- Hong Kong

- /

- Life Sciences

- /

- SEHK:1521

Frontage Holdings (HKG:1521) Shareholders Booked A 46% Gain In The Last Year

The simplest way to invest in stocks is to buy exchange traded funds. But if you pick the right individual stocks, you could make more than that. For example, the Frontage Holdings Corporation (HKG:1521) share price is up 46% in the last year, clearly besting the market return of around 16% (not including dividends). If it can keep that out-performance up over the long term, investors will do very well! Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

See our latest analysis for Frontage Holdings

Given that Frontage Holdings only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Over the last twelve months, Frontage Holdings' revenue grew by 5.9%. That's not great considering the company is losing money. The modest growth is probably largely reflected in the share price, which is up 46%. While not a huge gain tht seems pretty reasonable. Given the market doesn't seem too excited about the stock, a closer look at the financial data could pay off, if you can find indications of a stronger growth trend in the future.

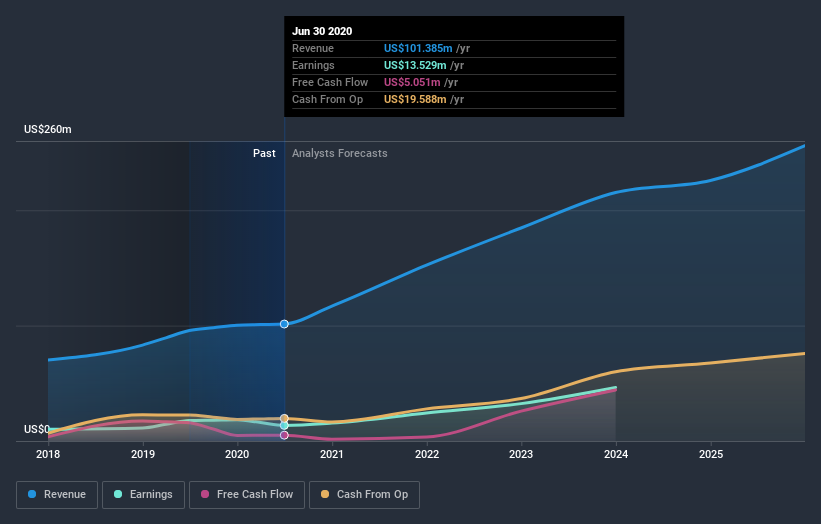

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Frontage Holdings' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Frontage Holdings boasts a total shareholder return of 46% for the last year. And the share price momentum remains respectable, with a gain of 77% in the last three months. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. It's always interesting to track share price performance over the longer term. But to understand Frontage Holdings better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Frontage Holdings you should know about.

We will like Frontage Holdings better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade Frontage Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1521

Frontage Holdings

A contract research organization, provides laboratory and related services to pharmaceutical, biotechnology, and agrochemical companies.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives