- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3533

3 Stocks That May Be Undervalued In December 2024

Reviewed by Simply Wall St

As global markets navigate a period of cautious optimism following the Federal Reserve's recent rate cut and ongoing political uncertainties, investors are closely watching for opportunities amid fluctuating indices. With U.S. stocks experiencing broad-based declines and European markets facing challenges from potential trade tariffs, the search for undervalued stocks becomes particularly relevant in this climate. Identifying potentially undervalued stocks requires careful consideration of a company's fundamentals and market positioning, especially during times when broader economic indicators show mixed signals.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Clear Secure (NYSE:YOU) | US$26.66 | US$53.14 | 49.8% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1129.90 | ₹2252.82 | 49.8% |

| Hanza (OM:HANZA) | SEK76.20 | SEK151.92 | 49.8% |

| HealthEquity (NasdaqGS:HQY) | US$94.95 | US$189.22 | 49.8% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP293.50 | CLP584.13 | 49.8% |

| Ingenia Communities Group (ASX:INA) | A$4.66 | A$9.19 | 49.3% |

| South Atlantic Bancshares (OTCPK:SABK) | US$15.02 | US$29.98 | 49.9% |

| KebNi (OM:KEBNI B) | SEK1.09 | SEK2.17 | 49.8% |

| RENK Group (DB:R3NK) | €18.342 | €36.50 | 49.7% |

| iFLYTEKLTD (SZSE:002230) | CN¥50.24 | CN¥103.29 | 51.4% |

We'll examine a selection from our screener results.

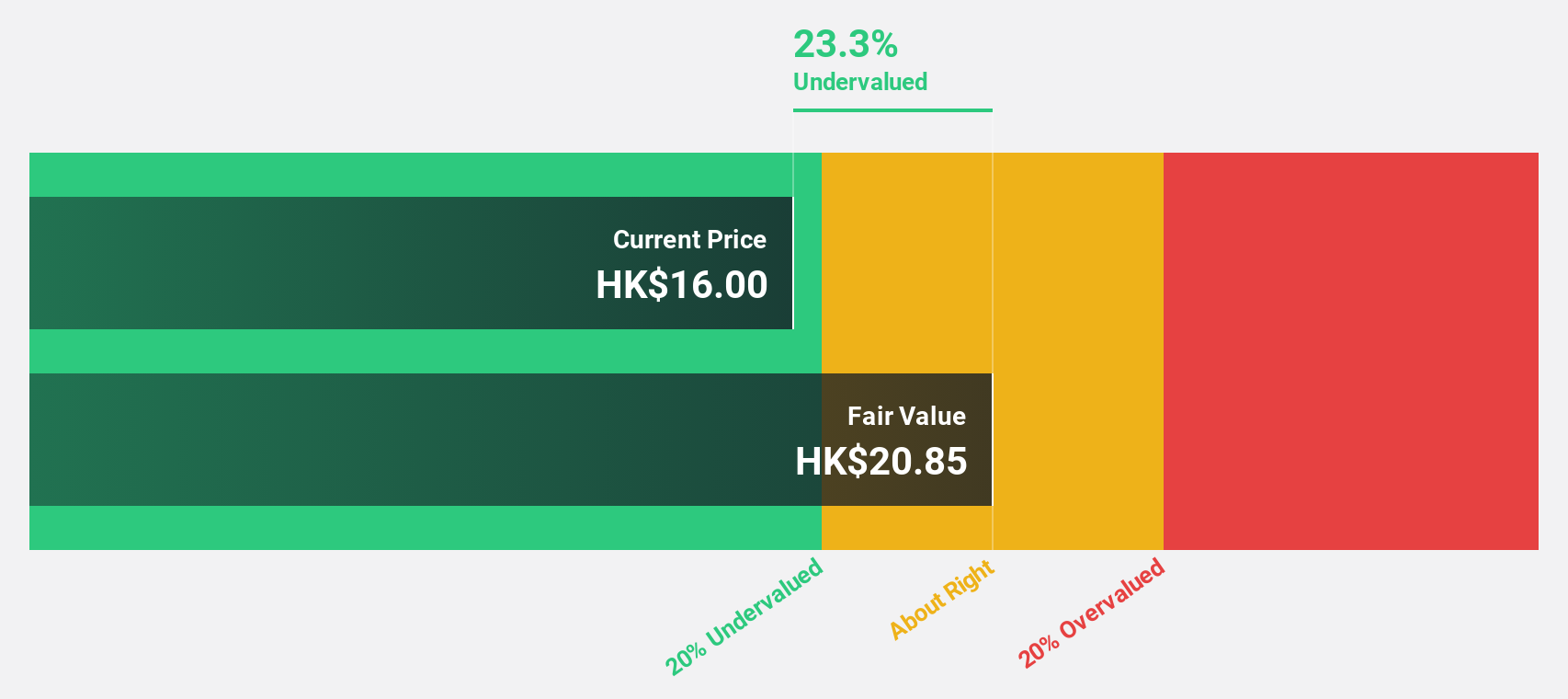

Genscript Biotech (SEHK:1548)

Overview: Genscript Biotech Corporation is an investment holding company that manufactures and sells life science research products and services globally, with a market cap of HK$20.87 billion.

Operations: The company's revenue segments include $456 million from Cell Therapy, $84.76 million from Biologics Development Services, $432.28 million from Life Science Services and Products, and $50.98 million from Industrial Synthetic Biology Products.

Estimated Discount To Fair Value: 15.2%

Genscript Biotech is trading at HK$9.74, below its estimated fair value of HK$11.49, reflecting a good relative value compared to peers and industry standards. The company's earnings are forecasted to grow 112.85% annually, with revenue expected to rise by 40.3% per year, outpacing the Hong Kong market's growth rate of 7.8%. Despite a low projected return on equity of 9.5%, these factors suggest potential undervaluation based on cash flows.

- According our earnings growth report, there's an indication that Genscript Biotech might be ready to expand.

- Take a closer look at Genscript Biotech's balance sheet health here in our report.

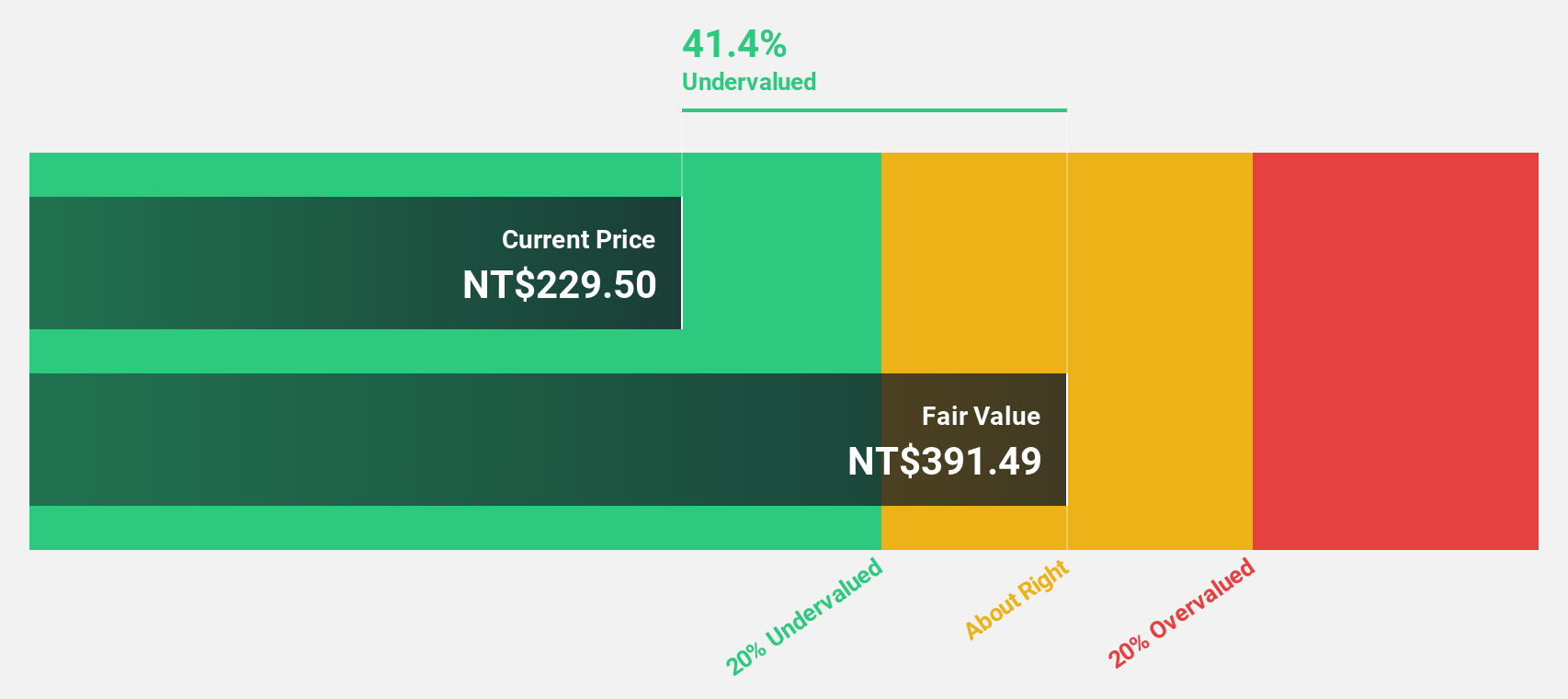

Innodisk (TPEX:5289)

Overview: Innodisk Corporation is engaged in the research, development, manufacturing, and sales of industrial embedded storage devices across Taiwan and various international markets, with a market cap of NT$19.23 billion.

Operations: The company's revenue from the research and development of various industrial memory storage devices amounts to NT$8.82 billion.

Estimated Discount To Fair Value: 35.5%

Innodisk is trading at NT$215, significantly below its fair value estimate of NT$333.39, indicating potential undervaluation. Forecasted earnings growth of 22.74% annually surpasses the Taiwan market average of 19.2%. However, recent earnings showed a decline in net income despite increased sales, highlighting challenges in maintaining profitability. The dividend yield of 4.65% is not well covered by free cash flows, adding a layer of risk to its financial stability despite strong revenue growth projections and innovative product launches.

- In light of our recent growth report, it seems possible that Innodisk's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Innodisk stock in this financial health report.

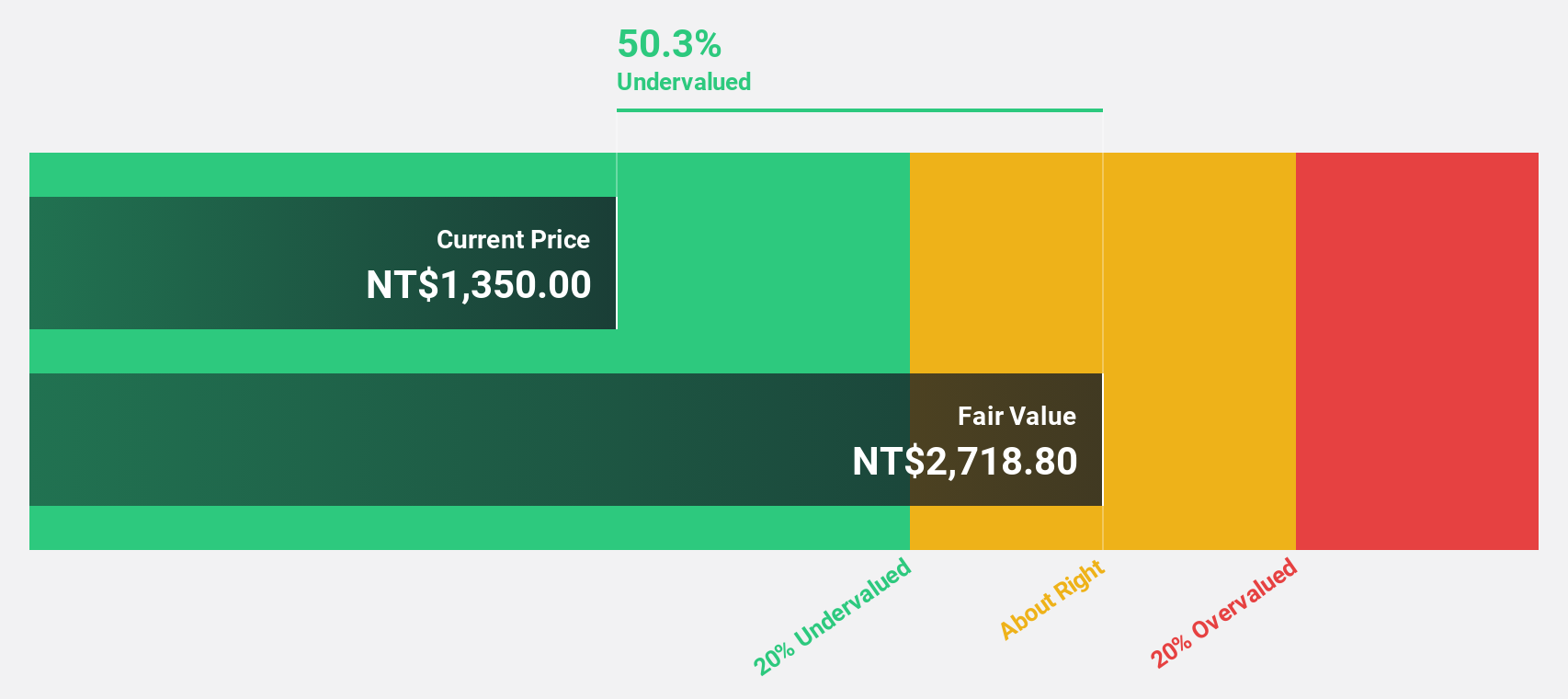

Lotes (TWSE:3533)

Overview: Lotes Co., Ltd is a company that designs, manufactures, and sells electronic interconnect and hardware components in Taiwan, Mainland China, and internationally with a market cap of NT$210.44 billion.

Operations: The company's revenue is primarily generated from its Electronic Components & Parts segment, which amounts to NT$28.36 billion.

Estimated Discount To Fair Value: 30.3%

Lotes is currently trading at NT$1,915, well below its fair value estimate of NT$2,747.81. The company reported strong third-quarter results with sales rising to TWD 8.07 billion from TWD 6.46 billion year-on-year and net income increasing to TWD 2.06 billion from TWD 1.87 billion. Earnings are projected to grow significantly at over 20% annually, outpacing the Taiwan market average and indicating robust cash flow potential despite recent share price volatility.

- Our earnings growth report unveils the potential for significant increases in Lotes' future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Lotes.

Key Takeaways

- Get an in-depth perspective on all 875 Undervalued Stocks Based On Cash Flows by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3533

Lotes

Designs, manufactures, and sells electronic interconnect and hardware components in Taiwan, Mainland China, and internationally.

Very undervalued with outstanding track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives