Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Genscript Biotech Corporation (HKG:1548) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Genscript Biotech

How Much Debt Does Genscript Biotech Carry?

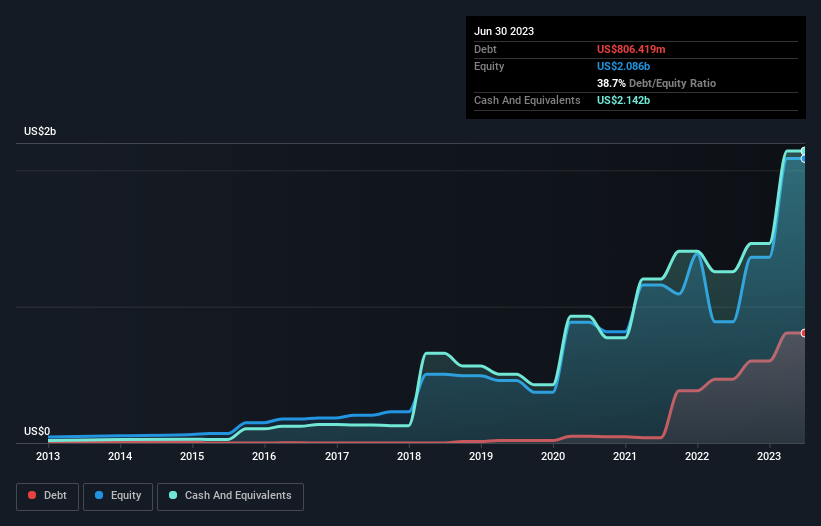

The image below, which you can click on for greater detail, shows that at June 2023 Genscript Biotech had debt of US$806.4m, up from US$468.1m in one year. But it also has US$2.14b in cash to offset that, meaning it has US$1.34b net cash.

A Look At Genscript Biotech's Liabilities

According to the last reported balance sheet, Genscript Biotech had liabilities of US$437.9m due within 12 months, and liabilities of US$860.4m due beyond 12 months. Offsetting these obligations, it had cash of US$2.14b as well as receivables valued at US$208.0m due within 12 months. So it can boast US$1.05b more liquid assets than total liabilities.

It's good to see that Genscript Biotech has plenty of liquidity on its balance sheet, suggesting conservative management of liabilities. Because it has plenty of assets, it is unlikely to have trouble with its lenders. Succinctly put, Genscript Biotech boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Genscript Biotech can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year Genscript Biotech wasn't profitable at an EBIT level, but managed to grow its revenue by 24%, to US$707m. With any luck the company will be able to grow its way to profitability.

So How Risky Is Genscript Biotech?

Statistically speaking companies that lose money are riskier than those that make money. And we do note that Genscript Biotech had an earnings before interest and tax (EBIT) loss, over the last year. Indeed, in that time it burnt through US$470m of cash and made a loss of US$185m. With only US$1.34b on the balance sheet, it would appear that its going to need to raise capital again soon. Genscript Biotech's revenue growth shone bright over the last year, so it may well be in a position to turn a profit in due course. By investing before those profits, shareholders take on more risk in the hope of bigger rewards. When I consider a company to be a bit risky, I think it is responsible to check out whether insiders have been reporting any share sales. Luckily, you can click here ito see our graphic depicting Genscript Biotech insider transactions.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1548

Genscript Biotech

An investment holding company, engages in the manufacture and sale of life science research products and services in the United States of America, Europe, Mainland China, Europe, Asia Pacific, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.