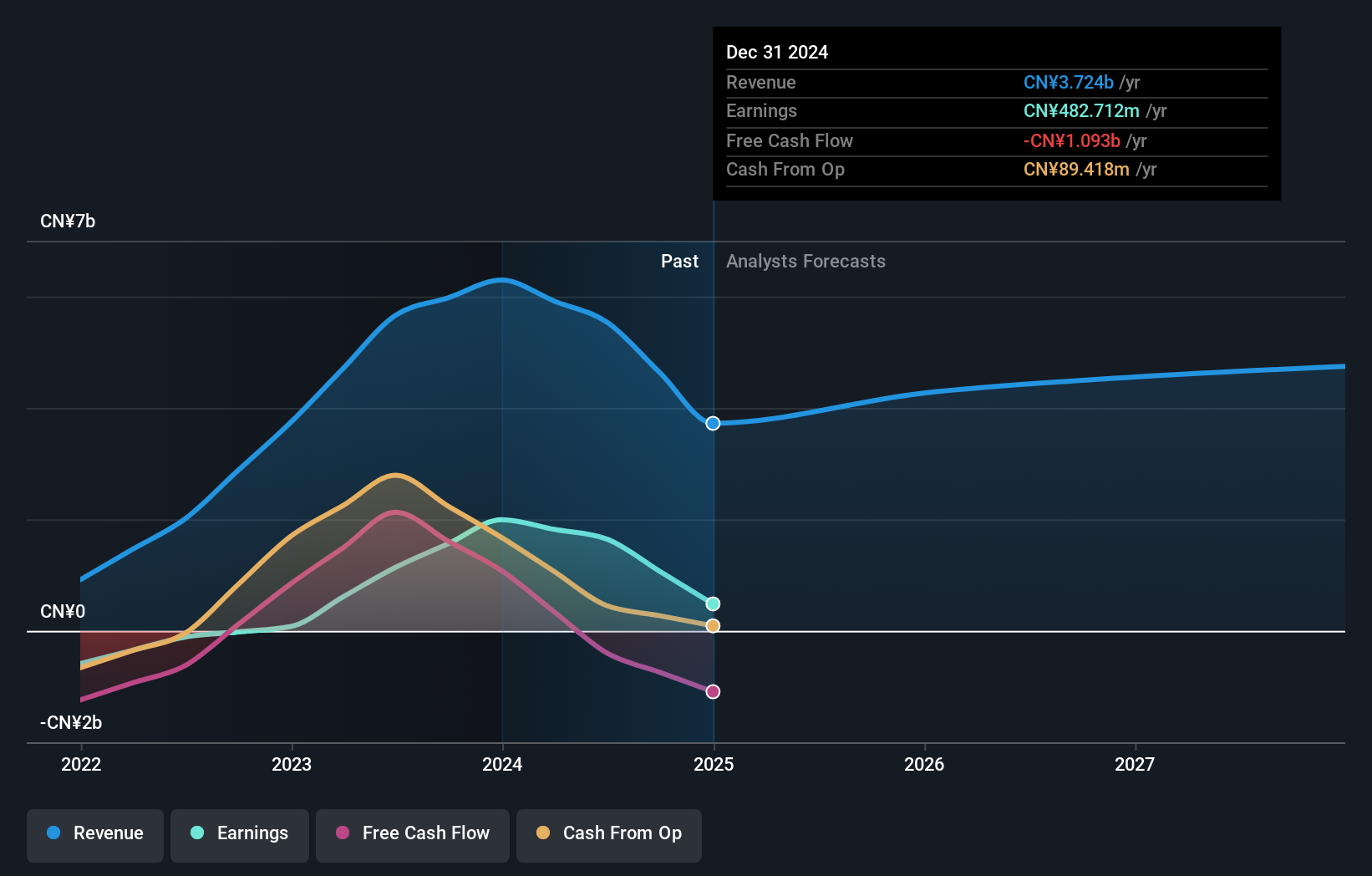

Operations: YiChang HEC generates revenue primarily through the sale of pharmaceutical products, amounting to CN¥5.54 billion. The company's financial performance is highlighted by its gross profit margin, which reflects its ability to manage production costs relative to sales.

YiChang HEC ChangJiang Pharmaceutical, a relatively small player in the pharmaceutical sector, shows promise with its net debt to equity ratio at a satisfactory 6.3%, reflecting prudent financial management. Over the past five years, this ratio has impressively decreased from 74.6% to 23.9%, demonstrating effective debt reduction strategies. Despite earnings declining by 2% annually over five years, recent performance is encouraging with a robust 44.7% growth last year, outpacing industry peers significantly at just 9%. Trading at nearly half its estimated fair value suggests potential undervaluation opportunities for investors seeking growth prospects within pharmaceuticals.

Next Steps

- Access the full spectrum of 4507 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:ATATP

ATP Yazilim ve Teknoloji Anonim Sirketi

Develops software and infrastructure solutions for finance, hospitality, and other industries in Turkey and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives