Earnings growth of 3.1% over 5 years hasn't been enough to translate into positive returns for 3SBio (HKG:1530) shareholders

Generally speaking long term investing is the way to go. But unfortunately, some companies simply don't succeed. To wit, the 3SBio Inc. (HKG:1530) share price managed to fall 62% over five long years. We certainly feel for shareholders who bought near the top.

With the stock having lost 3.1% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

View our latest analysis for 3SBio

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the unfortunate half decade during which the share price slipped, 3SBio actually saw its earnings per share (EPS) improve by 17% per year. So it doesn't seem like EPS is a great guide to understanding how the market is valuing the stock. Or possibly, the market was previously very optimistic, so the stock has disappointed, despite improving EPS.

Because of the sharp contrast between the EPS growth rate and the share price growth, we're inclined to look to other metrics to understand the changing market sentiment around the stock.

We don't think that the 1.3% is big factor in the share price, since it's quite small, as dividends go. In contrast to the share price, revenue has actually increased by 11% a year in the five year period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

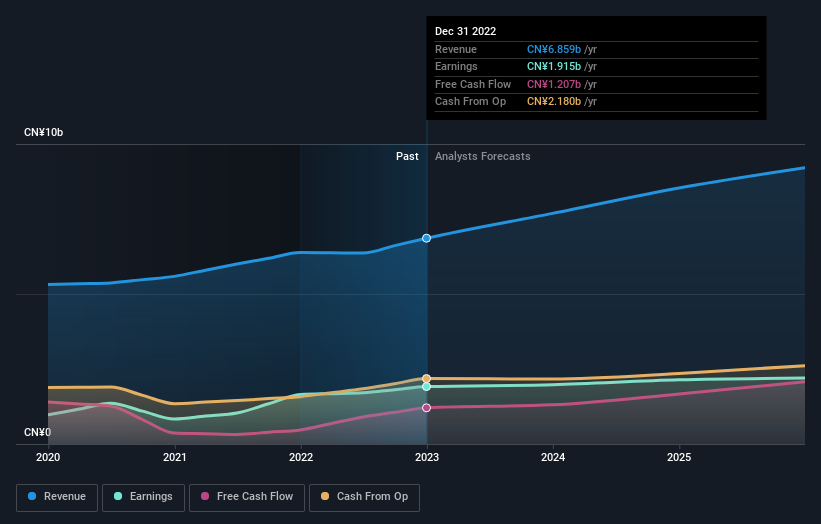

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

3SBio is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for 3SBio in this interactive graph of future profit estimates.

A Different Perspective

It's nice to see that 3SBio shareholders have received a total shareholder return of 48% over the last year. Of course, that includes the dividend. There's no doubt those recent returns are much better than the TSR loss of 10% per year over five years. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. Before forming an opinion on 3SBio you might want to consider these 3 valuation metrics.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're here to simplify it.

Discover if 3SBio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1530

3SBio

An investment holding company, develops, produces markets, and sells biopharmaceutical products in Mainland China and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives